GBP: Taking No Prisoners

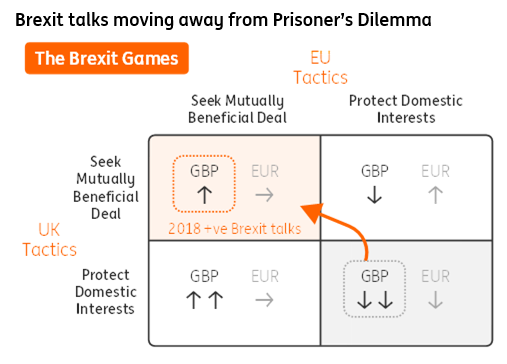

French president Emmanuel Macron has warned that the EU should avoid a 'prisoner's dilemma' in Phase 2 of Brexit talks. We have previously used this concept to model the long-run Brexit risks and argued that greater cooperation is positive for an undervalued pound

Applying 'Prisoner's Dilemma' to GBP's Brexit risks

Our game theory application to Brexit negotiations is proving a handy framework for analysing the political risks to the pound in 2018 - and coincidentally, French President Emmanuel Macron is using the 'prisoner's dilemma' as well to nudge his fellow EU leaders towards a more cooperative approach with the UK during Phase 2 of Brexit talks.

One should not underestimate what this means for the pound. While much of 2017 has been marred by UK and EU politicians playing ‘hardball’ with one another, the resolution of a Brexit divorce deal - and harmonious comments by senior EU officials like Emmanuel Macron - suggest that a more constructive, rational approach may be the way forward for negotiations in 2018.

Politicians moving away from the Prisoner's Dilemma scenario, and towards greater cooperation, is positive for GBP

Politicians moving away from seeking to protect their own domestic interest (the Prisoner's Dilemma scenario) – and slowly moving towards a mutual agreement – is unambiguously positive for GBP. For example, while agreeing a divorce deal has little economic significance for the price of GBP, the political significance of progress in Brexit talks is quite profound – not least as it reduces the tail risk of a 'No Deal' scenario and a complete breakdown in negotiations. The reduction of this tail risk should help GBP remain resilient against most major currencies in the near-term - while slowly gaining against a cyclically weak US dollar.

Markets underestimating the cyclical economic benefits of a Brexit transition

Judging by GBP's rally since late November, which has continued in the first few weeks of the new year, a reassessment of the Brexit political games looks to be underway. But we feel there is more upside to come – especially if a transition deal were to be signed, sealed and delivered in 1Q18. Our ‘GBP Brexit Equation’ (below) demonstrates the chain of logic here. With a range of indicators suggesting that the UK economy is at a standstill, a reduction in medium-term uncertainty may rekindle some of the ‘animal spirits’ among consumers and firms – and see more cash put back to work over the coming year. At a time when the BoE is in tightening mode, positive revisions to the UK growth outlook – and a subsequently steeper rate curve – could be a powerful pick-me-up for a weak pound.

Week Ahead: Sticky above-target UK inflation would be a hawkish BoE development

Economic data over the next few months will continue to give conflicting policy signals. This trade-off is part of being in a late cycle - or an economy operating at full capacity. In our view: slower yet resilient economic activity + higher inflation = slightly higher interest rates – especially for an economy that has super-low policy levels. The reaction to UK data over 4Q17 suggested to us that markets may not be quite in sync with this logic - and subsequently, we'll need some guidance or signals from the Bank of England.

After rallying to its highest since the Brexit vote on both a weak USD and reports of some EU countries wanting a soft Brexit, GBP/USD will be looking for further directional impetus from UK data and BoE policy speakers this week. On the data front, the Dec UK CPI report (Tue) may show headline inflation staying at 3.0% YoY, while the core rate could tick to 2.5% YoY. Sticky above-target inflation, however, would be a hawkish development in terms of BoE policy - so we'll be looking more at whether price pressures are broadly downshifting or not. Dec retail sales (Fri) may come in soft (headline: -0.8% MoM; core: -0.9% MoM) - not least due to a strong November print (which included Black Friday sales) and general consumer spending volatility.

