Hungary: Brace yourself for a new record

With the March industrial production data, we have almost everything we need to make a 'now-cast' for 1Q19. We see a new record for GDP growth and it’s not even a close call

Forecasters are fallible

Economists and forecasters have been unanimously expecting a slowdown in GDP growth in 1Q19. But after high frequency data over the past three months, we now call for a strengthening. So what exactly has changed? While it appeared that economic momentum was losing momentum, March industrial production data suggested otherwise. So let’s try to assess all of the components on the production side of GDP.

The agriculture instability

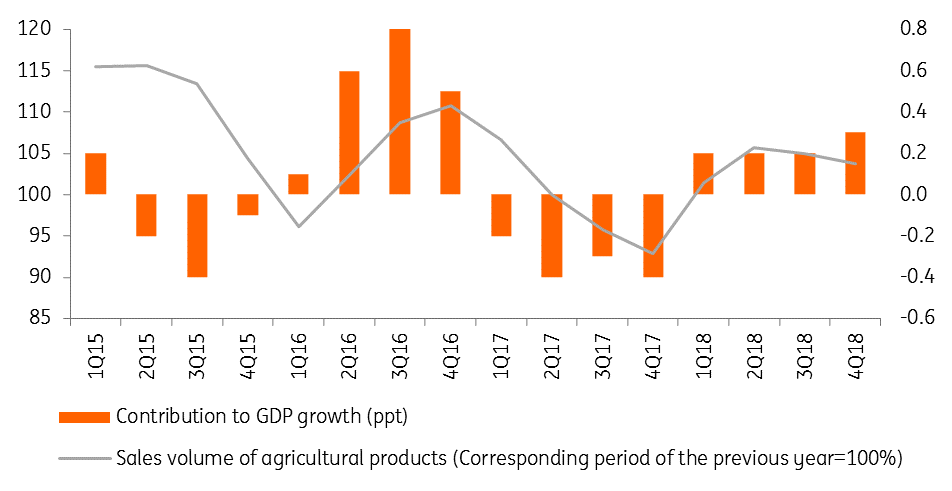

The agricultural sector was a positive contributor in 2018, posting strong growth rates throughout the year, with a 5.3% YoY increase in the value added, on average. This means a high base for 2019 - a year which started with a drought. Based on available data for the first two months, the agricultural products index of sales volume dropped by 2.7% YoY. This calls for a small (around 0.1 - 0.2ppt) negative contribution to GDP growth in 1Q19.

Sales of agricultural products and contribution to GDP growth

The industry amplification

After a poor year in 2018, which saw an increase in production volume of just 3.6% YoY as well as a gloomy external outlook, we expected only a mild rebound. However, car manufacturing has finally picked up, mainly due to production of the new Audi Q3 model restarting in Győr in northwest Hungary. This could increase output by around 30% this year, providing a good opportunity for strong growth. The carmaker Audi agreed to increase wages after a workers' strike and quickly recovered its lost production, as did other manufacturers. Electronics and other main manufacturing segments also remained strong in 1Q19, despite the Brexit story, the ongoing trade war and the German slowdown.

Speaking of Germany, it seems that the decoupling of Europe's biggest economy from Hungary has continued. Domestic demand in Hungary is still strong, driving industrial sales. However, as Hungary (and Poland) are involved in the early phases of global value chains, we can assume that Hungarian industry and PMI figures serve as a leading indicator for Germany. In any event, the 6.2% YoY growth in industrial production in 1Q19 could translate into a similar increase in the value added. Against this backdrop, we could easily see a contribution of more than 1ppt to GDP growth.

Industrial production, value added and contribution to GDP growth

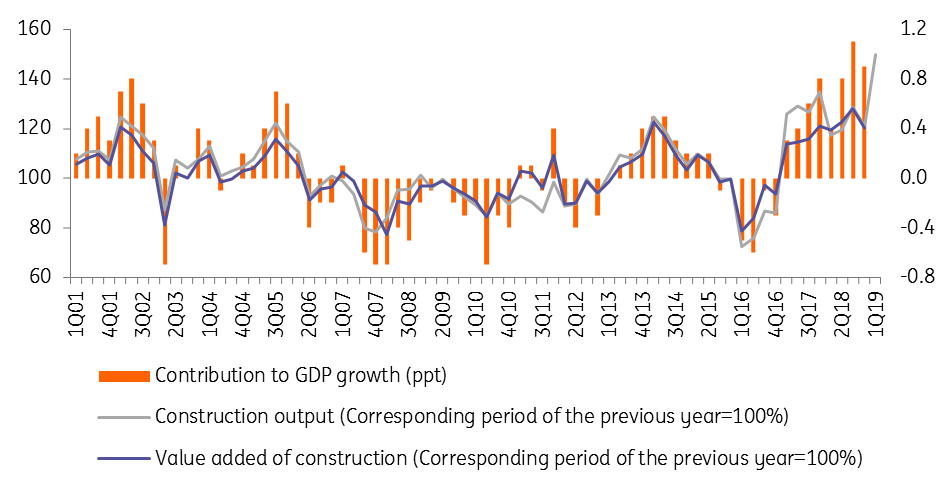

The construction explosion

The construction industry has been living its best life in the past couple of years, which stems from three different sources:

- EU projects are providing strong demand in infrastructure development.

- Labour shortages and strong domestic demand are pushing manufacturers to enhance their production and storage capacities.

- And the housing boom, which is fed by strong wage growth and government programmes.

