Key events in EMEA and Latam next week

Highlights next week include contrasting inflationary reports from Romania and the Czech Republic and two rating agency reviews on Poland

Rating agency reviews for Poland

The data calendar in Poland is quiet next week, but two rating agencies will review their assessments next Friday. We don't expect any change either from Fitch (A-, stable outlook), or Standard & Poor's (BBB+, positive outlook). A potential upgrade from S&P should have a limited market impact as it has a lower rating compared to the others anyway.

Czech's summer lull may play on industrial data

September inflation might accelerate further, partially due to higher food and fuel prices, but seasonal factors are pushing prices down slightly in monthly terms.

We think industrial production will disappoint a little, as July's figure was supported by a holiday effect, which pushed annual dynamics higher and will not be repeated in August. Retail sales shouldn't bring any positive surprises, though car sales could benefit from one-off purchases before new emission rules kick in. Meanwhile, the unemployment rate is expected to fall slightly in September to 3% based on typical seasonal developments.

Romanian inflation to be in line with central bank forecast

We expect September CPI to decline by 0.4 percentage points to 4.7% year-on-year as the statistical base impact (last year saw an excise duty hike for fuel) more than offsets the recent increase in oil prices. This is in line with the latest National Bank of Romania forecast from August.

Hungary: Positive budget balance news

In Hungary, we expect the government balance to improve - the European Commission transferred HUF 200-300 billion for some pre-financed projects under the scope of operative programmes which are not affected by suspended payments. On Tuesday, we'll see headline inflation jumping to 3.6% YoY on the back of higher oil, food and tobacco prices.

Another eventless National Bank of Serbia meeting

We expect the National Bank of Serbia to stay on hold at 3.00% as the CPI outlook looks less benign, especially after the recent rise in oil prices. Serbian dinar strengthening pressures have subsided, GDP growth has surprised to the upside and the fiscal prospects appear rather expansionary. The next move is likely to be a rate hike, but not before the European Central Bank's first normalisation step.

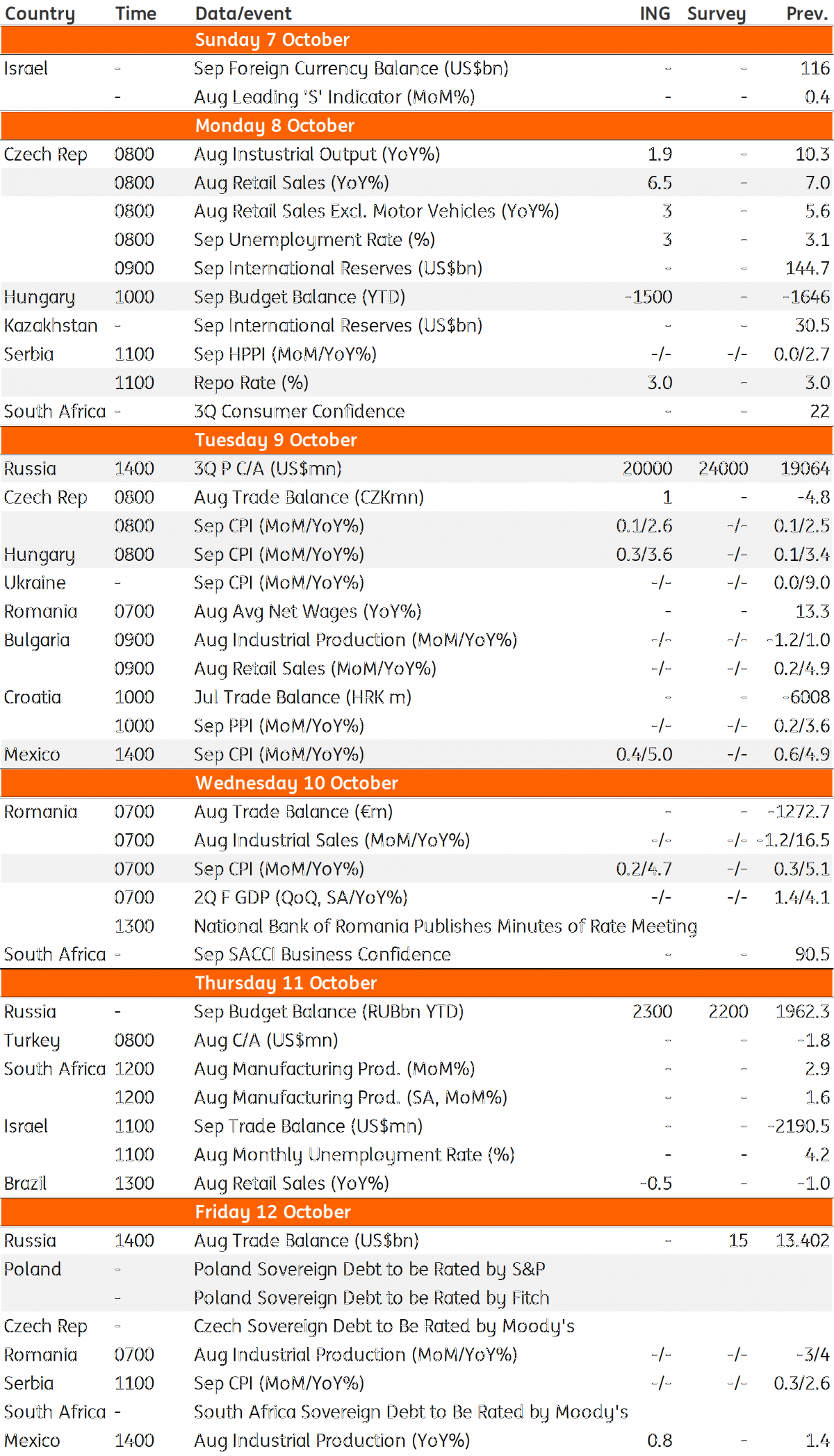

EMEA and Latam Economic Calendar

Download

Download article5 October 2018

Our view on next week’s key events This bundle contains {bundle_entries}{/bundle_entries} articlesThis publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more