Key events in developed markets next week

Biden's inaugauration will be the dominating event next week. However, keep an eye on the US housing market numbers, central bank decisions from the eurozone, Canada, Japan and Norway and PMI data releases

US: Biden inauguration will dominate but keep an eye on housing numbers

The inauguration of Joe Biden as the 46th President will dominate headlines around the world, with security having been stepped up following events in Washington DC earlier in the month. Joe Biden has already made the case for another substantial fiscal package given the calamitous impact the pandemic has had on the economy, but this will still require working with Republicans to get the legislation passed swiftly.

In terms of the data, it will be housing numbers that lead the agenda. Record low mortgage rates have supported activity and that will continue to be the case. The housing market is more insulated from the pain felt in the leisure and hospitality sector given the bulk of the workers who lost their jobs are relatively young and the median age for a home buyer in the United States is 47, according to the National Association of Realtors. The strength in housing has positive knock on effects for retail sales tied to home furnishings and building supplies while also boosting employment in the construction sector.

None of this will alter the outlook for stable monetary policy from the Federal Reserve on 27 January. The recent increase in longer dated yields and the consequent steepening of the yield curve has caused some concern at the Fed given the speed and scale of the move. Talk of asset purchase tapering (the Fed is currently spending $80bn a month on Treasuries and $40bn per month on mortgage-backed securities) has been knocked on the head based on recent Fed comments and we expect them to retain a dovish bias given the ongoing pandemic.

Eurozone: ECB stance to stay constant

This week, the eurozone focus will be on the European Central Bank, but after December’s big splash there is not much to be expected this time around. ECB President Christine Lagarde will be happy to sit this one out and wait for more information about the second wave impact on the economy and vaccination programmes to come in. In terms of data, the PMIs will be worth watching on Friday. December data was rather upbeat but came in before the harsh German and Dutch lockdowns were announced. Since then, more countries have tightened restrictions, so don’t get your hopes up for a strong reading here.

UK PMIs to be overshadowed by vaccine figures

UK PMIs next week are unlikely to tell us much we didn’t know already. Services output will retreat further below the 50 level on the latest restrictions, but despite the current reports of Brexit drama, the headline manufacturing index may suffer only mildly. That’s because there’s the ‘supplier delivery times’ component is likely to see a significant increase, after the port issues in December and widespread reports of transport issues now that the transition period has ended. That’s obviously not a good thing, but mechanically this will push up on the manufacturing PMI next week.

The bigger question, in the context of ending current Covid-19 restrictions, is whether the vaccine programme will see a further rapid acceleration in pace next week. Vaccinations are at about 300,000 per day, and reports suggest that is likely to accelerate. The key question is when this enables all over-50s to receive their first dose, which data shows is key to ending the lockdown (two-thirds of ICU patients are below the age of 70). If vaccination numbers continue to tick higher, this may be possible by late March or early April if supply comes as hoped, potentially allowing a gradual removal of restrictions through the spring.

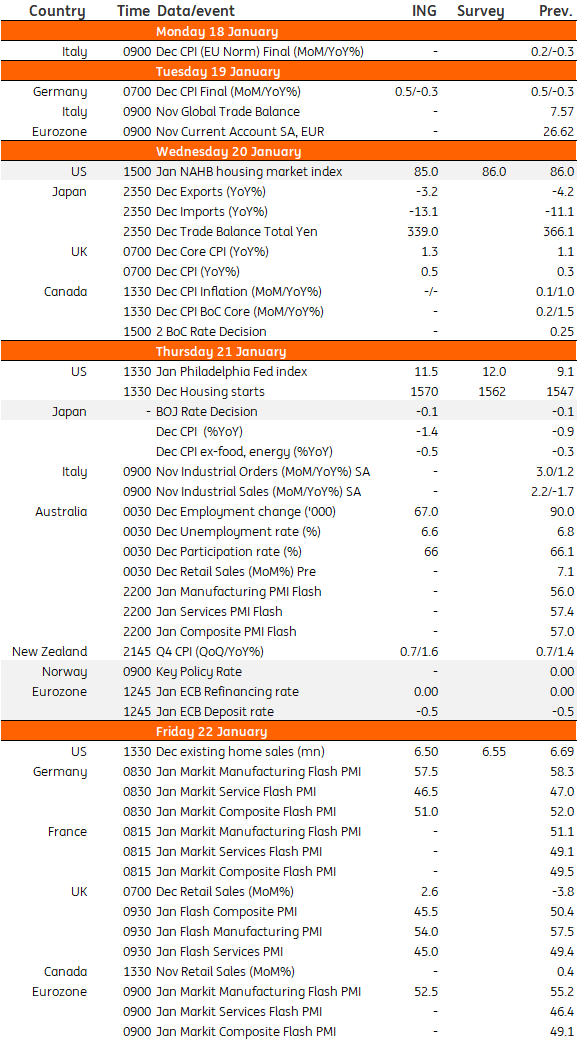

Developed Markets Economic Calendar

Download

Download article15 January 2021

Our view on next week’s key events This bundle contains {bundle_entries}{/bundle_entries} articlesThis publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more