Key events in developed markets next week

The Bank of England meeting will be in the limelight next week but we don’t expect rates to enter negative territory for a while. We'll also be keeping an eye out on US fiscal stimulus talks and employment data and the myriad data releases coming out of the Eurozone

Bank of England to pass on negative rates

Next week's Bank of England meeting will be coupled with new information on the Bank's review it has conducted on negative rates - in particular the impact on commercial banks. However, our impression is that concerns surrounding banking sector profitability/health are unlikely to be the factor that stops the Bank in its tracks. Instead, there is a certain amount of scepticism among some committee members on how useful the policy would be in practice - particularly now that the economic outlook is looking a little brighter.

So, while we could see the Bank formally lower its estimate of the lower bound to below zero next week, we don't expect policymakers to hint that negative rates are imminent.

We expect rates to remain on hold this year, while QE remains the primary tool of delivering stimulus.

US: Fiscal stimulus talks continue and the January employment report is released

In the US we will be looking to see how much progress can be made in negotiations over Joe Biden’s proposed $1.9tn stimulus plan.

Given wafer-thin Democrat majorities in the House and the Senate, President Biden’s team will need to work with Republicans to get the legislation passed –the Senate filibuster where-by 60 Senators have to agree to end a debate and bring it to a vote is the toughest challenge. Consequently, it looks increasingly likely that there will be a dilution to get enough support and the package may need to be split in two with more contentious aspects delayed and incorporated into the budget reconciliation process, which only needs a simple majority to pass. Given the Donald Trump impeachment trial is scheduled for the week of 8 February, it looks increasingly likely that it will be late March before part of the package is signed into law. Moreover, it is likely to end up being closer to $1tn than $1.9tn.

In terms of the data, all eyes will be on the January employment report after December saw a 140,000 fall in jobs. We expect to see a modest positive figure given a decent start to the year based on high-frequency spending data, but there should be a better figure in February now that California stay at home order has been rescinded. This has allowed restaurants to re-open for outside dining and hair salons and nail bars to start accepting customers in the US’ most populous state. However substantial improvements in employment are not going to happen until there is a broader re-opening of the economy, which could still be a few months away.

There will be several Federal Reserve officials speaking next week and they may face increasingly tough questioning over financial market conditions.

Eurozone: GDP, inflation and unemployment data

It’ll be a big week for eurozone indicators with a ton of data being released.

Most important is the GDP release for 4Q, for which individual country estimates have already suggested that the negative impact from the second wave will be milder than initially expected. With surprisingly positive growth figures for Germany, Belgium and Spain and a milder than expected contraction for France, the eurozone aggregate is likely to have contracted by less than 1% in the fourth quarter.

Mind the inflation reading as well, which is set to jump on German VAT effects and higher energy prices across the zone. On Monday, we will also see Eurozone unemployment released for December. This will shed light on whether jobs are falling thanks to weakness in many sectors that are most impacted by the second wave of the coronavirus.

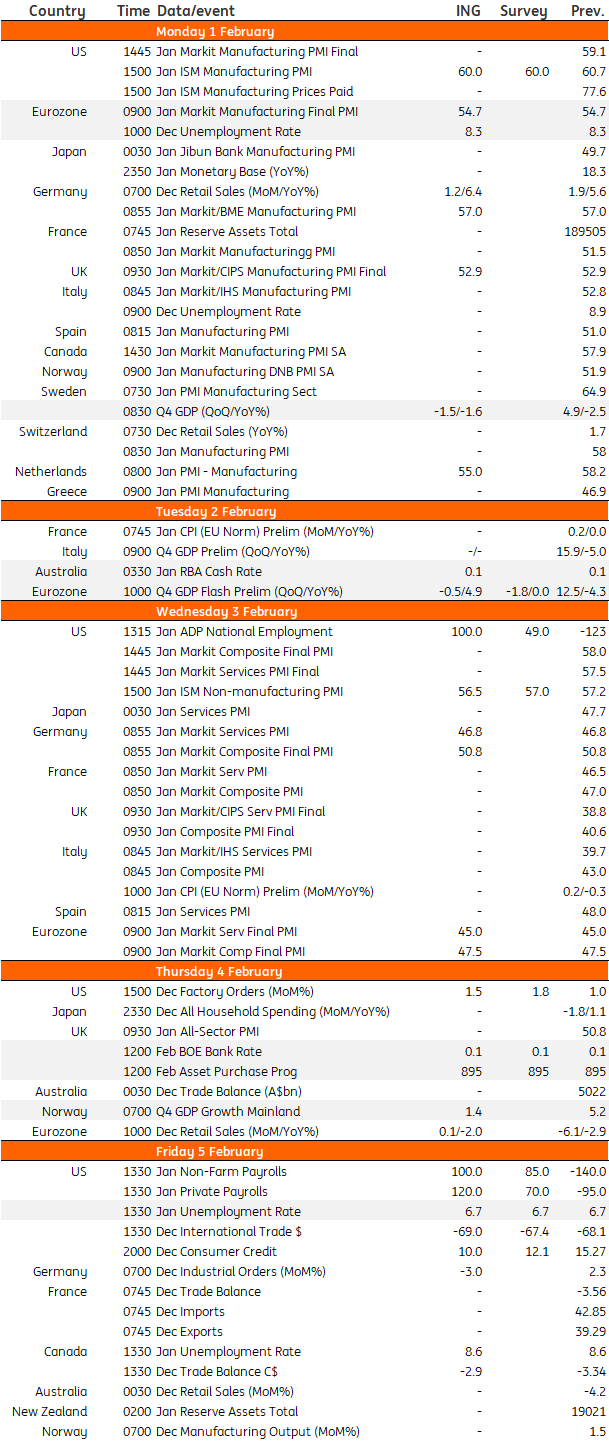

Developed Markets Economic Calendar

Download

Download article29 January 2021

Our view on next week’s key events This bundle contains {bundle_entries}{/bundle_entries} articlesThis publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more