Industry outlook 2022: bracing for the energy impact

The manufacturing sector continues to be plagued by supply chain problems, while demand is weakening. A post-pandemic reshuffle is in the making with demand weakening and supply becoming less disrupted. Energy remains the key downside risk

Global production growth was decent, despite supply disruptions

The past year has once again been a volatile year for manufacturers. Facing dramatic shortages of labour, materials and equipment, output was hindered and delayed. Still, demand remained strong despite the overconsumption of goods compared to pre-pandemic years. Overall, this has resulted in steady growth in industrial production for most large economies over the past year, but large differences have occurred by region and sector.

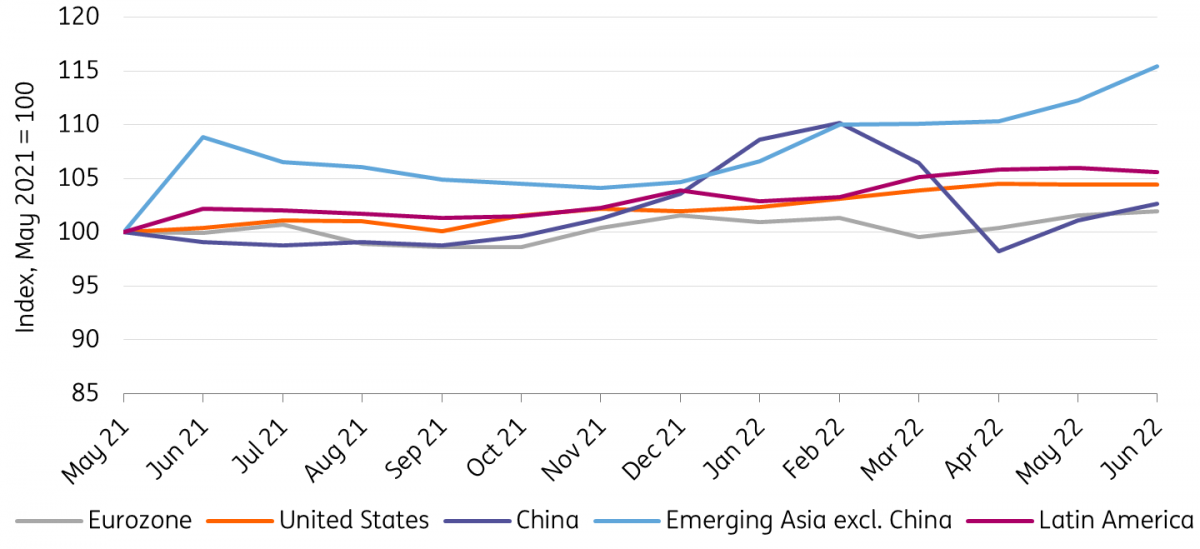

Global production has been steadily rising over the past year

Industrial production excl. construction

The best performance has been noted in Emerging Asia, which has experienced fewer problems with input shortages and has continued its rapid recovery of production. This is despite significant Covid-related disruptions, which caused steady declines in industrial output over the second half of last year. Since the start of 2022, in particular, the recovery in production has been rapid. China is the exception, which saw a quick recovery at the end of 2021 but has struggled with the Omicron variant of Covid-19 since. Lockdowns in key production regions have resulted in a large squeeze in output in 2022, from which it is uncertain how fast Chinese manufacturers can recover.

Advanced markets had a decent year, but much stronger in the US than in the eurozone. Supply chain problems seem to have been larger due to sharper transport cost increases and probably due to a stronger connection to the global value chain, which has turned from a strength to a weakness in these exceptional times. While many eurozone economies have managed to improve, it’s the two largest markets that contracted: Germany and France. The car industry plays an important role here, which – deprived of semiconductors – once again experienced a disappointing year from a production perspective.