Against this backdrop, construction output increased by 30% in 2017 and 22% in 2018. The market expected a further deceleration in 2019. In contrast, the construction sector posted a 29% and a 48% YoY increase in January and February, respectively. Taking into consideration the low base in March 2018 (a 0.5% YoY increase coupled with an almost 10% MoM drop), we could see a 70% YoY increase this March. This would mean 50% YoY growth in construction output in the first quarter and a roughly 2ppt contribution to GDP growth.

Construction output, value added and contribution to GDP

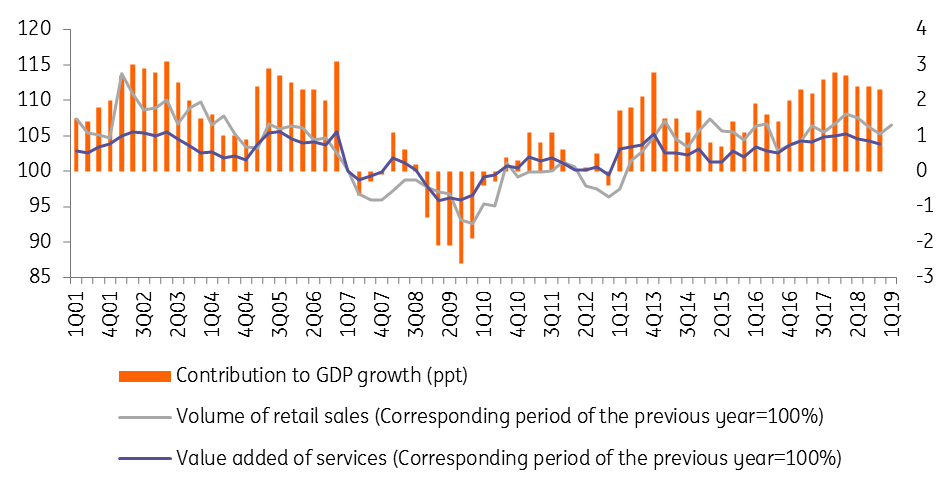

The services catalyst

To assess the performance of services, we need to rely on the monthly data of retail sales, along with figures on wage growth. It would be hard to argue for a deceleration here. Despite the high base and the increase in fuel prices, the volume of retail sales turnover increased by 6.6% YoY in 1Q19, more or less the same rate as in 2018 as a whole and a rebound from 4Q18. Net wages rose by 11.4% in January-February, roughly unchanged compared to the average of last year. This counts as a positive surprise as minimum wages for both skilled and unskilled labour increased by just 8% and the market expected high single-digit wage growth. Against this backdrop, it’s hard to imagine that the contribution of the services sector will retreat from the 2.3ppt contribution measured in 4Q18.

The retail sector turnover and performance of services

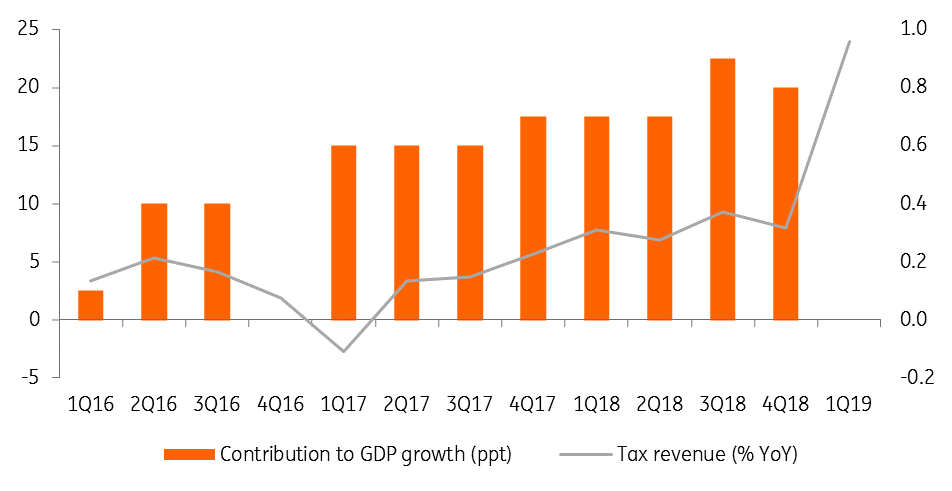

The tax revenue conjecture

Only one component remains, which is the balance of taxes and subsidies. This is (in a practical way) the income of the government or the net tax effect. The contribution of taxes has been significantly positive since 2014 when the government started a series of programmes to reduce the shadow economy. In 2019, the government expanded the number of sectors which are now obliged to have an online cash register, while also introducing online accounting and billing for invoices having above HUF 100k tax content. So what to expect this year? VAT revenues increased by 41.7% YoY in 1Q19, while the total amount of tax collected (direct and indirect) rose by 24% YoY. Tax revenues increased by 8% on average in 2018 and the GDP contribution came in at 0.8ppt. Even if we are ultra conservative, we can count on at least a 1ppt contribution.

Budgetary developments and the contribution of net taxes to GDP growth

The big bang

All that's left to do now then is add up the estimated contributions from each sector. Agriculture (-0.2ppt), industry (1.1ppt), construction (1.8ppt), services (2.3ppt) together with the balance of taxes and subsidies (1.0ppt) equate to 6.0% YoY GDP growth, a new record high. It would also mean a 2.3% quarter-on-quarter growth rate, roughly 0.2ppt higher than the previous record.

So please buckle up, Hungary's putting the pedal to the metal.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more