Key events in EMEA and Latam next week

It's a packed week ahead for EMEA and Latam, with key data on inflation and consumer spending along with several monetary policy decisions

Hungary: Busy data week to bring soft figures

In Hungary, the economic calendar for next week is very busy. We expect the manufacturing PMI survey to follow the lead of global indices, dropping closer to the key 50-threshold. On Wednesday, we see retail sales growth slowing down a bit, and industrial production will likely disappoint on Thursday due to issues in the automotive sector.

The October CPI reading might accelerate further to 3.7% year-on-year on the back of energy and food prices, with core inflation remaining roughly unchanged. We don’t expect the National Bank of Hungary to react. A busy week should close on a positive note, however, with an improvement in the budget balance.

Poland: Monetary Policy Committee to be more cautious

We expect the Monetary Policy Committee to maintain a dovish stance during Wednesday's meeting but there may be a caveat. The Council should reiterate its forward guidance of flat rates until the end of 2019 but it's unlikely to extend that guidance into 2020. The new projections should show that the trajectory of CPI is unchanged though the GDP profile will likely be adjusted. We expect an upward revision to 2018 growth and a downward revision to the 2019 forecast from the July report.

Turkey: Inflation to rise further in October

Headline CPI is likely to go up further in October. This is due to the broad-based pick-up in price pressures and across-the-board increases in all major price categories. The drop in the Turkish lira is still lifting import prices and cost-led price pressures have increased- as seen by annual PPI inflation rising above 46%. We expect monthly inflation at 2.7%, pulling the annual figure up to 25.2% from 24.5%.

Russia: CPI to accelerate but key rates will stay on hold

Russian CPI is likely to accelerate to 3.6% YoY in October. The near-term inflationary risks seem to be in check:

- Weekly CPI growth has been slowing down throughout October

- Households’ 12-month CPI expectations improved by 0.8 percentage points

- The government has reached an 11th hour agreement with oil companies to put retail gasoline prices on hold.

As a result, CPI appears to be on track to fit into the CBR’s 3.8-4.2% YoY guideline for year-end, which reinforces our expectations of an unchanged key rate, at 7.5%, in the coming months.

Barring the local near-term CPI trend, the framework for Russian monetary policy remains skewed towards risks.

- First, the geopolitics-related news flow might intensify soon, with US mid-term elections on 6 November and the US-RUS presidential meeting on 11 November - this is followed by Congress coming back from recess on 12 November, with a couple of sanction-related bills (DETER/DASKAA) potentially on the agenda.

- Second, the current agreement on gasoline prices between the Russian government and oil companies expires at the end of March 2019, and so far does not provide much assurance that flat local gasoline prices are sustainable in the longer-term, given the upcoming VAT/excise tax hikes next year.

https://think.ing.com/snaps/bank-of-russia-confirms-stand-by-mode/

Romania: Key rate on hold at 2.5% with a hawkish twist

We expect the National Bank of Romania (NBR) to stay on hold at 2.50% on 6 November. But a likely upward revision to the inflation outlook and fears of “de-anchoring inflation expectations” require a hawkish twist in tone.

Liquidity management, relative strength in the Romania leu and macro-prudential measures could be cited as reasons for a firmer policy stance. We attach a 25% probability to the NBR frontloading the hike to boost its credibility. FX is the only thing on the central’s bank mind- at least as long as inflation remains well above the target band- due to high and rapid FX pass-through. As deputy governor Liviu Voinea said, “volatility on the global markets is the key risk” for monetary policy ”at the moment”, reiterating that the central bank remains in a tightening cycle and rate hikes are not over, but the timing “either this year or next, depends on evidence”. His comments sounded very hawkish to us.

Serbia: Key rate on hold at 3% and chance of tightening could be delayed

With core inflation muted at 1.1% in September, and the headline rate quite well behaved at 2.1% (from 2.6% in August), the National Bank of Serbia (NBS) has little reason to change its stance at the 8 November meeting. As base effects will dissipate towards the end of the year, we expect inflation to approach the 3.0% mid-point of the NBS target interval but remain below it for this year.

The dinar remained stable against the single currency without too much central bank support. Some mild concerns regarding a potential deceleration of the economy could emerge after the 3Q18 flash GDP data showed the economy expanding by 3.7% YoY, after 4.9% and 4.8% growth in the first two quarters, respectively. Italy being the largest export destination for Serbia is an additional reason for forecast uncertainty for the NBS. Hence, the chances for tightening to be delayed further into late 2019, or even into 2020, depending on the ECB are rising.

