Key events in EMEA and Latam next week

Inflation data dominates EMEA and Latam next week and the common theme is that figures will edge slightly higher in March. However, with the National Bank of Hungary likely to be seen as overly patient and the National Bank of Serbia possibly debating a cut, higher inflation could be met with (what seems) the opposite response

Serbia: Rates on hold

We expect the National Bank of Serbia (NBS) to decide for the 12th consecutive time to keep the key rate on hold at 3.0%. Headline inflation rose in February to 2.4%, while core inflation inched only marginally higher to 1.3%.

We believe that the NBS could be mulling a cut this year, as the external environment - and in particular, the FED/ECB policy stance seems to be pointing towards a slower pace of policy normalisation. On the internal front, inflation is expected to remain below 3.0% for the rest of the year.

RSD appreciation pressures triggered relatively frequent FX interventions in the past weeks. We tend to believe that the NBS will first leave surplus liquidity unsterilised for some time to lower market rates, before moving ahead with a rate cut. Hence, while not imminent, chances for some mild easing are on the rise in our view.

Romania: Higher inflation, hawkish central bank

We expect March CPI to inch 0.1ppt higher to 3.9% YoY, driven by higher oil prices and weaker RON. This is likely to be the peak for inflation this year, assuming no meaningful supply shocks (including from regulated prices) ahead. The National Bank of Romania (NBR) minutes are likely to be hawkish.

Czech Republic: Positive production

Car production improved by 1.2% MoM in February, so after the 1.0% YoY decline in industrial production in January, we believe February's figure should be more positive - slightly above 1.0% YoY.

Moreover, we expect the unemployment rate will decline in March due to typical seasonality and relatively warmer weather increasing construction work. Inflation should accelerate slightly, partially due to higher fuel prices (+0.8 MoM), but also preliminary data has signalled that food prices might pick-up further despite the typical negative seasonality in March. This is quite an uncertain element though. As such, the annual CPI figure might reach 2.9%, but this close-to-3.0% level is short-lived and we expect inflation to start slowing down again come May.

Russia: Strong current account surplus

Russia is due to report strong $32 billion current account surplus for 1Q19, especially after the $22 billion seen in 2M19. It's likely to have been fully neutralised by the fiscal rule-related FX purchases of $13 billion in 1Q19, as well as private net capital outflows - which were reported at $19 billion already for 2M19.

With the likely halving of the current account surplus in 2Q19, RUB is to become increasingly dependent on the portfolio inflows to local state bonds (OFZ). The latter may have reached $4 billion in 1Q19, thanks to the recovery in the global risk appetite, but further prospects will depend on global growth concerns and persisting sanction-related newsflow around Russia.

National Bank of Hungary: Overly patient?

When it comes to Hungary, all eyes will turn to the inflation data. We expect headline inflation to jump by 0.5ppt to 3.6% YoY, mainly on the back of fuel and unprocessed food prices. On the other hand, core inflation should only edge up 0.1ppt to 3.6% YoY. As this outcome would perfectly match the National Bank of Hungary’s latest staff projections (released end-March), we hardly see this uptick as a game changer in the eyes of the policymakers. However, for market players, such readings can raise some doubts about the overly patient approach of the central bank.

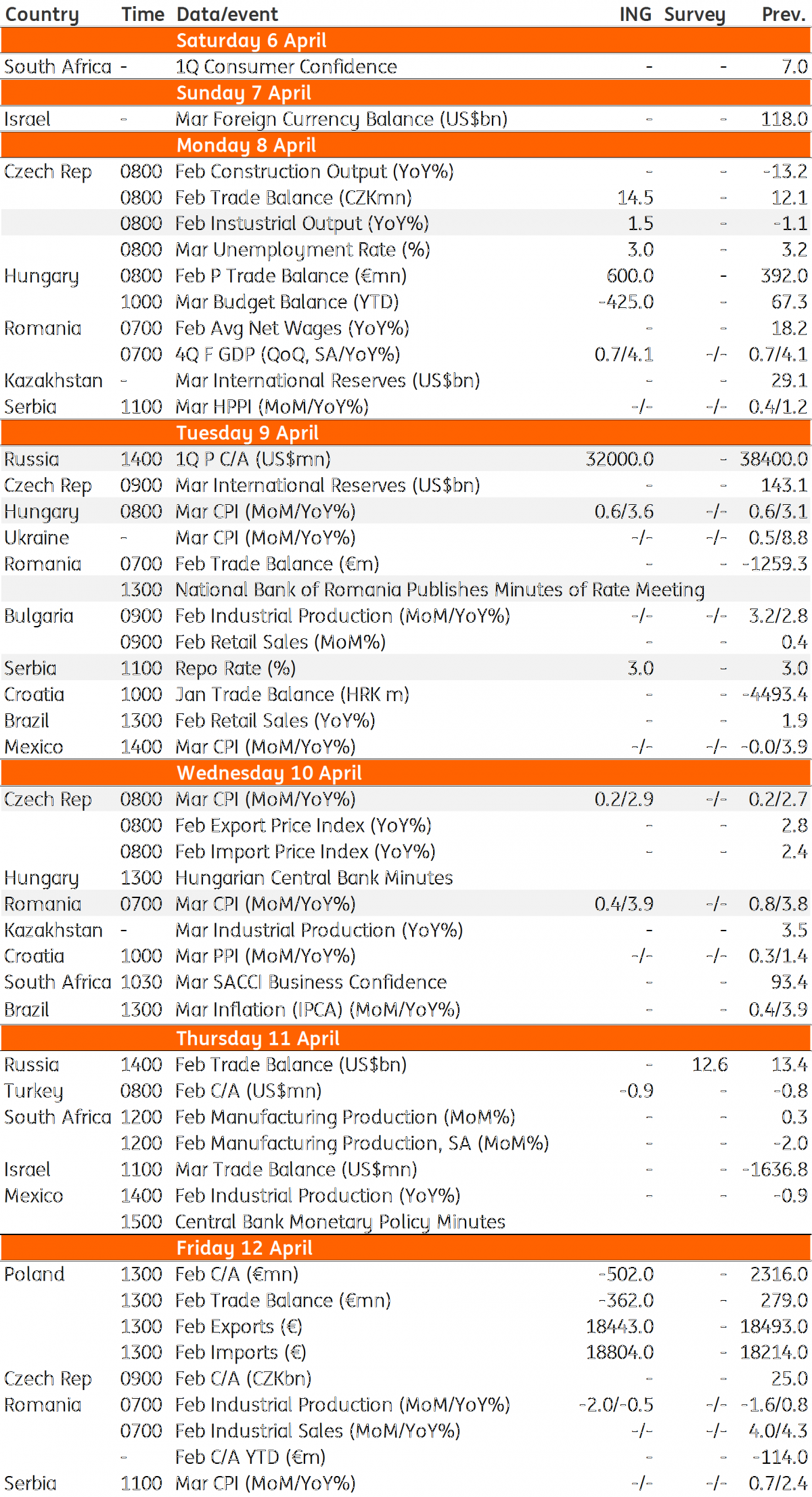

EMEA and Latam Economic Calendar

Download

Download article5 April 2019

Our view on next week’s key events This bundle contains {bundle_entries}{/bundle_entries} articlesThis publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more