Have emerging markets reached an inflection point?

This was one of the many questions we asked the attendees of the Emerging Markets Traders Association meetings in Hong Kong and Singapore. Although there was some divergence in responses - both panels were cautious after the recent sell-off

A poor outlook for emerging markets

The Emerging Markets Traders Association (EMTA) meetings in Singapore and Hong Kong took place against the backdrop of the escalating trade war, emerging market sell-off and contagion, Chinese central bank policy action and Indian central bank policy inaction this year.

The event was hosted by ING, and there was plenty to talk about, not least, where last year's panel went wrong. Last year the panel had agreed that although an inflection point for emerging markets was near, it wasn't imminent. Clearly, that inflection point has now been reached, so we asked whether it had further to go, or whether the more battered parts of emerging markets were starting to look good value?

The consensus was that EM still has a place, but needs careful differentiation - a blanket tracking approach was unlikely to deliver superior performance

There was some divergence in terms of the Singapore and the Hong Kong panel, with Singapore more open to the idea that EM assets were nearing (but hadn't yet reached) good value, but the Hong Kong panel was more reluctant to call a buying opportunity just yet.

The panelists discussed whether there was a place for EM in portfolios, given that the S&P 500 had returned better returns for lower risk profiles since the Lehman crash. The consensus was that EM still has a place, but needs careful differentiation - a blanket tracking approach was unlikely to deliver superior performance. Another observation was that recent market weakness had reflected more a lack of buying, than any substantial fund outflows. This has been a somewhat orderly re-pricing rather than a wholesale rejection of the EM universe.

The biggest negative shock that could make for an even bleaker outlook would be an acceleration in US inflation, coupled with a slowdown in the US and/or Chinese growth

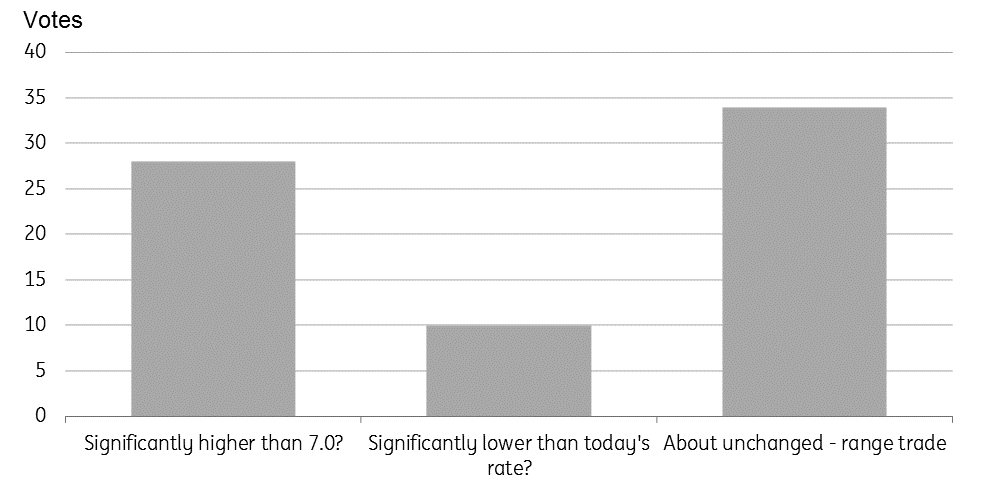

The audiences in both settings were still negative, with 38% more votes by the audience in Singapore for a further sell-off over the coming 12- months than for a rally (see chart below) and a 40% margin in Hong Kong favouring more selling.

The biggest negative shock that could make for an even bleaker outlook would be an acceleration in US inflation, coupled with a slowdown in the US and/or Chinese growth. That was seen as combining all the most negative components that would result in a much more aggressive EM sell-off, dashing hopes for a rally.

The market outlook for EM on a 12-month horizon

What's changed? The USD for one...

One of the main reasons for the worse emerging market outturn than expected by the panel last year was the appreciation of the US dollar. It was felt that this was mainly a function of the market capitulation to fall in line with the Fed dot diagram, and had been driven by recent Federal Reserve speaker comments, in particular, Jerome Powell and also the strength of recent US data flows. Whereas last year, there was maybe a sense of "Fed fatigue", which clearly has been shaken off.