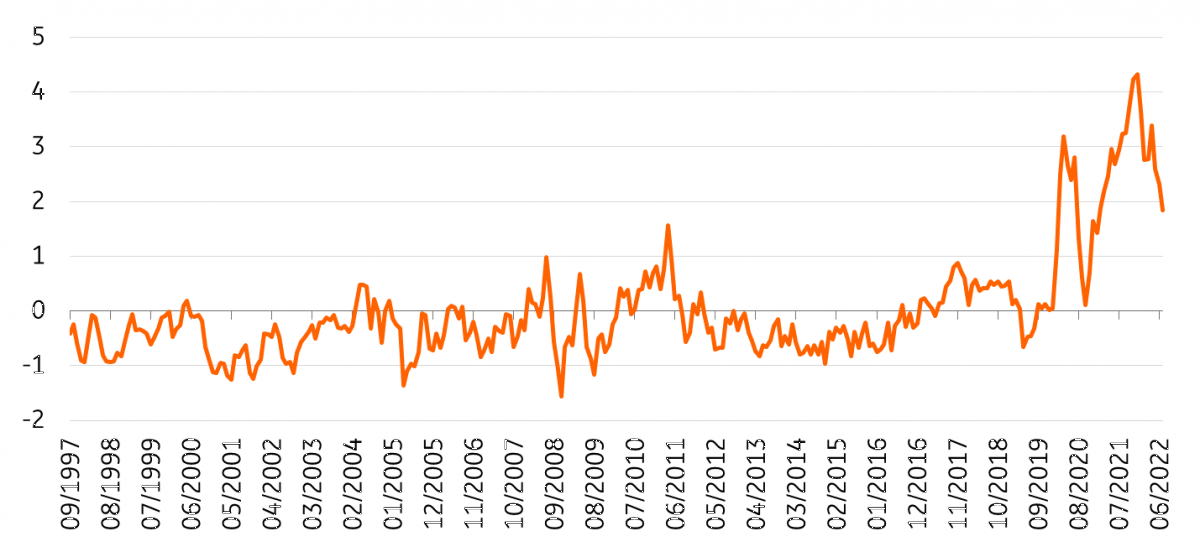

Supply chain disruptions are fading, but are far from gone

The main concern of 2021 was the rise of large supply chain disruptions in the aftermath of the global lockdowns. Last year, we expected normalisation to happen around the summertime of 2022, which has been delayed by the lockdowns in China this spring. Still, the impact of the lockdowns on transport prices and availability of inputs has been milder than expected. Spot prices for container transport have remained on the decline. In recent months, prices have fallen at a steep pace. While they are still well above levels seen prior to the pandemic at about US$6,000, this is an almost 40% decline from a year ago. Delivery times are also dropping according to global PMIs, further indicating that the worst seems to be behind us in terms of disruptions.

Supply chain pressures have fallen in recent months, but remain elevated nonetheless

World, Foreign Trade, Global Supply Chain Pressure Index, Total, Index

Key inputs have also seen some relief. While many businesses still indicate that equipment shortages hamper production, the number is coming down. Think of semiconductors, for example, for which key exporters South Korea and Taiwan have recently seen inventories rise. Prices for raw materials like lumber and metals have also fallen from peaks. Global commodity indices have therefore retreated, which has been favourable for a production catch-up. That has been happening recently, where the last production data turned out to be quite positive as backlogs of orders are shrinking now that more inputs are available again.

European problems related to energy are a key risk for manufacturing

While some costs for manufacturers are currently abating, sky-high market prices for energy continue to be a key concern. Uncertainty about supply and record high prices are set to have a dampening effect on total manufacturing production and could have a dramatic impact like temporary shutdowns in certain sectors. Outside of Europe, this problem is smaller, but within it is the key risk to manufacturers for the months ahead.

At this point, it looks like gas reserves are filling quite rapidly and that there is a good chance that the winter will pass without sizable shutdowns of industry to keep the supply to households intact. A cold winter could still make this a possible scenario, but some cautious optimism is in place at this point. The problem is that Europe is paying for this through the price channel. At current levels, prices are unsustainably high and resulting in voluntary production stops as production is simply not viable in certain sectors at these levels of energy prices.

Europe is also experiencing drought problems that have a significant impact on production. It is not alone in that; China is also struggling with extreme droughts at the moment. For European producers, this adds to the energy problems as coal transportation is hindered by low water levels in key rivers and nuclear plants are struggling to be cooled sufficiently.

Demand is also weakening, making for tough times ahead for industry

While fading input shortages and some relief in input prices are a boon for industry, the reason behind it is not necessarily positive. Demand for goods has been fading due to the high inflation rates seen in advanced markets and because of a shift in consumer preference back from goods to services. The first, high inflation, is causing a squeeze in real incomes among consumers, which is causing a squeeze in consumption. In the eurozone, retail sales have been declining since November last year. The second is happening because Covid-19 restrictions have ended and people feel comfortable going out again now that the virus has entered a milder phase. This is resulting in a catch-up demand for services around tourism and hospitality, which adds to the weaker demand for goods.

For the coming year, we expect subdued growth in demand, with a decline in the upcoming quarters. The shift to services is unlikely to last much longer, but the squeeze in purchasing power is set to continue for quite some time as wage growth is unlikely to make up for high inflation anytime soon. This is especially the case in the eurozone. At this point, the risk of a recession in the eurozone and the US is high for the coming year, which means that demand for goods is set to remain under pressure for some time to come.

ING forecasts for industry

Three calls for supply chains amid volatile times for manufacturers

Supply chain problems continue to be an issue. Looking ahead, shifts in demand will play a greater role, while structural changes to trade flows will gain momentum.

