Key events in developed markets next week

In developed markets next week, we are looking for strong US data releases to cement expectations for the Fed to hike rates again in September. Industrial production in Germany may shed some light on the ongoing trade tensions and we expect subdued core inflation readings from Norway and Sweden

Spotlight on September

The forthcoming data is likely to cement expectations for the Federal Reserve to raise interest rates again at the 26 September FOMC meeting. With the economy having expanded 4.1% in 2Q and this week’s inflation report set to show headline CPI ticking up to 3%, with core CPI (excl. food and energy) remaining at 2.3%, the case for higher interest rates is robust.

At the same time, the jobs market is going from strength to strength with payrolls set to rise by close to 200,000 yet again. Wages should also move higher and unemployment could drop back below 4%, which should help underpin consumer spending growth in the second half of the year.

Trade war impact on Germany may be revealed through industrial data

The entire batch of industrial data for June should not only shed some light on the possible impact from current trade tensions on the German economy but will also provide the last pieces of evidence for 2Q GDP growth, which is to be released on 14 August.

Scandi inflation in focus

Inflation figures for Norway and Sweden are due next week. We expect high energy prices, especially rising electricity costs due to the extremely hot summer weather which has depleted hydro power reservoirs, to keep headline inflation above 2% in both countries. But core inflation, which is more important to central bank policy, still looks subdued at 1.3% and 1.2% respectively.

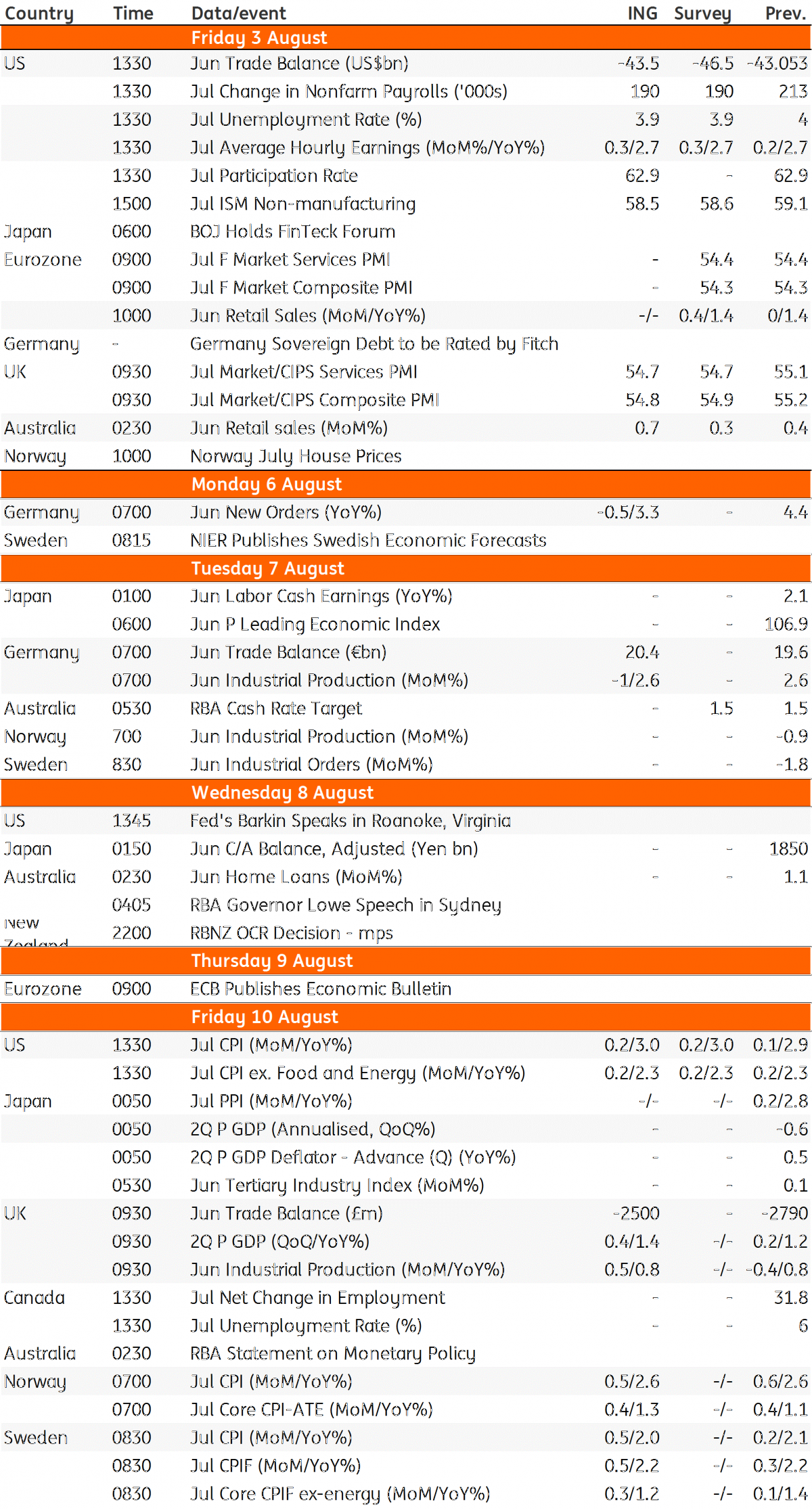

Developed Markets Economic Calendar

Download

Download article3 August 2018

Our view on next week’s key events This bundle contains {bundle_entries}{/bundle_entries} articlesThis publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more