Key events in EMEA and Latam next week

Expect a data heavy week in EMEA and Latam next week, combined with a sprinkle of central bank action from Serbia and Romania

NBR vs NBS a tale of two central banks

We expect the National Bank of Romania (NBR) to hike the key rate by 25bp to 2.50% on 7 May as political pressures subside. With inflation inching higher and a likely upward revision in the short-term inflation profile, after recent upside surprises, the NBR cannot afford the credibility cost of doing nothing. Firm liquidity management, though not committed, already tightened the policy stance significantly and this hike might be followed by a long data dependent pause.

In Serbia, inflation stands below the National Bank of Serbia's (NBS) target band and the RSD firming pressures prompted central bank intervention to curb them. The above expectations of 1Q18 GDP growth might play against NBS plans to ease further, through another key rate cut 25bp to 2.75% accompanied by the narrowing of the standing facilities corridor to +/-100bp, which offsets most of the easing in the context of surplus liquidity is the most likely scenario in our view.

Hungary: softening industrial production and accelerating inflation

In Hungary, we see industrial production softening further based on recent PMI and business confidence indicators. Budget data might remain ugly at first sight, as the government continues to pre-finance EU projects from the budget. The headline inflation is expected to accelerate to 2.3% on the back of an increase in fuel, food and clothing prices.

Czech data mix

Next week's data releases might surprise on the downside, especially as year-on-year dynamics for March industrial production and retail sales including cars could end in negative territory. This is driven not only by the calendar bias, as March 2018 had 2 less working days compared with last year, but also very high base effects from March 2017.

April inflation will remain below the 2% target and if food prices do not surprise significantly again by falling, it might slightly accelerate in year-on-year terms compared with March. The share of unemployed people will decline, continuing to signal an overheated labour market and a lack of a suitable workforce.

Inflation in the CIS space

In the CIS space, inflation data will be in focus in Russia and Ukraine. In the Russian case, we see headline CPI remaining at 2.4% on the a back of core CPI edging higher from 1.8% to 2% with underlying inflation being likely to have passed its trough with recovering consumption, but it is mostly an expected performance.

In the Ukrainian case, we think monthly inflation is set to decelerate slightly, especially with the government's decision to not hike natural gas prices as required by the IMF programme. Also, Russian Services PMI is worth monitoring after the manufacturing index surprised to the upside, weathering effects of the US sanctions on business confidence.

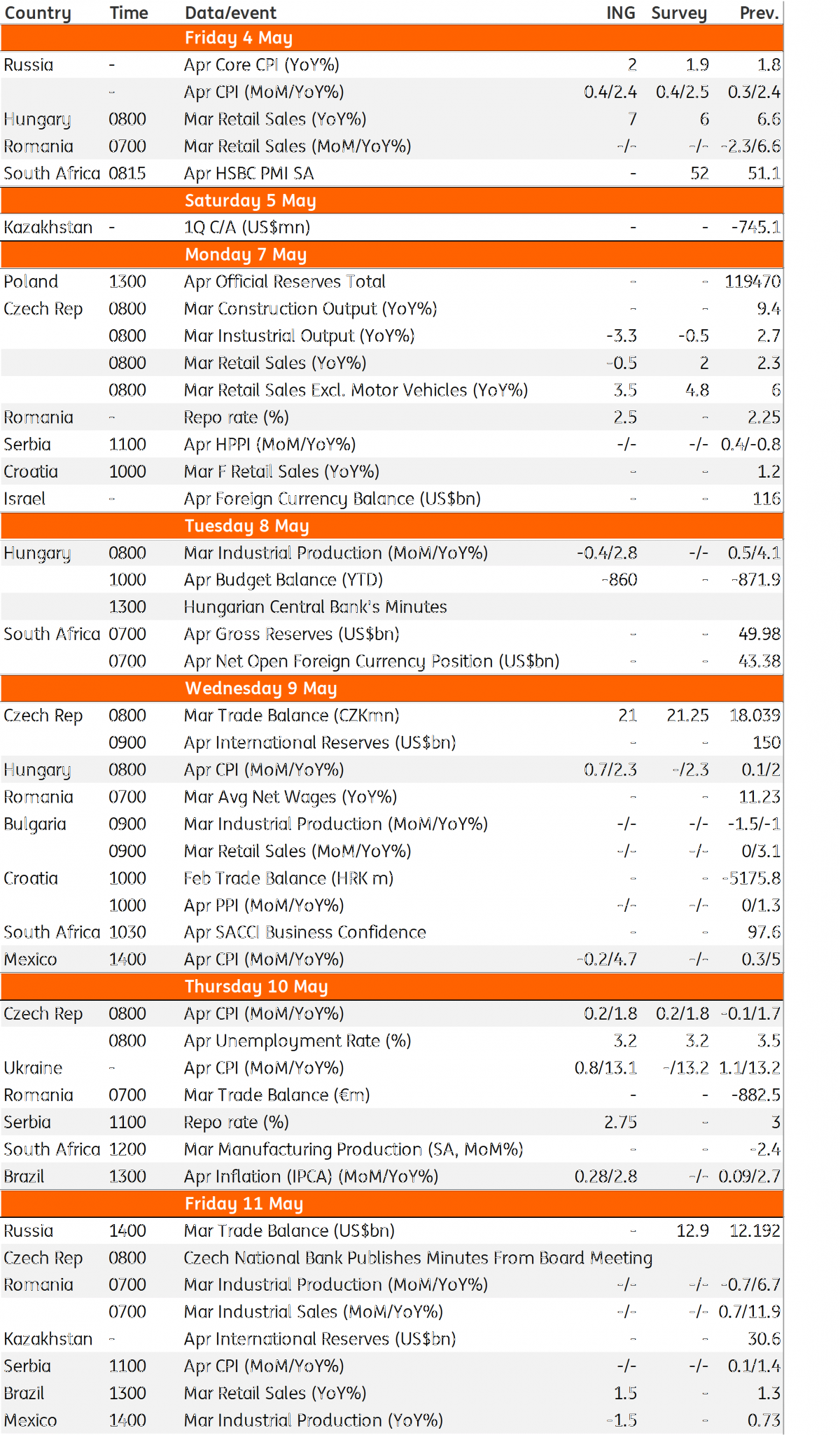

EMEA Economic Calendar

Download

Download article3 May 2018

Our view on next week’s key events This bundle contains {bundle_entries}{/bundle_entries} articlesThis publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more