Key events in developed markets next week

US jobs, Eurozone inflation and UK PMIs will be in focus in what is a jam-packed week for data

US: Jobs report in focus with markets on the lookout for wage pressures

It's fair to say the past couple of jobs reports have been pretty rosy. Employment has soared since the start of the year, and according to the household survey, well over a million new workers have entered the labour force. While this undoubtedly good news, it has led to questions about whether there is in fact more slack in the economy than thought - and by extension, whether a larger pool of workers will keep a lid on wage growth.

However, we don't think this is the case. Surveys are increasingly pointing to labour shortages; a measure of vacancy length shows that it's taking firms almost twice as long to fill posts as it did during the depths of the crisis. And according to the NFIB small business survey, the proportion of firms planning to raise compensation is the highest since the early-2000s. This is also what we are hearing from our own US corporate clients, many of whom are worried about not being able to fill posts at all should employees quit.

With this in mind, we expect a modest recovery in wage growth next week and look for it to test 3% again later this year. This is one of the main reasons why we expect four hikes from the Federal Reserve this year.

Eurozone: Expect the recent slide in headline inflation to come to a halt

Inflation will be the release to watch in the Eurozone next week. The recent slide we've seen in the headline rate should come to a halt this month, although the disappointing pickup in Spanish CPI indicates that we shouldn't expect too much.

The latest unemployment rate will also be announced, and even though the direct market impact could be pretty limited, it will provide an insight into the domestic engine of the Eurozone upswing. Slower declines in unemployment are likely to translate into slower household consumption growth and the limit the prospect of an acceleration in wage growth.

UK: Is the lagging service-sector coming back to life?

After a tough twelve months, last month's services PMI were a little more upbeat - new work is rising at the fastest pace in just under a year, which is pushing up demand for labour. We expect a similar story this month, although there's a risk the PMIs suffer from the recent bouts of cold weather. And despite the more encouraging news coming from the service sector as a whole, the consumer-facing sector is still struggling, and this looks set to keep a lid on overall economic growth in 2018.

That said, the manufacturing sector continues to be a relative bright spot. With global growth momentum continuing to drive new orders, we expect another solid manufacturing PMI next week.

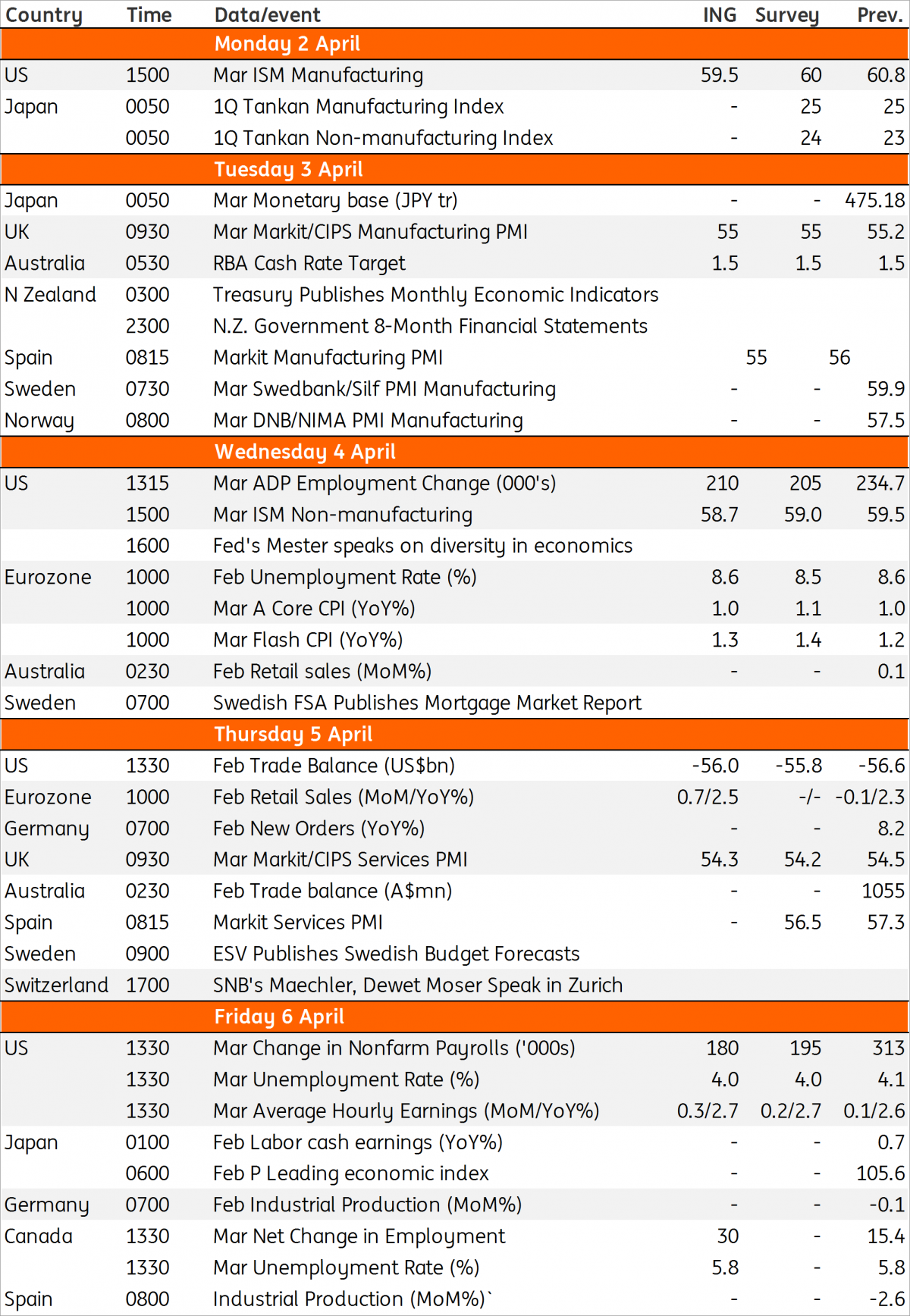

Key events next week

Download

Download article29 March 2018

Our view on next week’s key events This bundle contains {bundle_entries}{/bundle_entries} articlesThis publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more