Key events in developed markets next week

A packed week ahead for developed markets. The US jobs report, UK's autumn budget announcement and key data releases from the Eurozone steal the spotlight

US: Hitting new heights

The US economy looks set to grow 3% this year, and with all the key inflation measures at or above the Federal Reserve’s 2% target, monetary policy hardly looks restrictive at this point. The case for further rate hikes is likely to increase this week, with the October jobs report set to rebound after a weather-depressed September reading caused by Hurricane Florence. We would have hoped for an even stronger outcome than our 200,000 forecast for payrolls, but Hurricane Michael hit Florida the week of October payrolls data collection. Nonetheless, the underlying story is strong, with the recent Federal Reserve Beige Book highlighting the tightness of the jobs market. It suggested that pay pressure was increasing - which is evident in other surveys too and that companies were using additional methods to recruit labour including offering flexible working, more vacation days and signing on bonuses.

In terms of wages, we think the annual rate will move up to 3.2%, which would make the fastest rate of pay growth since April 2009, while the unemployment rate could drop to the lowest since December 1969. With business surveys, such as the ISM manufacturing survey, pointing to a positive outlook for activity, we expect to see the Fed raising rates in December with three more rate hikes coming in 2019.

Eurozone GDP and inflation data up next

After the ECB meeting, German inflation data should get the most attention next week. This should provide further evidence of whether or not core inflation in the Eurozone could eventually pick up.

But taking centre stage will be Eurozone data, as both GDP for the third quarter and inflation data for October will be released. Even though the ECB portrays confidence in the medium-term outlook for inflation, the September decline in core inflation (down to 0.9% YoY) disappointed. This makes the October data all the more interesting.

For GDP, risks have also moved to the downside over the past few months, so the question is whether Eurozone growth has maintained its cruising speed of 0.4% QoQ. Also look out for unemployment data, usually overshadowed by inflation data, but does provide key information about domestic demand potential in the months ahead.

‘No deal’ buffer vs. ending austerity? Tough balance for UK Chancellor in Autumn budget

Given all the near-term unknowns of Brexit, UK Chancellor Philip Hammond appears keen to avoid making any dramatic changes as part of next week’s Autumn Budget. But that could prove tricky, following the government’s recent commitments to boost spending on health, as well as to bring the long-running austerity programme to an end from 2019. If Hammond wants to stick to his fiscal goals, which include bringing debt down as a percentage of GDP by the end of the current Parliament, he knows he will need to find extra sources of funding to help square the circle.

Admittedly, the UK’s independent forecasting body – the Office for Budget Responsibility - will reportedly gift Hammond with the timely news that tax revenues should be significantly higher than previously thought. But this is unlikely to be enough to plug the gap entirely, and with neither Parliament nor the prime minister likely to back tax rises, Chancellor Hammond faces a tough balancing act. Reports suggest he is banking on the economy gaining momentum next year if a Brexit deal is struck, which would help boost revenues and take some of the pressure off the Treasury to make tough policy trade-offs in future budgets.

Bank of England to hold tight as ‘no deal’ risk rises

In any other situation, we suspect the Bank of England would be looking to increase interest rates pretty soon. Wage growth - something which has been at the heart of the Bank's rate hike rationale - has been surprisingly strong over the past few months. But inevitably, Brexit remains policymakers’ number one consideration, and given that there may still be some time before we know for sure whether a deal will be in place before the UK formally leaves the EU - there is a risk growth slows as businesses and consumers grow more cautious.

That means we’re likely to see a unanimous vote to keep policy unchanged next week, and we don’t expect a rate hike before May 2019 at the earliest. But having stayed relatively quiet on Brexit risks at recent meetings, probably the most interesting question for markets next week will be whether Governor Carney voices greater concern about the short-term outlook.

Scandi PMIs in focus

The key data next week will the PMI surveys on Friday. We expect the Swedish survey to fall further (down to 52.5 from 55.2), after the weakening in the ESI indicator and the Eurozone PMI this week. Norway should hold up a bit better to around 55.

Another issue to keep an eye on is the continued political stalemate in Sweden, which reaches another deadline on Monday when Social Democrat leader Lofven’s mandate to propose a new government expires. There is little sign of a compromise emerging, which means the task to propose a new government may pass to Centre Party leader Annie Loof.

Canadian growth story still shiny

Despite August posting the first trading surplus (0.526 CAD billion) since December 2016, negative prints for both retail sales and wholesale trade are likely to weigh slightly on Canada's August GDP. We forecast no change from July in the August growth figure. But at an estimated 2.4% YoY, the growth story is still upbeat as Canada continues to reap benefits from the strong foreign demand.

