Key events in developed markets, EMEA and Asia next week

The New Year starts off with some key data releases. In the eurozone, we expect inflation to drop below 10% due to base effects and declining oil prices. Turkish December inflation is expected to be at 2.9% month-on-month, leading annual CPI to decline even further. In Hungary, we expect a negative reading in November's retail sector performance

Eurozone: Energy inflation is set to drop

The eurozone starts off the year with some key data releases. Energy inflation is set to trend lower on the back of base effects and declining oil prices. That makes a small drop below 10% quite possible but beware of developments outside of energy. The Economic Sentiment Survey, meanwhile, will give some insight into price expectations from businesses. It will also give a sense of how businesses have fared through the final month of the fourth quarter when we expect a contraction.

Turkey: Annual CPI expected to maintain its downward trend

We expect December inflation to be at 2.9% MoM, leading to a further decline in the annual figure, to 67% from 84.4% a month ago. Easing global commodity prices and strength in the currency will likely be supportive factors in the monthly reading, and along with favourable base effects, this will contribute to annual CPI continuing its downward trend in the near term, depending on the continuation of currency stability.

Hungary: Negative reading in November retail sector performance

In Hungary, the New Year starts with some strong labour market data. Strong wage growth might come from the one-off, mid-year wage adjustment, which is reflected in inflation readings. The unemployment rate will show some short-term stability heading into year-end. But the real deal will be the retail sector performance in November, where we expect a negative reading, showing the impact of negative real wage growth and the changing propensity to consume.

