GBP: Near-term turbulence for sterling

There's turbulence ahead for the pound as key UK data releases collide with Brexit and geopolitical noise

Talking points: Key UK data and the government's Brexit position

While markets are in the midst of summer holiday mode, the combination of key UK data releases, as well Brexit and geopolitical headlines, may present some near-term turbulence for GBP markets. On the data front, there are three key reports to note next week:

- CPI report (Tue 15th Aug): After coming in surprisingly softer last month - and denting August Bank of England rate hike expectations - our economists expect annual headline inflation to pick up to 2.7% as GBP weakness continues to feed through into higher food prices. Utility price hikes are also beginning to take effect. Equally, core inflation could rebound to as high as 2.6%. While this is likely to raise some eyebrows among the MPC hawks, we would caution that part of this increase is also due to the transitory effects of a weaker currency. Given that domestically generated inflation overall is likely to remain muted for some time, we suspect any subsequent move higher in short-term UK rates and GBP - as a result of greater BoE tightening sentiment - may prove short-lived.

- Labour market report (Wed 16th Aug): Those looking to wage growth as evidence for rising underlying price pressures are unlikely to find much support in the latest jobs report. We expect average hourly earnings growth to remain unchanged at 2% in June - and stay pretty much anchored at this level for the rest of 2017. This may not come as too much of a surprise to markets given that it would be in line with the BoE's latest forecasts outlined in the August Inflation Report. The bigger question, however, is whether wage inflation can pick up to 3% in 2018 as the Bank estimates; such a sharp uplift in earnings growth is unlikely in our eyes given greater signs of slack in the labour market.

- Retail sales report (Thu 17th Aug): Our view for a more cautious BoE policy bias would be reinforced by a disappointing July retail sales report. While the second warmest June on record got UK consumers out spending at the start of summer, a range of factors, including waning confidence and less credit-card spending, suggest households are cutting back on non-essentials as the squeeze on real incomes takes effect.

Reports in the media also suggest the UK government is set to release position papers on key Brexit issues in the next few weeks. Of particular economic interest will be the UK's proposals for replacing the customs union and achieving 'frictionless trade' with the EU. We could also receive clarity on the type of transitional deal the UK is willing to seek, notably the length of any transition period and willingness to replicate existing arrangements.

GBP implications: Data to deliver final blow to 2017 BoE rate hike calls

We expect the next round of key UK data releases to be the final nail in the coffin for a 2017 BoE rate hike. The implied probability of a 25bp hike by year-end has already fallen to less than 25% after the BoE's dovish disappointment. While higher inflation figures may keep lingering hopes alive, the slowing trend in consumer activity, as well as uncertainty over the degree of slack in the labour market, should keep the hawks at bay. Risks are that the front-end of the UK curve continues to flatten and that BoE rate hike expectations get pushed further out into 2018. This could weigh on GBP in the near-term.

On the Brexit front, we continue to believe it is too early for GBP markets to price in any Brexit transitional deal hopes; there are a number of “divorce” stumbling blocks that need to be overcome before any transitional arrangement is signed, sealed and delivered. Diminishing tail risks of a cliff-edge Brexit is certainly easing any major downside GBP pressure but the currency is far from out of the woods when it comes to political event risks. We earmark early October as a key test for GBP markets; both the governing Conservative Party Conference (1-4 Oct) and the final round of opening Brexit talks (Oct 9) will shed light on the stability of the UK political environment, as well as any progress being made when it comes to the UK's 'smooth' exit from the EU.

