Key events in developed markets and EMEA next week

Activity data dominates next week's economic calendar, some of which will help determine what happens at the forthcoming round of central bank meetings in late April and early May

US: Watch Fed commentary ahead of pre-meeting quiet period

The market remains split on whether the Federal Reserve will hike interest rates on 3 May. Core inflation continues to run too hot for the Fed’s liking, but the minutes of the March FOMC meeting showed that officials acknowledged the risk that lending conditions will tighten in the wake of recent banking stresses and that the likelihood of a recession has increased. Nevertheless, that didn’t stop officials from forecasting the fed funds target ceiling ending the year higher than it is today in their March projections.

Next week’s data flow is unlikely to have much influence on the market’s thinking. Instead, we expect the focus to be on individual Fed officials, who will get their last chance to air their views to the public ahead of the quiet period in the days leading up to the May FOMC meeting. We strongly suspect that if market conditions allow, the Fed will look to raise the policy rate one last time in May.

The data consists of housing numbers and some regional manufacturing surveys. The general view is that high borrowing costs and a lack of affordability will continue to depress activity here, but the manufacturing numbers may get a bit of a lift from the China re-opening story, which has certainly boosted activity there and should further improve any lingering supply chain issues in the US. We also look for a further increase in initial jobless claims, reflecting the spike in lay-off announcements at the start of the year.

Eurozone: PMIs in focus after conflicting signals on economic direction

It’s survey data week again for the eurozone, which will be especially interesting given that it has been providing conflicting signals in recent months. The PMI has been very upbeat, while the European Commission survey on sentiment has shown a more cautious picture of actual growth developments. The April data should provide some more sense of direction for an economy that is still struggling with high inflation, but also experiencing some tailwinds now that supply chain problems have faded and energy prices have moderated. Also, look at the trade balance, as we expect the deficit to shrink in the coming months as gas prices are much lower than before.

UK: Data to make-or-break a May rate hike

A raft of economic data due out over the next week may well decide whether the Bank of England hikes rates by another 25bp in May. So far, Bank officials have largely refused to be drawn either way, and the most recent March meeting kept the range of options wide open. Barring any big surprises next week, we expect the committee to hold rates at 4.25% in May. Here's what we're looking for:

- Jobs/wages (Tues): Official wage data has finally started to turn, and regular weekly pay has increased by £1 on average over the past two months of data, compared to a rate of £3-4/month through much of 2022. Something similar next week would take the 3M/3M change (ie the average of the past three months' pay level relative to the three months before that) to roughly 4.5% on an annualised basis, down from close to 8% at the tail end of last year. That would be a clear dovish signal for the Bank, though there’s still an open question of how quickly wage growth will ease back even if it has finally peaked.

- Inflation (Weds): Headline inflation looks set to dip back into single digits next week for the first time since August, but when it comes to the BoE’s focus on “persistence”, it’s clear that services inflation is the most relevant metric. The data here has been volatile over the past couple of months, but our best guess for next week is that we get a fractional increase in the rate of service sector inflation. The Bank of England has said it thinks it will stay broadly unchanged in the short term – and therefore we think it would take a material upside surprise to nudge the odds in favour of another rate hike in May.

- Retail sales/PMIs (Fri): After a stronger run so far in 2023, we’re likely to see a modest pullback in retail sales, though with energy prices set to dip from the summer and consumer confidence off the lows, the worst for the retail sector is probably now behind us. Next week’s PMIs are also likely to be consistent with the relatively stagnant economic backdrop being displayed in the monthly GDP figures.

