Indonesia and the Philippines: Easing Covid-19 lockdowns

Indonesia and the Philippines have begun to relax lockdown restrictions to jump-start their economies

Flattening the curve

As the Covid-19 pandemic took hold across the globe most governments opted to implement aggressive quarantine measures to mitigate the spread of the virus in their countries. Restricting mobility and forcing citizens to remain at home may be an effective way of limiting infection to “flatten the (epidemiological) curve”, but the economic impact is likely to be significant with business activity outside essential services having ground to a halt.

The Philippines and Indonesia implemented lockdowns to help slow infections during the onset of their respective Covid-19 waves in the first half of 2020. Several months later, with unemployment on the rise and expectations for dismal 2Q GDP numbers, the Philippines and Indonesia are both moving quickly to relax quarantine measures to jump-start their economies. We examine the possible economic fallout from the lockdown measures and the outlook for their currencies and central bank policy rates.

Indonesia new daily Covid-19 infections and 7-day moving average

Philippines new daily Covid-19 cases and 7-day moving average

Philippine measures: ECQ (Enhanced Community Quarantine)

The Philippines implemented an ‘enhanced community quarantine’ (ECQ) on 15 March for the whole island of Luzon, effectively sidelining roughly 74% of the economy as daily new cases for Covid-19 increased. Mass transportation was shut down, schools closed, manufacturing and services shuttered with mobility limited to trips to the grocery shop or hospital. Lockdown measures were subsequently eased in select regions from 15 May while the capital region and its surrounding provinces saw restrictions lifted on 1 June. In total, hard lockdown measures were in effect for 75 days, covering two-thirds of 2Q20 in the capital region, before the government decided to restart the economy.

In the Philippines, the confirmed total number of Covid-19 cases as of 5 June was 20,451 while the 7-day moving average for daily new infections was 695.

Indonesian measures: PSBB (Large scale social restrictions)

Indonesia implemented ‘large scale social restrictions’ (PSBB) on 10 April in the capital Jakarta and neighbouring regions, although quarantine measures were less stringent than in other countries with President Jokowi putting an emphasis on social distancing, pushing back against ‘hard’ lockdown measures. On top of the partial lockdown, Jokowi implemented a travel ban on 21 April, ahead of an upcoming national holiday to limit intra-regional movement. PSBB ended on 5 June although areas experiencing a recent spike in cases will remain under PSBB until further notice.

As of 5 June, the official total number of Covid-19 cases in Indonesia was 28,818 while the 7-day moving average for daily new infections was 611.

Lockdowns likely to have weighed heavily on consumption-driven economies

Quarantine measures were implemented to stem the spread of infection but the impact on consumption is likely to be substantial with mobility restricted and citizens encouraged to stay at home. Lockdown measures hamper consumption activities and fear of catching the virus is also expected to weigh on consumer sentiment with households limiting purchases to basic goods (where there is still an option to buy other items). Indonesia and the Philippines are two countries that are heavily reliant on household spending, with consumption accounting for 55% and 65% of their respective economies. Lockdown measures are thus expected to have had a significant impact on growth prospects.

In 1Q20, Philippine GDP fell by 0.2% given the implementation of ECQ in mid-March, while Indonesia managed to grow by 3.0% as PSBB took effect in April. The combination of subdued demand, mounting job losses and stalling consumer sentiment is likely to manifest in severe contractions of GDP for both Indonesia and the Philippines.

We expect 2020 GDP to fall to -2.9% for the Phillipines and -1.9% for Indonesia.

For 2020, we now expect GDP to fall to -2.9% for the Philippines and -1.9% for Indonesia with consumption likely to stall with only a modest recovery towards the end of the year. Consumer sentiment is likely to remain severely eroded with investment activity anaemic until we see consumption back to pre-Covid-19 levels only after government fiscal measures take effect, likely by end-2020 or early 2021.

IDR and PHP: Riding the risk wave for now

Both the IDR and PHP have enjoyed strength in early June with the IDR up 3.65% while the PHP has posted a 0.68% appreciation for the month. Global sentiment has shifted to optimism, boosted in large part by hopes for an economic bounce-back as governments gradually wind down lockdown measures. But stark appreciation was not the theme for either the IDR or PHP during the early onset of Covid-19 and we examine how each currency performed during the lockdowns and how we expect them to fare in the coming months.

