Key events in developed markets next week

US inflation data should cement expectations for four Fed rate hikes while in Europe, public appearances from three ECB members will be closely watched

US: Wage growth to keep Fed on track for four rate hikes this year

With last month’s surprise upsurge in US wage growth, and the market correction that followed, still firmly at the back of investors' minds, inflation data due over the next week will be key.

We’re expecting wage growth to continue to flirt with 3% (read more here), whilst core CPI is likely to remain stable at 1.8%. But once a quirk with mobile data pricing drops out of the annual comparison in the next set of data, core inflation looks set to return to the 2% target and should receive further impetus from the weaker dollar and rising housing/medical costs.

All of this would help solidify the Fed’s view that the inflation dip over the past year has indeed been ‘transitory’ and should keep policymakers on track for four rate hikes this year.

Eurozone: all eyes on the ECB

Next week should be relatively light on macro data. Instead, with three members of the ECB’s Executive Board, Mario Draghi, Vítor Constâncio and Peter Praet, having public appearances, all eyes will again be on the ECB.

A quiet week for Eurozone data will give some insight into whether manufacturing has continued its strong production growth seen in the second half of 2017. Survey data for January were still strong, so we’re looking for confirmation of that positive picture for industry.

Norway and Sweden: Norges Bank policy meeting and Swedish inflation take centre stage

In Norway, the central bank’s policy meeting on Thursday is likely to be fairly low key. Policy rates will remain on hold at 0.5%, but we expect Norges Bank to upgrade its forecasts somewhat, confirming the strengthening economy and solidifying expectations of a first rate hike by the end of the year. In Sweden, the focus will be on inflation and house price data released on Wednesday.

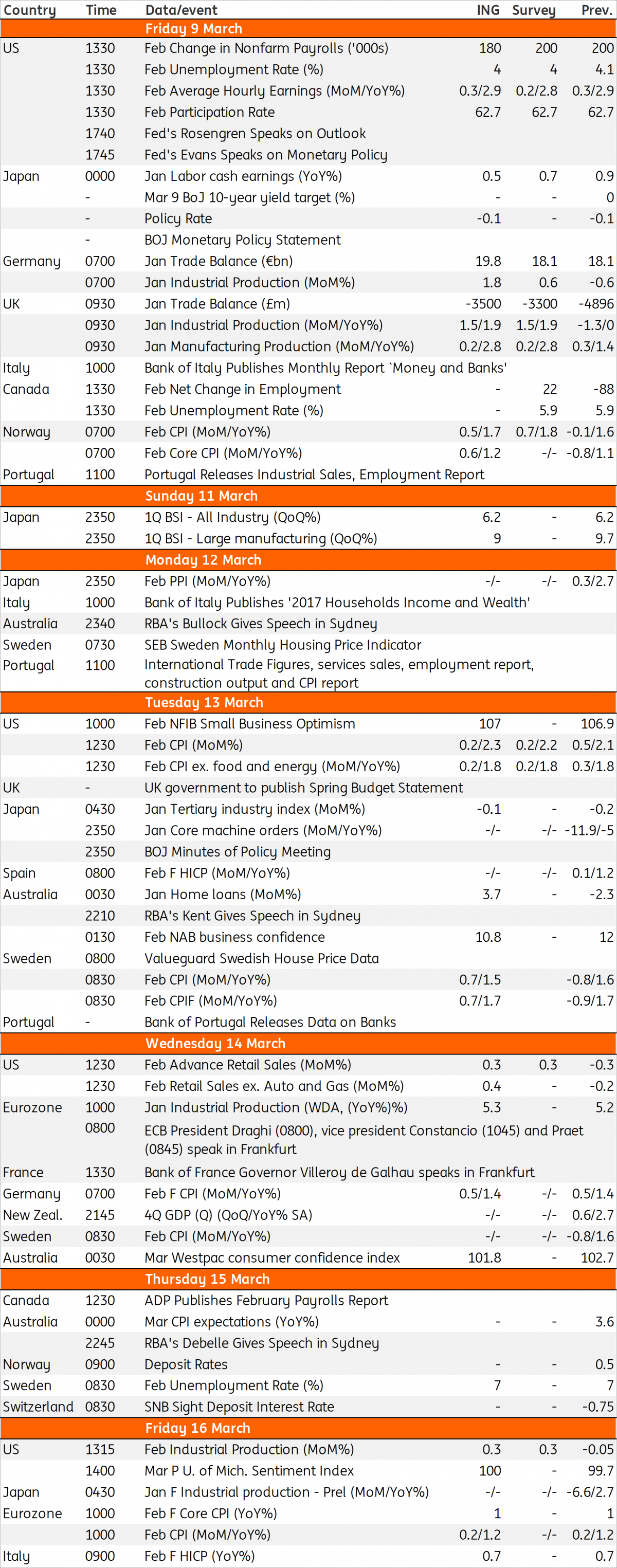

Developed Markets Economic Calendar

Download

Download article9 March 2018

Week Ahead: Our view on the key economic events This bundle contains {bundle_entries}{/bundle_entries} articlesThis publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more