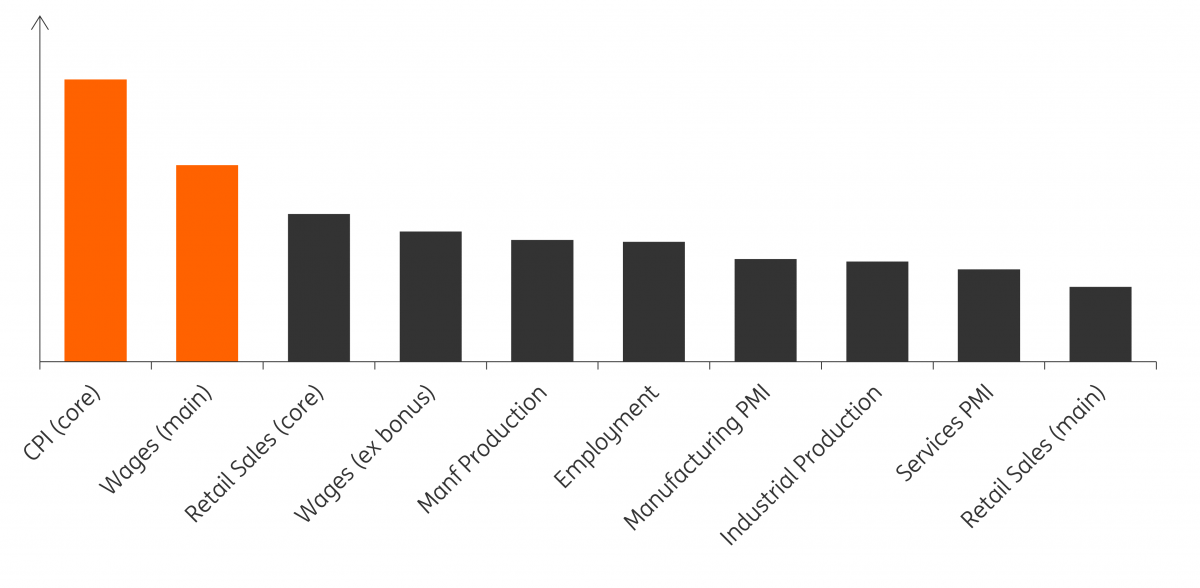

GBP likely to remain sensitive to UK inflation surprises

GBP sensitivity to UK data surprises based on ING's surprise model estimates

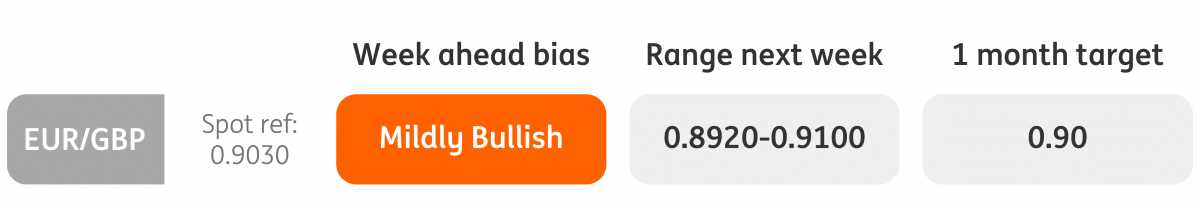

EUR/GBP: A 90s throwback

- With EUR/GBP having overshot our 0.90 forecast for 3Q17, we expect it to remain above this level. Unlike previous times when we have traded beyond this key horizontal level - namely during crisis episodes - there are now fundamental reasons to stay here; the diverging UK-Eurozone economic outlook - and widening interest-rate differentials - lend support to a higher EUR/GBP.

- We prefer to see the recent move as an "overshoot" rather than a broader trend towards parity; risks that over exuberant EUR markets are front-running ECB QE tapering, as well as fading cliff-edge Brexit risks, limit the scope to which EUR/GBP can move materially beyond 0.90. Domestic and geopolitical uncertainties may see us trade in the 0.9000-0.9150 range in the near-term, with greater risks of a downside breakout.

GBP/USD: Relative US-UK data to retain downside bias

- Robust signs of underlying inflationary pressures in the US may be a wake-up call to bond markets that currently see inflation as being more than just on a summer holiday. In theory, the return of a steepening bias in the US yield curve should be positive for the USD. This is particularly relevant for GBP/USD, where short-term rate spreads are a key driving force.

- We continue to see downside risks in GBP/USD towards 1.27-1.28 on the back of a US data-driven USD recovery and UK data weighing on GBP. However, recent geopolitical developments and rising US-North Korea tensions may see the current dollar nervousness remain in place, limiting any material downside below 1.30 in the near-term.

Download

Download article"THINK Outside" is a collection of specially commissioned content from third-party sources, such as economic think-tanks and academic institutions, that ING deems reliable and from non-research departments within ING. ING Bank N.V. ("ING") uses these sources to expand the range of opinions you can find on the THINK website. Some of these sources are not the property of or managed by ING, and therefore ING cannot always guarantee the correctness, completeness, actuality and quality of such sources, nor the availability at any given time of the data and information provided, and ING cannot accept any liability in this respect, insofar as this is permissible pursuant to the applicable laws and regulations.

This publication does not necessarily reflect the ING house view. This publication has been prepared solely for information purposes without regard to any particular user's investment objectives, financial situation, or means. The information in the publication is not an investment recommendation and it is not investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Reasonable care has been taken to ensure that this publication is not untrue or misleading when published, but ING does not represent that it is accurate or complete. ING does not accept any liability for any direct, indirect or consequential loss arising from any use of this publication. Unless otherwise stated, any views, forecasts, or estimates are solely those of the author(s), as of the date of the publication and are subject to change without notice.

The distribution of this publication may be restricted by law or regulation in different jurisdictions and persons into whose possession this publication comes should inform themselves about, and observe, such restrictions.

Copyright and database rights protection exists in this report and it may not be reproduced, distributed or published by any person for any purpose without the prior express consent of ING. All rights are reserved.

ING Bank N.V. is authorised by the Dutch Central Bank and supervised by the European Central Bank (ECB), the Dutch Central Bank (DNB) and the Dutch Authority for the Financial Markets (AFM). ING Bank N.V. is incorporated in the Netherlands (Trade Register no. 33031431 Amsterdam).