Italy: Industrial production in freefall in March

The dramatic impact of the lockdown showed up in March Italian production data. Things will likely get worse before they get better, in the hope that the recession will come to an end over 3Q20

Lockdown takes no prisoners, with almost no exceptions

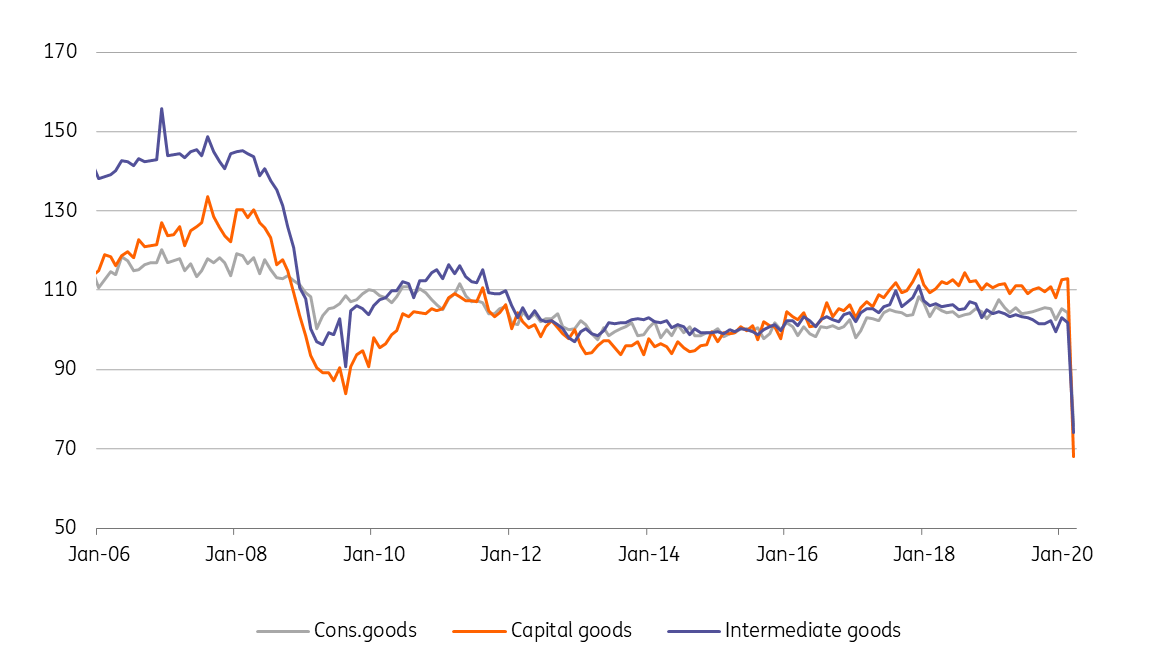

Istat reports that Italian industrial production contracted by an eye-watering 28.4%% MoM in March (from -1.0% in February). The working day adjusted measure was down 29.3% YoY (-2.3% YoY in February). In both cases, they are the steepest declines since the current production series began in 1990. In a single month, industrial production has fallen more than over the entire 2008/2009 crisis.

On the back of a full three weeks of lockdown in the month, the scale of the contraction is not a huge surprise, nor is the fact that all main aggregates, consumer, investment and intermediate goods, together with energy were deeply in the red, all in negative double-digit territory on the month.

Browsing the sector breakdown, we note that the most affected ones were transport equipment and textile and leather products all contracting by more than 50% YoY; unsurprisingly, only the food sector, less affected by the lockdown, was able to limit the damage, contracting by “only” 6.5% YoY.

Things to get worse in April before they get better

With the economy in lockdown for the entire month, production data for April will likely be worse. Lacking evidence from the relevant business confidence data, not released in April by Istat due to data collection issues, the decline in the manufacturing PMI to 31.1 in April (from 40.3 in March) has already provided unambiguous qualitative evidence of additional deterioration.

Taking for granted that things will get worse before they get better, the big question is how fast they will improve in the recovery phase. We suspect that the recovery will not take a V shape, proving instead only gradual. On the one hand, measures put in place by the Italian government to support businesses and households so far have not filtered through the economic fabric of the economy as expected, reportedly ending up in liquidity shortages for many businesses. This is clearly accentuated by the structural over-representation of small-size SMEs, intrinsically financially more vulnerable than their bigger peers. On the other hand, the very nature of the epidemic crisis will likely mean that some form of social distancing will remain in force throughout the summer, obliging many businesses to operate well below full capacity. To be sure, this might be more contained in manufacturing sectors, but the same will not hold for the hospitality, restaurant and recreation sectors.

The non-discriminating impact of lockdown

Upcoming second support package should help recession escape in 3Q20

The Italian government is obviously well aware of this risk and is working on a new support package, expected to be worth some €55 bn, to be disclosed very soon. We believe this will not prevent the Italian economy from deepening into recession in 2Q20, but should help to get out of it sooner (in 3Q20), if at an unspectacular pace. We currently expect Italian GDP to post an average 9.8% contraction in 2020.

Download

Download articleThis publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more