We see the unemployment rate stable at 5.9%. Possible upward pressure should be noticeable in the full-time employment figures. Firms hinted recently in the Bank of Canada's 3Q Business Outlook survey that hiring plans will be extended. But the typical post-summer dip we see in participation rate could put a ceiling on the availability of labour, slightly dampening employment figures.

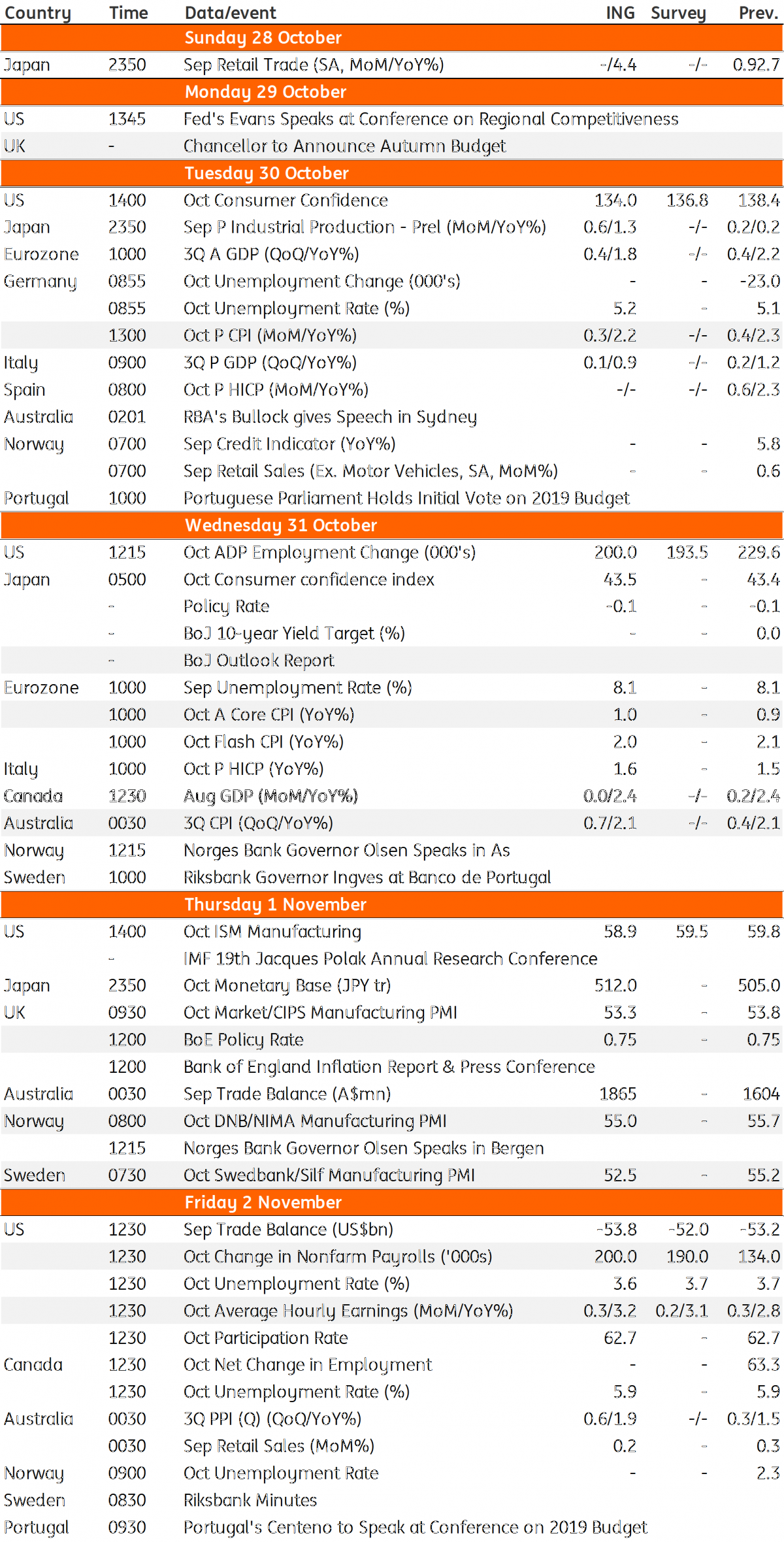

Developed Markets Economic Calendar

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more