PHP: Surprise outperformance but not likely to last

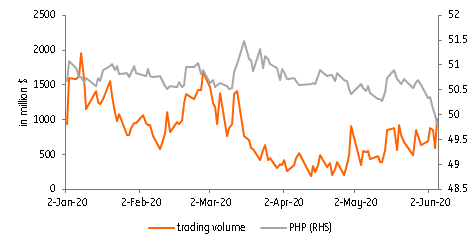

PHP appreciated by 2.25% from 16 March to 1 June to be the best performing currency in the region for that time period despite the lockdown. The Peso outperformed peers despite posting 49 straight trading sessions of net foreign selling in the local equity market as corporate demand for the dollar evaporated during the lockdown with businesses closed. Ahead of the planned relaxing of lockdown restrictions, PHP depreciated by 0.87% with corporate demand accelerating before the current risk rally took over to lift the PHP to multi-year strength and breach the 50 level.

In the months ahead, however, we expect PHP to face mild depreciation pressure as real demand for the dollar accelerates on import requirements for the government’s infrastructure programme. Meanwhile, PHP will also be missing the once-reliable cushion of Overseas Filipino (OFW) remittance flows, which are expected to decelerate with scores of OFWs returning to the Philippines after losing their jobs overseas.

IDR: Recovers on sentiment but likely to have less room to appreciate

IDR was beaten towards a historically-weak level of 16,575 at the height of the risk-off episode induced by the Covid-19 pandemic in March as foreign players dumped holdings of Indonesian bonds. The violent depreciation spell prompted widespread intervention from Bank Indonesia (BI) which intensified its ‘triple intervention’ in the spot, bond and non-deliverable forward markets. By 10 April, IDR had stabilised, appreciating by 8.7% from 10 April to 1 June with Bank Indonesia helping to support the currency by refraining from cutting policy rates at its April and May meetings. In June, IDR strengthened by 3.38%, further riding the risk wave with foreign investors returning to both the bond and equity markets.

We expect only a mild appreciation trend for IDR over the next few months given our expectation of monetary actions by the central bank and with investors turning more skittish on the prospects for Indonesia as the still-elevated level of Covid-19 infections likely weighs on consumption-driven growth.

Philippine Peso and trading volume

Indonesia Rupiah and VIX

Central bank outlooks: More easing on the way but some more than others

Bangko Sentral ng Pilipinas (BSP) acted early and aggressively at the onset of Covid-19 and the lockdown. Since the ECQ was implemented in the Philippines, BSP has cut policy rates by 100bp and reduced reserve requirements by 200bp. In the months ahead, however, we believe that BSP Governor Diokno is coming to the end of his rate cut cycle as the policy rate (2.75%) edges closer to inflation (2.5% year to date average) and we expect at most another round of 25bp easing from BSP for the balance of the year.

We expect the Philippines to cut rates by 25bp and Indonesia to cut by at least 50bp by year-end.

Meanwhile, Bank Indonesia (BI) has been more reticent with regards to policy rate cuts, reducing the main policy rate by 50bp to date with the central bank surprising market players by pausing at its two most recent meetings. BI Governor Warjiyo has indicated that IDR stability was the main consideration for refraining from easing with BI reiterating that the IDR remains undervalued. After bouncing back gradually after the March swoon, IDR has managed to strengthen considerably, which now provides BI scope to finally cut policy rates to bolster the sagging economy. We expect BI to cut policy rates by at least 50bp to aid economic recovery, which should cap IDR’s appreciation momentum in 2H20.

Reopening amid Covid-19

After implementing lockdowns to flatten their respective Covid-19 curves, government officials from both Indonesia and the Philippines are now hoping to jump-start their economies after the lull in business activity. GDP figures for 2Q and the rest of 2020 are expected to crater, possibly adding pressure on authorities to relax lockdown measures in their consumption-dependent economies even as respective Covid-19 curves appear less than flat. New daily infection counts for Indonesia and the Philippines average 626 and 693, respectively, over the past 7 days and the threat of a resumption in cluster infections remains a real possibility.

Thus, even as government officials move to quickly reopen their economies, authorities have prioritised strict enforcement of social distancing measures while they relax quarantine restrictions. President Jokowi has called on the military to help enforce social distancing across Indonesia while police checkpoints remain in place in the Philippines to ensure that movement of citizens is limited to work and the purchase of essential goods and services.

Potential second wave could force lockdown reinstatement

Over the coming months, it will be crucial for government officials to limit the spread of the virus even as economies reopen as a sudden spike in cases may force governments to reinstate lockdown measures to address a second-wave of Covid-19. A return to lockdown measures would be detrimental to growth prospects, squander the initial fiscal stimulus efforts and delay the recovery for as long as lockdown measures need to be in effect.

Given the still-elevated number of fresh daily infections in both countries and the increased likelihood of a second wave of infection, we expect both Indonesia and the Philippines to see a delayed and shallow recovery with economies only returning to form in early 2022.

Download

Download articleThis publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more