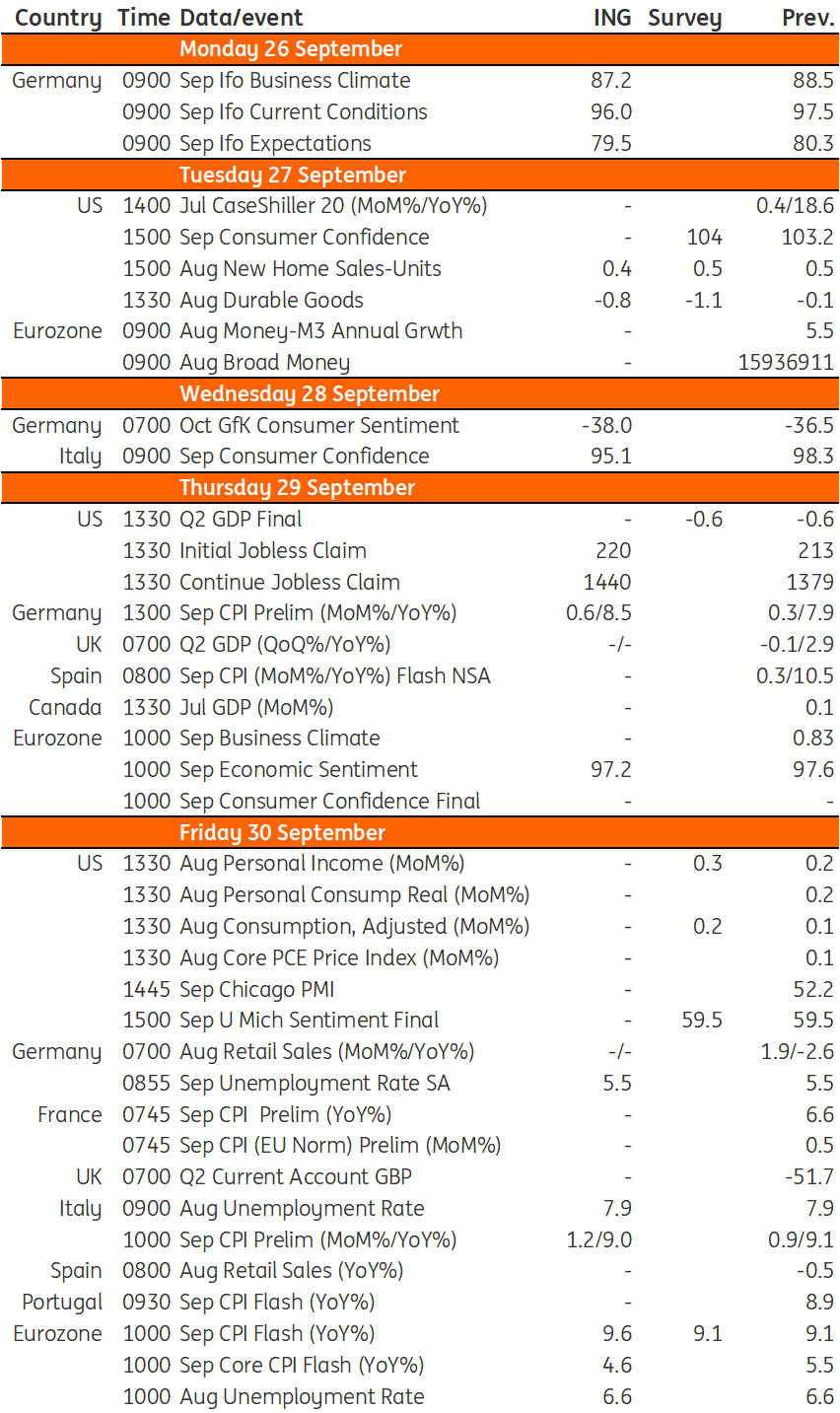

Key events in developed markets next week

US housing numbers will be the main focus next week. The Federal Reserve's aggressive hiking cycle has already sent the market into recession and more pain lies ahead. In the eurozone, we expect higher inflation at 9.6% while unemployment should remain unchanged

US: Housing numbers in focus after Fed's 75bp hike

After the Federal Reserve's 75bp rate hike this week and Jerome Powell's commentary that the Fed is prepared to sacrifice growth and jobs to ensure inflation comes back to target, we will be hearing from many more officials over the coming week. Given the strong clustering of near-term forecasts for rates and the economy, the hawkish comments hinting at another 75bp hike in November are likely to come thick and fast.

The data calendar is fairly light with housing numbers the main focus. With mortgage rates now firmly above 6%, more pain is coming in the housing market where a recession is already underway.

Eurozone: Higher inflation and unemployment rate expect to remain at 6.6%

Inflation figures will be the main focus in the eurozone. Expect higher prices partly due to Germany's decision to end cheap public transport tickets as of 31 August. The key will be to see how much other categories have continued to rise. Separately, unemployment data is out on Friday. We expect the labour market to have remained very tight with the unemployment rate stable at a historic low of 6.6% despite business hiring expectations sliding in recent months.

Key events in developed markets next week

Download

Download article23 September 2022

Our view on next week’s key events This bundle contains {bundle_entries}{/bundle_entries} articlesThis publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more