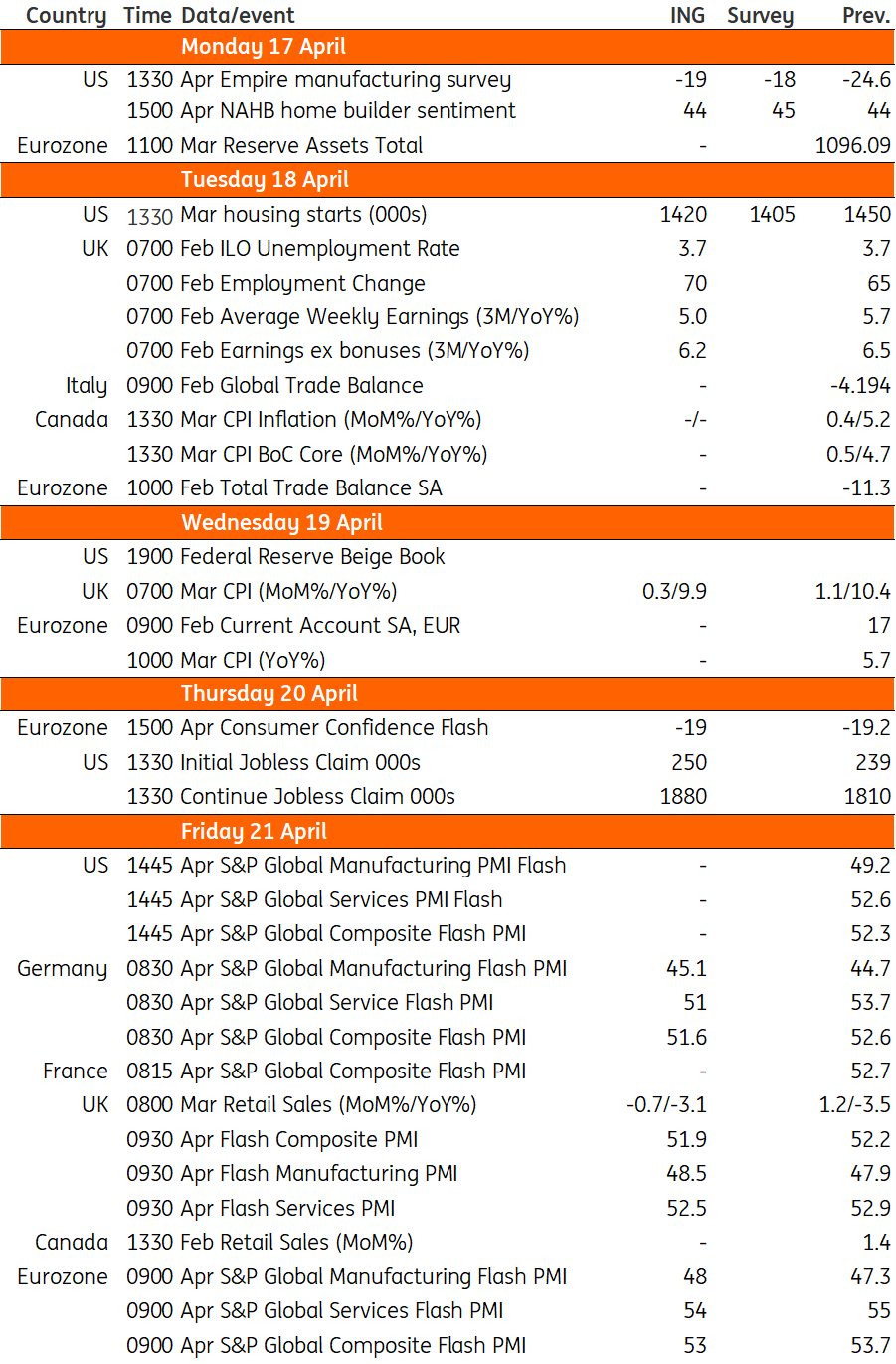

Key events in developed markets

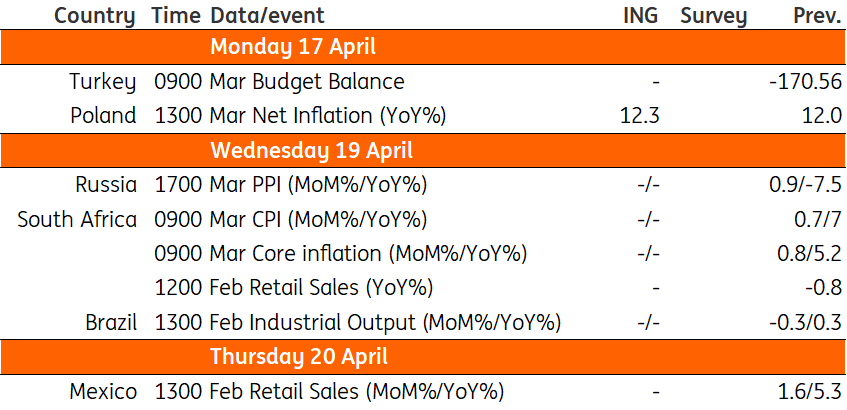

Key events in EMEA/LATAM next week

Download

Download article14 April 2023

Our view on next week’s key events This bundle contains {bundle_entries}{/bundle_entries} articlesThis publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more