Key events in developed markets this week

We're kicking off the New Year with the Georgia state run-off election which will determine who holds control of the US Senate, and we can finally put a hold on the Brexit watching as a deal was agreed over the holidays. On the data front, we have December's data including PMI releases

US: All eyes on the Georgia runoff elections

2021 starts with a bang with pivotal political and economic news for markets to digest. The undisputed highlight will be the result of the Senate seat run-off elections in Georgia on 5 January, which will be a straight battle between the Democrat challengers and Republican incumbents. If the Democrats pull off a victory in both, this will leave the parties with 50 seats each in the Senate giving Vice President Kamala Harris the casting ballot in the event of a tie. This would give the Democrats the so-called Blue Wave of the Presidency and control of Congress with majorities in both the House and Senate.

Markets had seemingly bought into the view that Republicans would retain control of the Senate, acting as a constraint on Joe Biden and some of the more radical proposals of the Democrat party involving tax hikes for corporates and higher income households, and the prospect of greater regulation. However, polls suggest the outcome in both seats is very tight with hundreds of millions of dollars spent on campaigning.

If the Democrats win both seats this should lead to the most substantial 2021 fiscal stimulus (focusing on infrastructure and, over the longer term, on energy policy) with Democrats likely able to override Republican objections to the cost. It therefore offers the strongest growth environment. Moreover, given the focus on getting the economy back on track, tighter regulations and higher taxes are likely to be delayed until 2022 or even 2023. Nonetheless, it could be the excuse for a near-term consolidation in risk markets after a strong post-election rally.

However, if the Republicans manage to retain just one of the seats and therefore their control of the Senate it would mean a likely watering down of any future fiscal stimulus (as we have seen over recent months), with the quid pro quo being less aggressive tax hikes down the line. While less reflationary, sentiment could still be supported through improved trade relations and less disruption for supply chains relative to what businesses have faced in the past few years under President Trump. Moreover, with Covid vaccinations gaining steam, the prospects for growth and risk assets in 2021 look very positive.

Nonetheless, there are near-term issues relating to the spike in Covid cases with hospitals increasingly struggling to cope with the number of patients. We continue to see the prospect of a challenging few months which risks more Covid containment measures that will come at an economic cost. This threat will likely be highlighted by a soft December labour report with the potential for a negative jobs number given surveys, such as the Homebase report, pointing to renewed falls in jobs in the leisure and hospitality sectors as restaurants and bars are forced to close, and as warnings about the risks from travelling are increasingly heeded by the broader population.

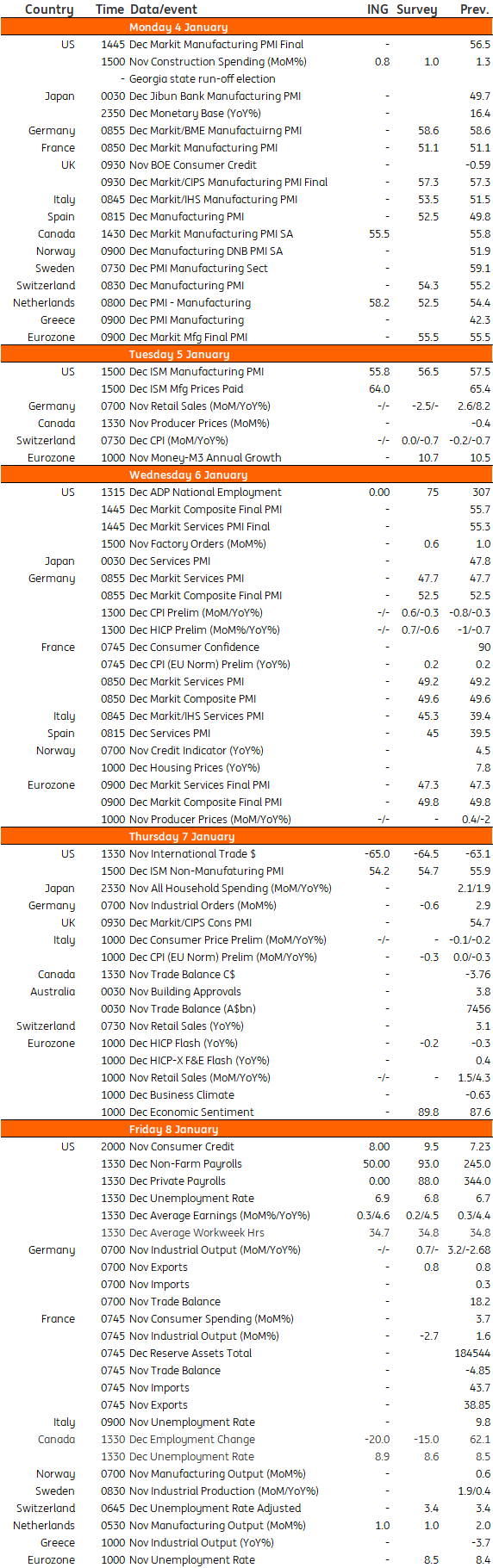

Developed Markets Economic Calendar

Download

Download article4 January 2021

Our view on this week’s key events This bundle contains {bundle_entries}{/bundle_entries} articlesThis publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more