Looking to the future, many panelists felt that the USD would weaken next year, though there was also a fairly uniform sense that the CNY would weaken further too, and in all likelihood, push through USD/CNY 7.0. All the panelists tended to argue that if USD/CNY did push through 7.0, it wouldn't be by so by much. A couple of panelists still had a low conviction feeling 7.0 would be held, mainly as to see further weakening raised problems of:

- Limited effective depreciation as other regional currencies follow

- Increased pressure for outflows

- Currency manipulation concerns

Even the softer USD view was tempered with risks, including the uncertain outlook for Eurozone and the euro, given the Brexit uncertainty, the ongoing Italian budget saga and EU elections.

Where do you see USD/CNY in 12 months?

What else? Oil hasn't helped

Another factor worsening the outlook for externally challenged economies and especially those for whom inflation was already on the verge of being a problem, is the price of oil. According to panel members, this was definitely a contributing factor to the worsening positions of Indonesia, India and the Philippines.

One of the factors that had gone wrong was that the "safety valve" of shale gas from the US had failed to respond as it had previously, as pipeline capacity constraints had prevented oil getting from where it was drilled to where it was needed. Addressing these logistical issues would happen in time, but it might be well into 2019 before this starts to alleviate pressure.

So although there was a widespread sense that oil prices would moderate over the coming 12 months, there seemed to be little conviction this would happen imminently.

Some old favourites remain; think Indonesia

Panelists have for years cited Indonesia as one of their favourite markets. But in spite of market developments this year, they still see Indonesia as closing in on some value, and while they are not quite ready to take the plunge just yet, the Indonesian market is still viewed favourably.

Factors in Indonesia's favour aside from the fact that yields have risen and the rupiah has plunged include a positive and proactive central bank approach and ongoing infrastructure investment. Negatives include next year's Presidential elections.

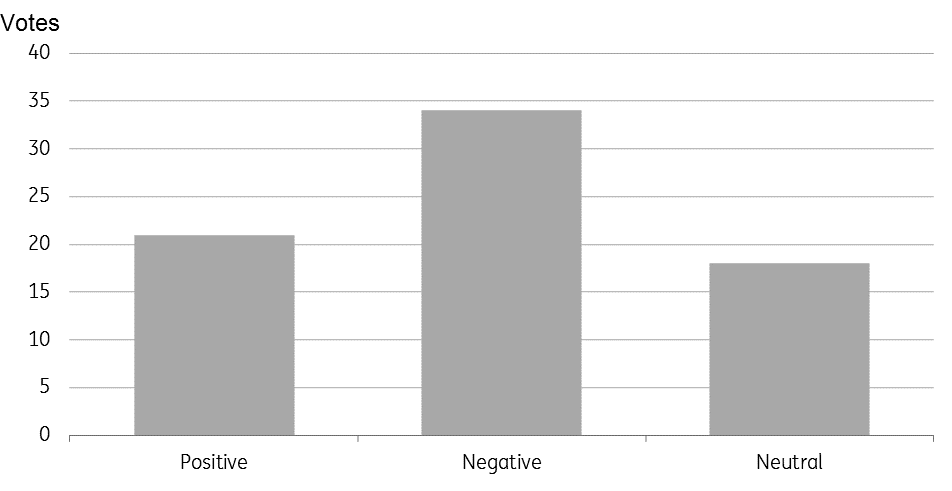

The Singapore audience wasn't so positive, with a net negative to the positive outlook of about 18 percent.

What is the 12-month market outlook for Indonesia?

Others...not so much

However, India didn't get such a glowing review, and was definitely off the favourites list this year and firmly on the most disliked list. Foot-dragging by the Reserve Bank of India in the face of the rupee's plunge and likely imminent reversal of currently favourable inflation prints, plus some unimpressive market restrictions to curb the external deficit has led to this change of view.