Czech: Negative calendar bias sees disappointing September data

Real economic activity in September might disappoint slightly due to a negative calendar bias. While retail sales (excluding cars) should remain solid, total retail sales will be affected by a double-digit drop in new car registrations in September - due to the new emission limits.

Industrial production growth (in YoY terms) will likely fall into negative territory due to the relatively high base from last year. On the other hand, the October unemployment rate will decelerate slightly based on seasonal effects. Further, typical seasonality, together with solid household consumption and higher food (+0.8% MoM) and fuel prices (+1.0% MoM), should push inflation to 2.4% YoY.

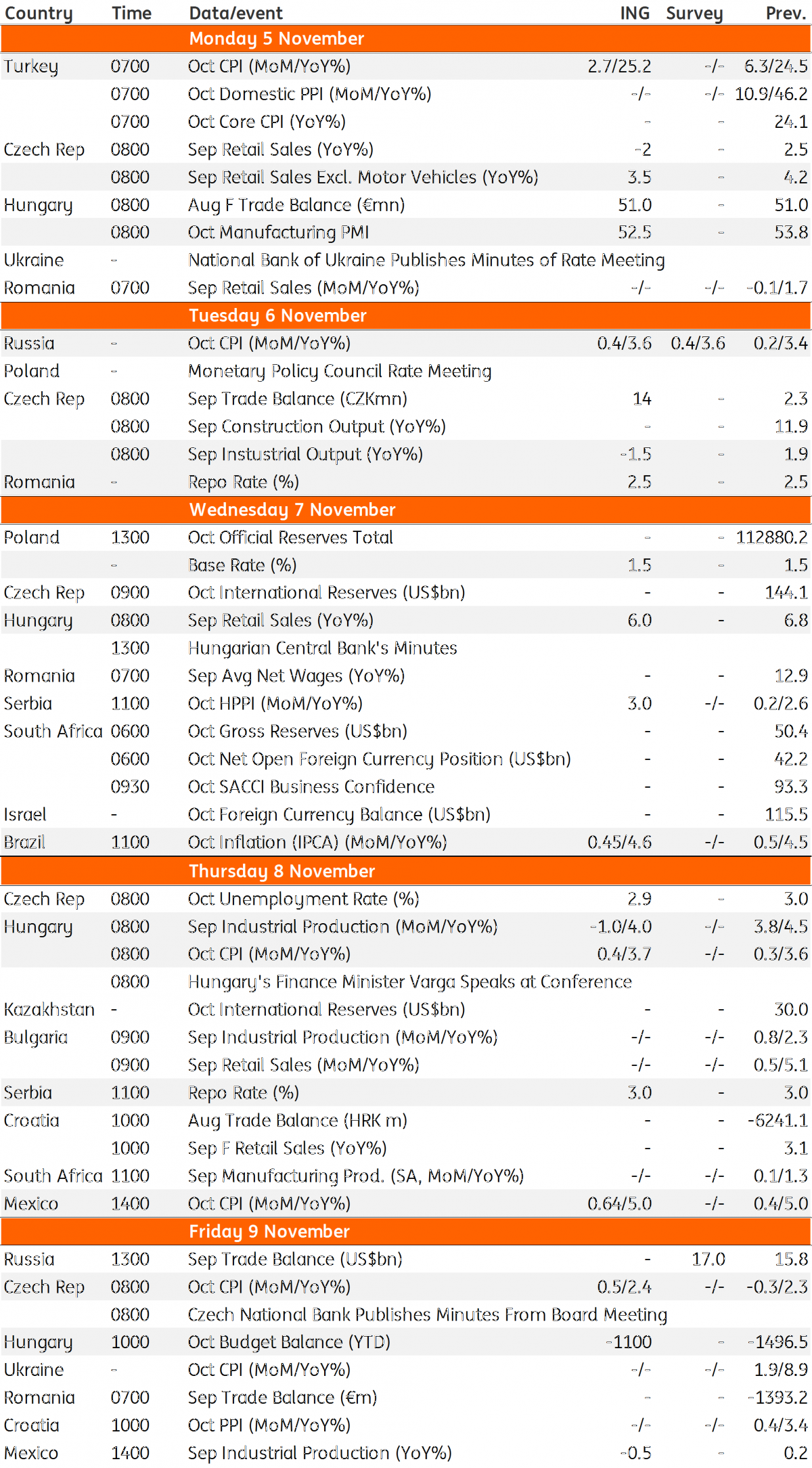

EMEA and Latam Economic Calendar

Download

Download article2 November 2018

Our view on next week’s key events This bundle contains {bundle_entries}{/bundle_entries} articlesThis publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more