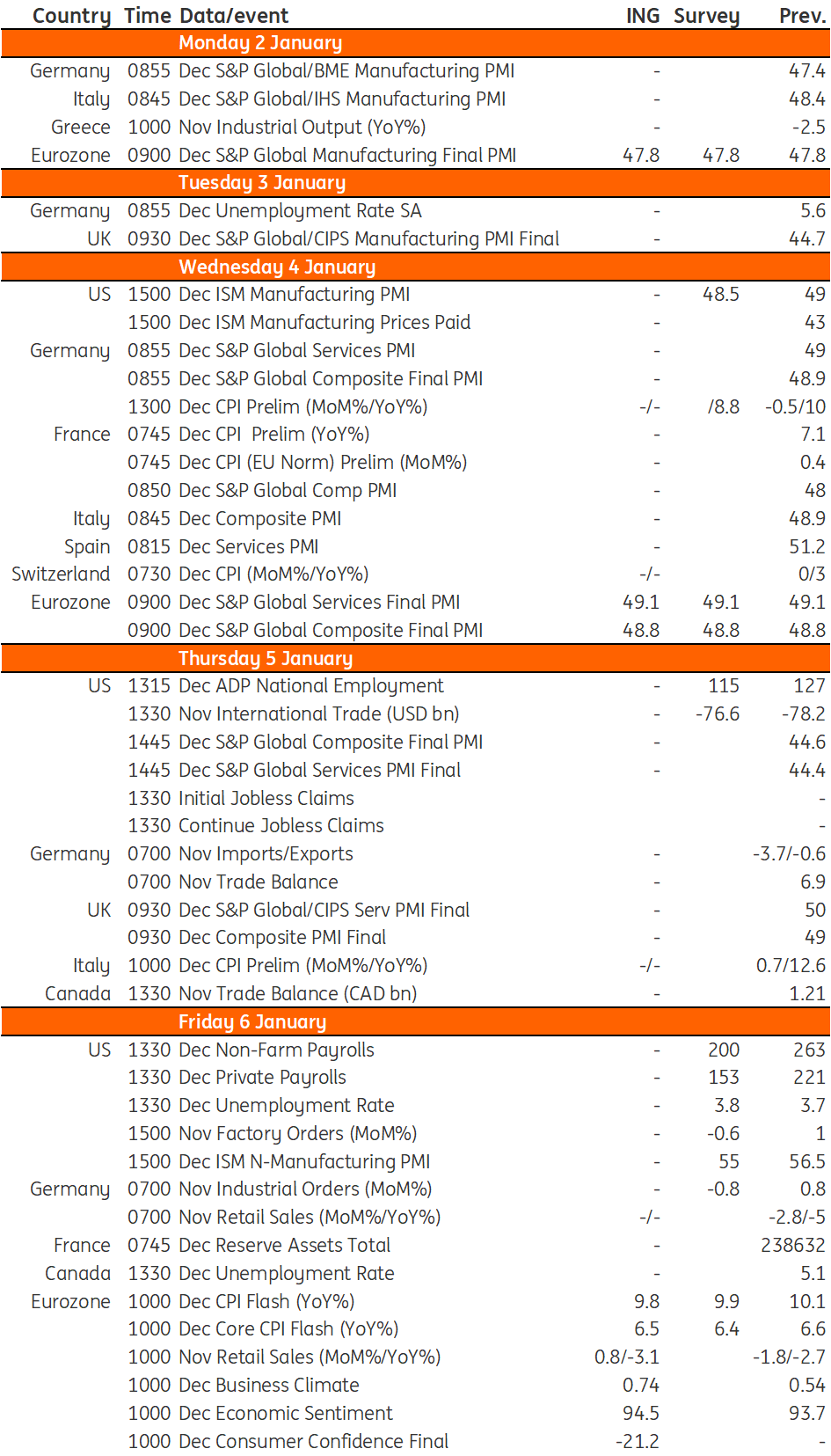

Key events in developed markets next week

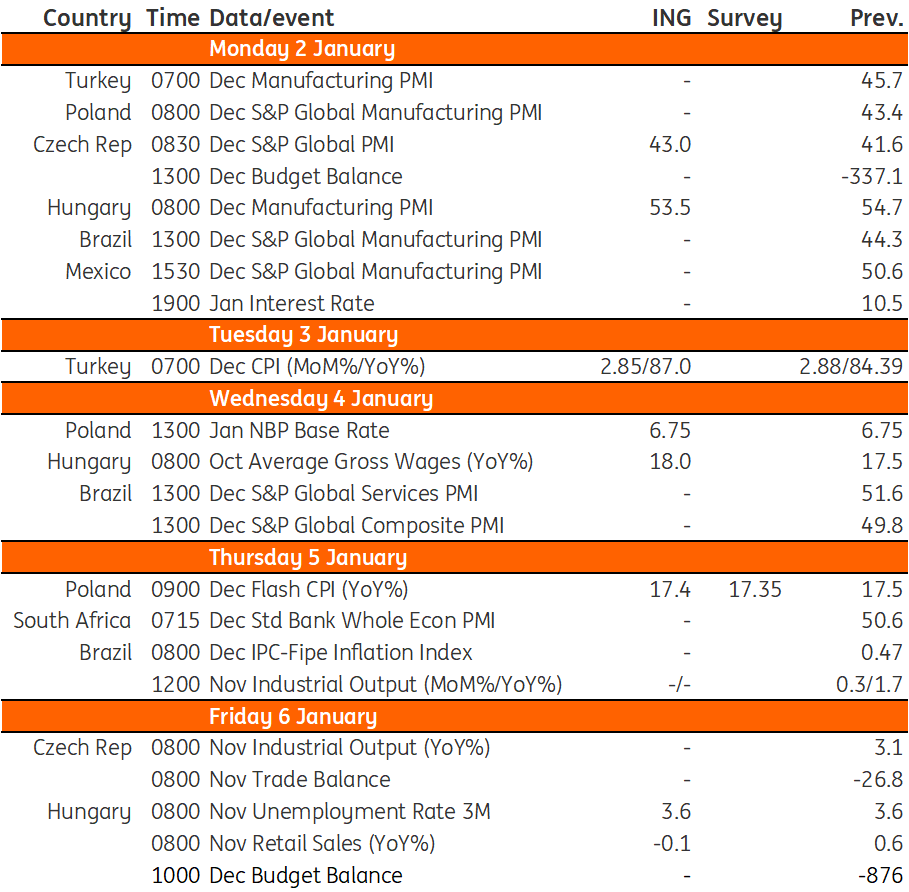

Key events in EMEA next week

