Japan: Stealth tightening

Market chatter is mounting about the possibility of the Bank of Japan (BoJ) changing its accommodative monetary stance later this year

Like the CCB, there is much chatter about the BoJ slowing its asset buying

Market chatter is mounting about the possibility of the Bank of Japan (BoJ) changing its accommodative monetary stance later this year – a possibility that Governor Kuroda (pictured) himself seemed to concede, when he remarked at Davos that progress had been made towards achieving the BoJ’s 2% inflation target.

That claim is highly disputable. What is not disputable is that Japan has been on an unprecedented growth spell for almost two years now. Our guess is that we may be due a quarter of upset soon. But that owes more to the vagaries of Japanese data and seasonality than to any genuine slowdown. The underlying story has indeed improved.

Rather than inflation, it is corporate profits that gives the BoJ room to move

To see what is driving this, we go back to first principles and look at corporate profits. It is from these that Japan’s business cycle stems – profits beget investment which begets employment and so wages and consumer spending and so on.

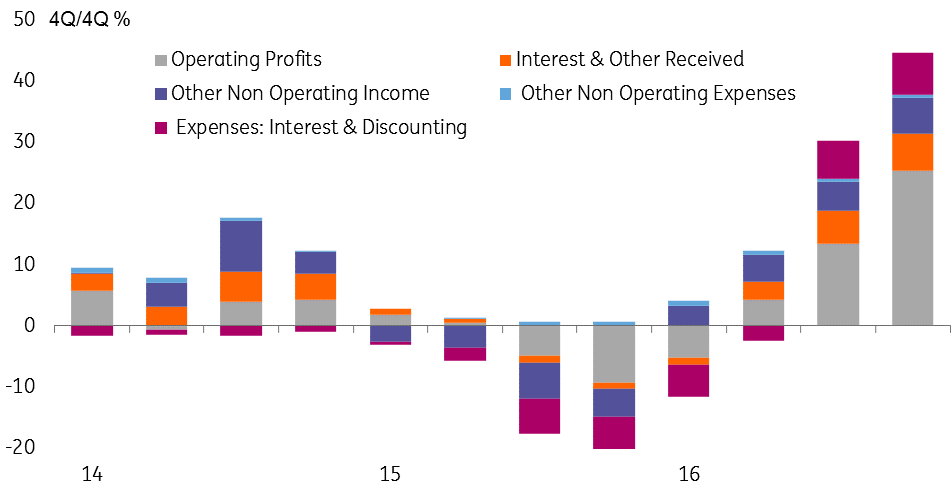

The profits data paint a very interesting and positive picture, which differs between sectors. 4-Quarter profit growth for Japan is close to 18% and has picked up sharply from its recent trough in mid-2016. But the split between manufacturing and non-manufacturing shows that this pick up is almost entirely a manufacturing phenomenon.

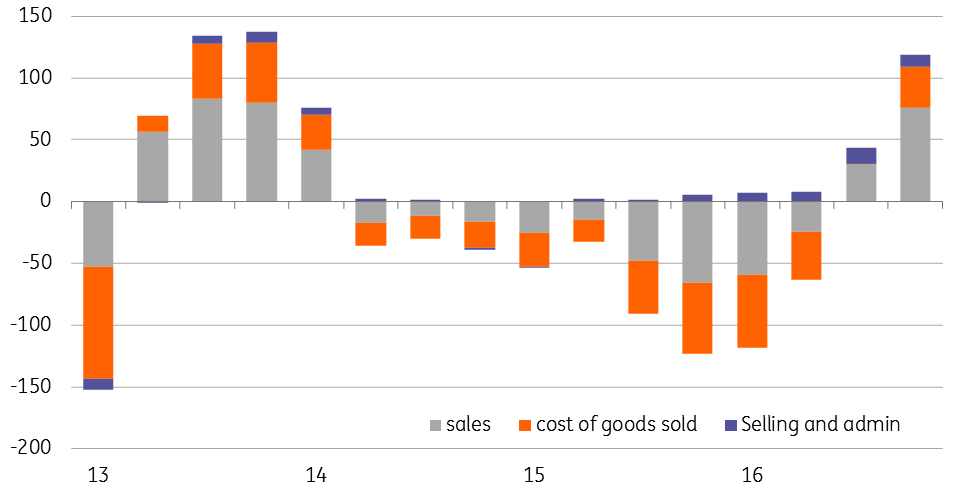

4Q/4Q contribution to operating profits

Strong operating profits in manufacturing making the difference, driven by sales growth

In the manufacturing sector, profit growth on the same basis is more than 40%, of which the lion’s share is operating profit (so not flaky interest or other non-operating incomes that come and go). And crunching the numbers still further, we find that this operating profit is largely a sales driven phenomenon (global demand) though bolstered by a contribution from sales costs and admin efficiencies (robotization, automation perhaps?)

With underlying strength like this, and strong pressure from Abe to pass on profitability in higher wages (Abe has been calling for a 3% wage rise from firms this Spring wage round), the probability of wages feeding into Japan’s resilience and underpinning growth still further has risen substantially.

4Q/4Q% contributions to recurring profit growth

We anticipate this feeding into the Spring Wage round and supporting consumer spending

Back to the inflation story, and really not much has changed, though the Tokyo figures indicate that headline national inflation will push meaningfully above 1.0%YoY next month. It may rise a little further on base effects through the early part of this year before settling back below 1.0% in 2H18. The pertinent question though is “So what?”. And with corporate growth and the labour market in great shape, it is little wonder that some are speculating about the end of QQE.

Our best guess as to how this comes about is that later this year, and probably under cover of ECB tapering announcements in 3Q/4Q, the BoJ quietly formalises their “underpurchase” of assets relative to their stated aim of buying JPY80tr per year. They are now buying only at about a JPY45-50tr rate, and so that becomes the new target without any change in actual purchases. Later on, the BoJ quietly slows the pace still further, and later still, formalises this again. In this way, it can slowly ratchet down their QQE until they eventually stop buying altogether.

We see a very strong likelihood that such action will feed through into JPY currency strength. But as the profit data shows, ‘Japan.Inc’ is in a very favourable starting position for this, and will still likely be making profits if the JPY breaks through 100.

Download

Download articleThis publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more