Key events in developed markets next week

Macro momentum is to keep the Fed on track, the next ECB meeting is to be heated and pressures on NAFTA could mean a deal is signed by early May. All in all a busy week ahead for developed markets

Macro momentum keeps Fed on track

In the US the main data release to watch will be the 1Q GDP report. It is likely to be softer than the 2.9% rate recorded in 4Q17, mainly due to a weaker consumer spending contribution. We have seen retail sales being hit by weather and tax refund delays, but the retail sales figures for March and the strong consumer confidence readings suggest there is decent momentum as we start 2Q18. Government spending is also likely to correct lower and investment may also be a little softer. However, we expect the net trade contribution to be more positive in 1Q and inventories should also provide a boost.

We are a little above market, forecasting overall growth of 2.5% versus the consensus forecast of 2.1%. Interestingly various regional Federal Reserve Bank “Nowcast” models suggest anything between 2% and 3.4% growth. Either way, the US continues to grow nicely, create jobs in significant numbers and is seeing inflation moving towards target. As such we continue to forecast three additional Fed rate hikes this year.

Expect a heated ECB meeting but without any clear conclusions

The ECB will meet in Frankfurt next week and discussions behind closed doors on how to bring QE to an end should be heated, though without any clear conclusions. The big showdown will be the June meeting. Still, we will watch out for any signs between the lines by Draghi.

Additionally important for the ECB will be whether activity and sentiment continue to slide in the second quarter as survey data for 1Q was quite disappointing. The PMI on Monday will provide an insight into that.

Expect UK GDP to cool as freezing temperatures bite

The UK economy hasn’t had the best start to the year, and that’s likely to result in a slower first quarter GDP growth figure next week. Several waves of snowy weather undoubtedly played a part, resulting in disruption to both industry and retailers. But that doesn’t tell the full story. Consumer demand has remained stubbornly low, with some data pointing to the worst quarter in over five years for spending. This looks set to persist for a little while longer, which is one reason why the Bank of England may struggle to hike rates more than once this year.

Will a NAFTA deal be reached in the next couple of weeks?

Pressures for a new NAFTA deal are mounting with upcoming elections, the expiration of the US Trade Promotion Authority, the ending of the reprieve given to Canada on US-tariffs and the possibility of a US-China trade war drawing near.

However, although recent noises about NAFTA have been positive, with talks of a deal being signed by early May, there are still controversial issues that need tackling including government procurement, dispute panels, agricultural laws and the 'sunset clause'. We are therefore expecting a busy couple of weeks talks-wise with these being the hot topics to be discussed.

The Ifo index to echo recent weak German data

In Germany, the Ifo index should echo recent weak data. However, watch out. Due to technical changes of the index, at face value the drop could look worse than it actually is.

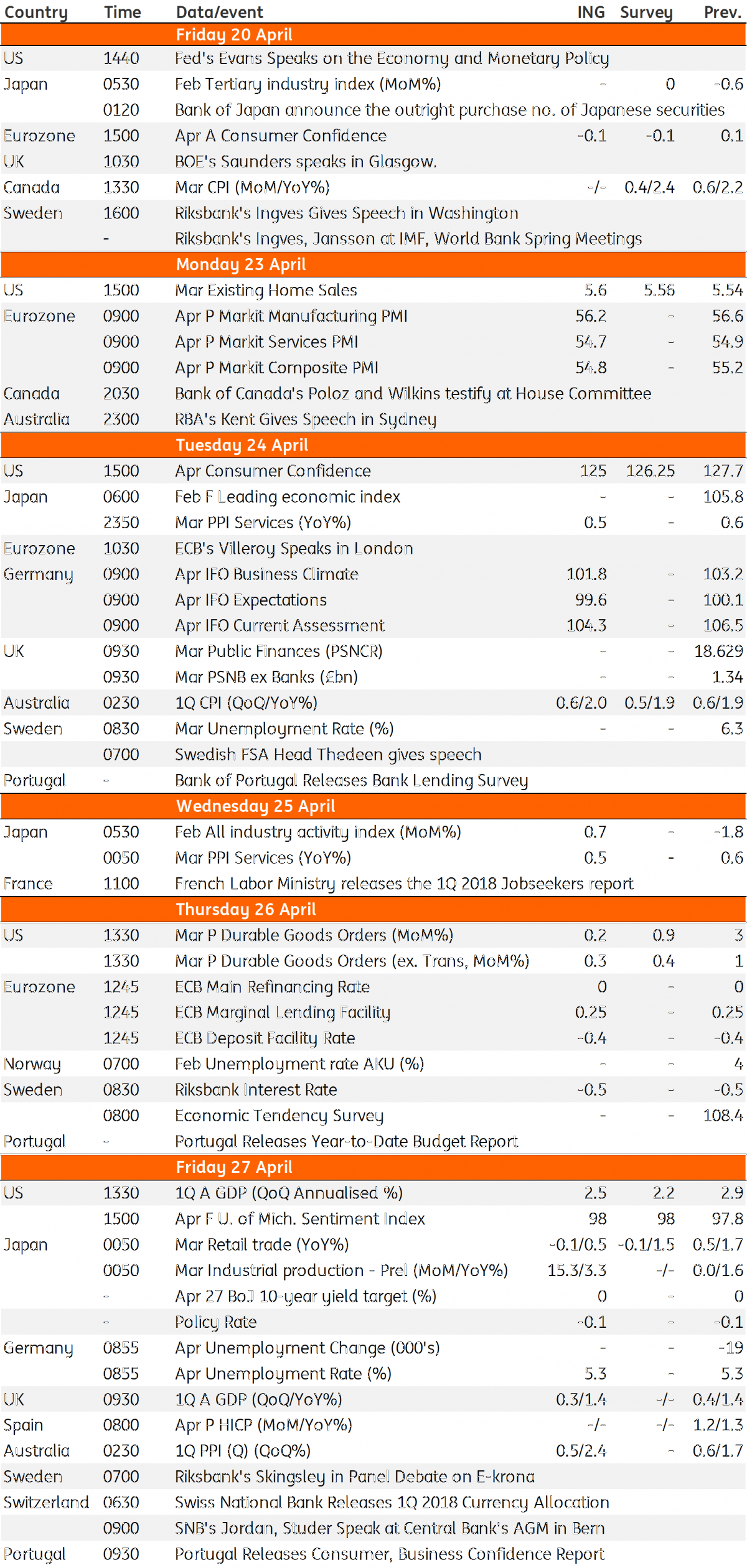

Developed Markets Economic Calendar

Download

Download article20 April 2018

Our view on next week’s key events This bundle contains {bundle_entries}{/bundle_entries} articlesThis publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more