The MPC's Tenreyro (Mon) and Saunders (Wed) speak this week. Both interesting to some degree - the former given her relative novelty to the role, while the latter is thought to be one of the more hawkish members. We doubt BoE officials will want to rock the boat ahead of the February 'Super Thursday' policy meeting (8 Feb) - and would instead prefer the data to do the talking in the near-term. With markets still only pricing in a 40% chance of a May rate hike, however, there is scope for further BoE-fuelled upside in GBP.

Constructive Brexit headlines will keep GBP supported

While not necessarily relevant for the week ahead, it's probably worth mentioning a quick line or two on overall Brexit risks - and what this means for GBP in the near-term. Reports on Friday that the Spanish and Dutch governments are seeking a 'soft' Brexit helped GBP sentiment, but we are reluctant to start re-pricing long-run Brexit risks just yet (not least as these reports were denied). But a move towards a mutual Brexit agreement - and what we call an 'economically rational' Brexit for both the UK and EU - should gradually see some of the long-run Brexit risk premium unwind out of GBP. That might be a 4Q18 (early 2019) story - but forward-looking markets seeing this as the general direction of travel may be willing to chase this story much earlier. Indeed, more constructive headlines of Brexit progress (like the UK and Spain working on a solution for Gibraltar) - will keep GBP supported over the medium-term.

Talk of a second Brexit referendum is merely noise at this stage - and we don't see it as a realistic possibility in 2018. Yet, were it to occur - the latest poll from ComRes shows that 55% of the electorate is in favour of Remain (albeit UK polls haven't exactly been the most reliable in recent years). That sentiment could be spun as positive GBP factor - were we to see any referendum noise arise - but caution is needed here; more uncertainty driven by another UK referendum vote would be negative (or at least a limiting factor) for GBP in the short-run. Nonetheless, the bar to actively sell GBP on domestic politics is very high - and it appears as though we're running out of bearish non-Brexit catalysts to send GBP lower. Only a delay or lack of Brexit progress seems the obvious - and meaningful - tail-risk to GBP now.

Bottom line: Actual Brexit progress or positive UK data surprises needed for GBP to push higher

Sure, we need actual progress for the pound to hold onto its recent gains, but it's no surprise to us that GBP/USD is trading at its highest since the Brexit referendum - especially in a weak USD environment. Our conviction remains for GBP/USD at 1.40 in 1Q18 as markets positively reprice both Brexit and UK economic risks. We think that stability is the name of the game for EUR/GBP, given that we have two positive cyclical stories offsetting each other in the near-term - with the broad 0.85-0.90 likely to remain in tact over 1H18.

Download

Download article"THINK Outside" is a collection of specially commissioned content from third-party sources, such as economic think-tanks and academic institutions, that ING deems reliable and from non-research departments within ING. ING Bank N.V. ("ING") uses these sources to expand the range of opinions you can find on the THINK website. Some of these sources are not the property of or managed by ING, and therefore ING cannot always guarantee the correctness, completeness, actuality and quality of such sources, nor the availability at any given time of the data and information provided, and ING cannot accept any liability in this respect, insofar as this is permissible pursuant to the applicable laws and regulations.

This publication does not necessarily reflect the ING house view. This publication has been prepared solely for information purposes without regard to any particular user's investment objectives, financial situation, or means. The information in the publication is not an investment recommendation and it is not investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Reasonable care has been taken to ensure that this publication is not untrue or misleading when published, but ING does not represent that it is accurate or complete. ING does not accept any liability for any direct, indirect or consequential loss arising from any use of this publication. Unless otherwise stated, any views, forecasts, or estimates are solely those of the author(s), as of the date of the publication and are subject to change without notice.

The distribution of this publication may be restricted by law or regulation in different jurisdictions and persons into whose possession this publication comes should inform themselves about, and observe, such restrictions.

Copyright and database rights protection exists in this report and it may not be reproduced, distributed or published by any person for any purpose without the prior express consent of ING. All rights are reserved.

ING Bank N.V. is authorised by the Dutch Central Bank and supervised by the European Central Bank (ECB), the Dutch Central Bank (DNB) and the Dutch Authority for the Financial Markets (AFM). ING Bank N.V. is incorporated in the Netherlands (Trade Register no. 33031431 Amsterdam).