Supply chains to remain fragile

Global supply chains should expect another few months of extreme market conditions with schedule reliability a long way off, delivery times prolonged, and transport receding lower but still highly elevated. Supply chains are fragile in their current state, and an interrupted weak link can easily lead to new setbacks. Once major shipping routes face delays, this leads to various destabilising knock-on effects.

Stringent Covid-19-related lockdown measures adopted in China, and the war in Ukraine, are keeping supply chains under pressure. The situation is likely to worsen in the autumn when the heating season begins with less energy supply from Russia.

The transportation industry is still suffering from a lack of equipment and personnel. Additionally, high inflation leads to increased worker strikes for better wages and working conditions, exacerbating the current situation.

Supply chain problems are certainly here to stay for the rest of the year.

Shifts in demand will play a greater role

Shifts in consumer patterns and extra inventory building from businesses have led to demand being overstretched. However, the extreme rise in energy and food prices has worsened purchasing power and pushed consumer confidence numbers back to levels last seen during the depths of the Covid-19 crisis.

Pent-up demand for travelling and other services has kept consumers spending so far, but that can change quickly. Additionally, new Covid waves in the autumn could strain activity and weigh further on demand. While the current backlog is enough to keep supply chains strained throughout the year, oversupply could re-emerge as an issue once demand drops off to more regular levels, which we expect to happen during the second half of the year. With demand for goods retreating, transportation companies could face an oversupply of containers and fleet capacity next year.

Structural changes to trade flows will gain momentum

As a result of the war in Ukraine, we believe that trade flows will be significantly reshaped as market players that previously purchased commodities and goods from Russia look for alternatives, while other countries step in to benefit from discounts. There will also be substitutions, like the replacement of piped gas with LNG and coal. This results in a new world economic order, being characterised by more ‘friend-shoring’ – trading relationships with countries that have long-standing relationships, cooperation and share similar values might become more valuable. Ethics may also become a more important consideration in trading. Yet, shifting trade flows due to moral considerations will be mainly done by wealthy countries. This opens completely new trade opportunities which in turn could boost global trade again.

Rerouting, diversification in suppliers and or regions, more stockpiling, and inventory building will shape trade relations in the years to come.

Euro weakness is no blessing in disguise for the eurozone

The euro's depreciation has helped to improve the competitiveness of eurozone businesses, but in contrast to previous episodes of euro weakness exports are hardly benefiting. Remarkably, structurally weaker eurozone economies have gained relative competitiveness since the start of the pandemic

Does parity bring relief for eurozone exporters?

Euro-dollar reached parity in July for the first time since 2002 – a milestone that is largely symbolic. However, the weakening of the euro, in general, deserves attention. The euro has been falling against the dollar since mid-2021, which seems to be largely related to diverging central bank expectations and a sudden decline in the eurozone's trade balance. The latter is mainly related to the energy crisis, which has turned a solid trade surplus into a large trade deficit. The high energy prices paid in international markets have played an important role in the weakening of the currency.

Because the energy element is so important in the slide of the euro, the euro has weakened most significantly against the dollar. Against other important trade partners, the eurozone has seen its currency weaken less. While the euro has lost 16.2% vis-à-vis the US dollar since 1 January 2021, the trade-weighted exchange rate has only depreciated by 6.9%. The euro's slide has resulted in a lot of imported inflation because we pay for global commodities in dollars. At the same time, gains in competitiveness have been modest. This is far from the best of both worlds.

The euro weakening is closely linked to higher energy prices

Competitiveness is improving, but businesses aren’t noticing it

The competitiveness improvement does require a deeper look, though, as relative inflation between trade partners plays a role. Taking this into account, the real effective exchange rate (REER) for a country is considered to be a key indicator measuring competitiveness. This is an exchange rate which is weighted by local cost developments. In this case, we use unit labour costs. As chart 3 shows, the REER for the eurozone has been sliding, which boosts the competitive position of eurozone companies. This means that despite a limited drop in the nominal effective exchange rate, businesses do seem to be profiting from relatively better price competitiveness. So while the main impact of the weakening euro is definitely negative through higher imported inflation, there is at least some improvement in export competitiveness to be seen, which could cushion the recessionary effects in the domestic market.

Competitiveness is improving, but weak global demand gets in the way

The problem is that businesses are far from feeling this. The Economic Sentiment Indicator has a subindex which reveals how businesses perceive their competitiveness to have changed in their home markets and abroad. This indicates that competitiveness has dropped significantly within the EU and outside. While exports have recovered to the pre-pandemic trend in recent quarters, it looks like the weaker euro has not given an extra push. The question is whether this relates to price competitiveness or whether weakening global demand is causing this. Regardless, it does not look like businesses are profiting from the improved REER at this point, highlighting the fact that the eurozone is currently mainly feeling the burden from the weak euro and is reaping little benefit from it.

Download

Download articleThis publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more