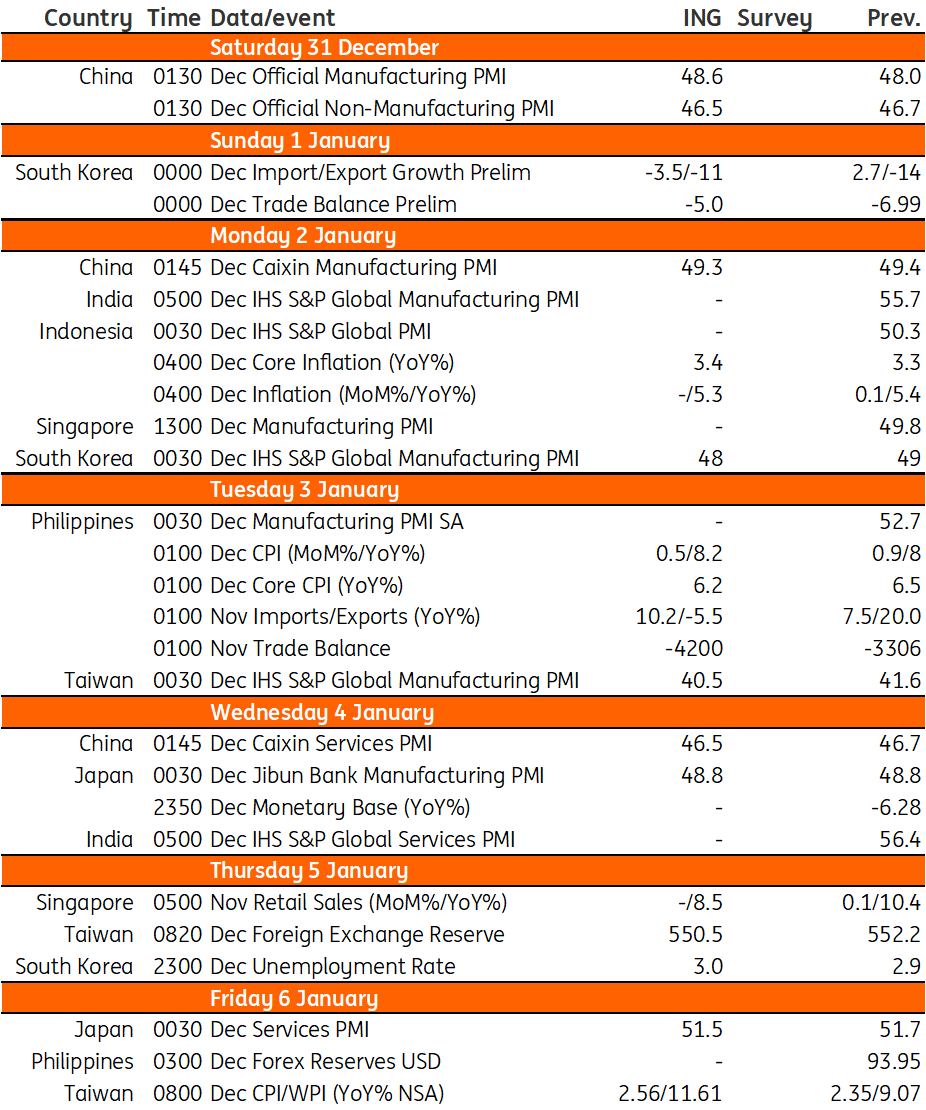

Key events in Asia next week

Download

Download articleThis publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more