Key events in developed markets next week

Norway's central bank follows the ECB and Bank of England in setting monetary policy next week. Unlike its counterparts, however, we expect the Norges Bank to hike rates and signal somewhat faster rate hikes in the future. Elsewhere, we'll be watching out for UK inflation and retail sales as well as housing data from the US

US: housing in focus

The US calendar is much lighter this week with a focus on housing. There have been some signs of moderation but this reflects a lack of property on the market and high prices rather than a slowdown in demand. Consumer confidence is close to a record high and employment is very strong. Two further rate hikes in September and December from the Federal Reserve remains our call.

UK: resilient data, for now

UK data has been quite good recently, suggesting some resilience despite the fast-approaching Brexit deadline. However retail sales will likely soften from last month given the ongoing squeeze on spending power. Inflation may edge modestly lower. As such, we continue to see little prospect of another BoE rate hike until after Britain formally leaves the EU.

Eurozone: Italian budget to dominate

In the eurozone, digesting the outcomes of the European Central Bank meeting, as well as the discussion on the Italian budget should dominate headlines.

Norway: Rate hike in view

The key event this week is the Norges Bank policy meeting on Thursday, which is likely to see the first interest rate hike in Norway since 2011. The NB has signalled clearly its intention to raise rates and we fully expect them to not only deliver a 25 basis point rate hike but also an interest rate forecast that signals somewhat faster rate hikes in future. In Sweden, the minutes from the Riksbank’s September meeting could also prove interesting, showing the reasoning (and internal arguments) behinds its current policy. And the political situation in Sweden will remain uncertain as the mainstream parties seek to negotiate a compromise government following a very close election.

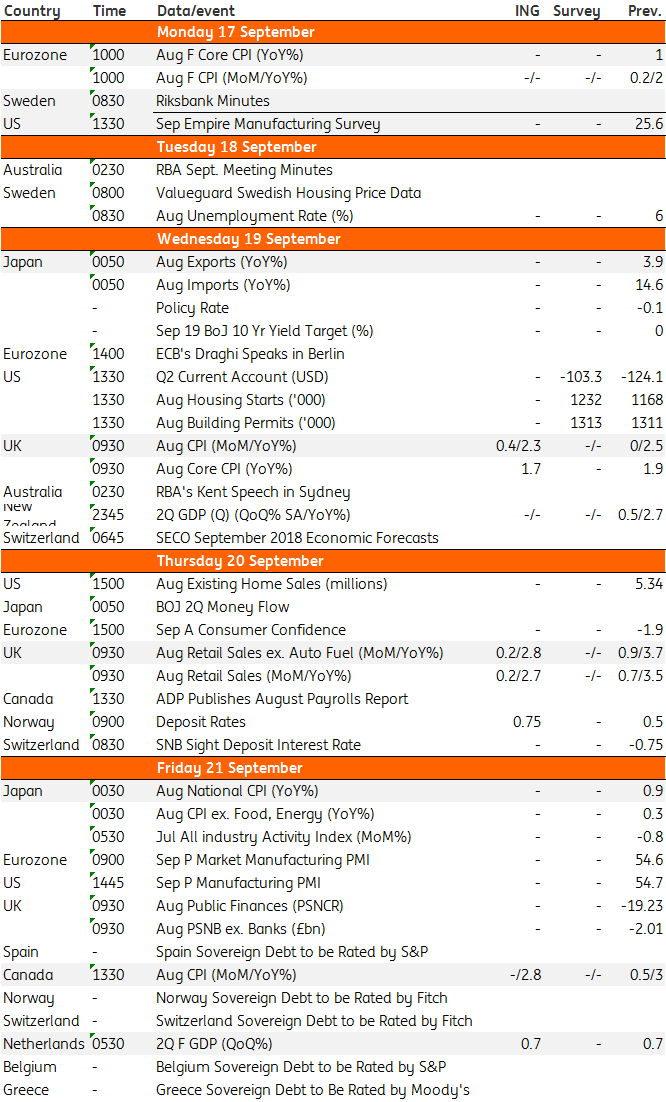

Developed Markets Economic Calendar

Download

Download article14 September 2018

Our view on next week’s key events This bundle contains {bundle_entries}{/bundle_entries} articlesThis publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more