One panelist drew similarities between the RBI's recent policy inaction and that of the Sri Lankan central bank, though to be fair, in Sri Lanka's case, the growth outlook was admittedly much weaker, making their inaction somewhat more understandable. One panelist referred to the Sri Lankan situation as toxic, referring to the additional complication of elections in 2020.

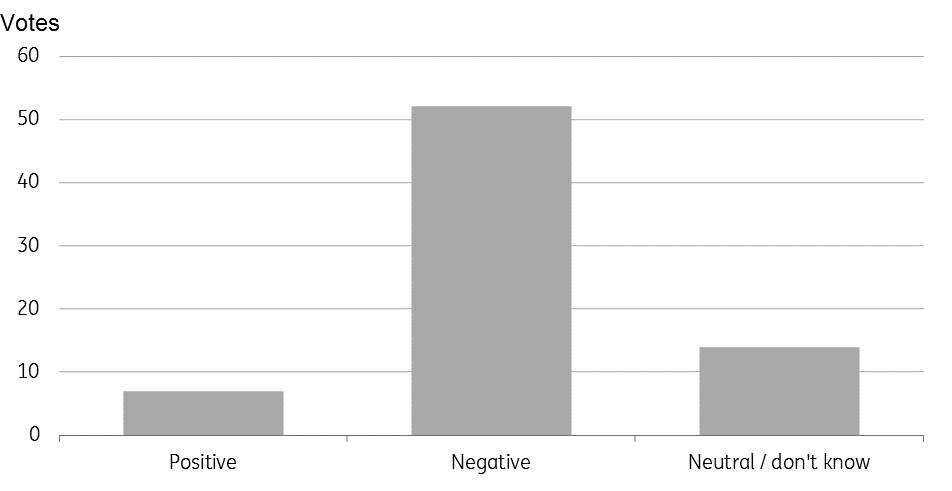

The audience in Singapore had an even more unfavourable view of India relative to Indonesia, with a net negative to a positive spread of almost 62%.

What is the 12-month market outlook for India?

Trade - getting worse

With worsening US-China trade relations at the back of many investors' minds, we also asked the audience whether they saw a resolution to the trade war within a 12-month window. The vast majority, by more than 34%, thought that it would get worse, rather than better.

Some panelists felt that US trade protectionism could actually intensify after a poor mid-term result for President Trump

One highly interesting observation by panelists was that the previous received wisdom that a poor Republican mid-term election result would lead to some pull back on the trade aggression no longer held. Recent comments by Vice President Mike Pence, the microchip scandal, election meddling allegations and a naval 'game of chicken' seemed to have taken the trade dispute to new and much more hostile levels. Few could see a positive scenario emerging and some felt that US trade protectionism could actually intensify after a poor mid-term result for President Trump.

The trade war is unlikely to deliver any absolute benefits to economies in the Asia region, some thought that the relative winners of this trade war would be Vietnam, Malaysia and Thailand

Another interesting remark was that any future change in the US executive would not necessarily result in a reversal of the trade aggression. One panelist indicated that this policy was winning support from supporters of both parties, with the main bone of contention being the approach taken, rather than the goal. The goal is to reduce non-trade barriers and eliminate coerced technology transfer. Losing the tariff revenue was likely to be a bitter pill to swallow for any future President of either party looking to overturn current trade policy shifts.

Although the trade wars were not likely to deliver any absolute benefits to economies in the Asia region, panelists thought that the relative winners of this trade war (in order of their relative gains), would be Vietnam, Malaysia and Thailand.

Do you see a resolution to the US-China trade war

(12-month horizon)

Likes and dislikes

In both Singapore and Hong Kong, market favourites included:

- Thailand

- Vietnam

- Malaysia

- Indonesia (still and with reservations)

- Singapore

Making it onto the disliked list were:

- India

- Sri Lanka

And the two with mixed sentiments were:

- Korea, but some panelists felt the Bank of Korea's threats to hike in response to household debt were counterproductive, though this wasn't a unanimous view.

- China (in the thick of the trade war, but with considerable government and central bank support.

Download

Download article12 October 2018

In case you missed it: A war of words This bundle contains {bundle_entries}{/bundle_entries} articlesThis publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more