G10 FX Week Ahead: Dollar gets the Trump treatment

Ahead of weekend political event risks in Europe, we provide our best guess on how the various scenarios will play out and also how the key events of (1) Trump protectionism, (2) the ECB meeting and (3) US February jobs data will impact G10 FX markets over the next week.

Protectionism trumps European politics

| Spot | Week ahead bias | Range next week | 1 month target | |

|---|---|---|---|---|

| EUR/USD | 1.2310 | Mildly Bullish | 1.2200 - 1.2450 | 1.2500 |

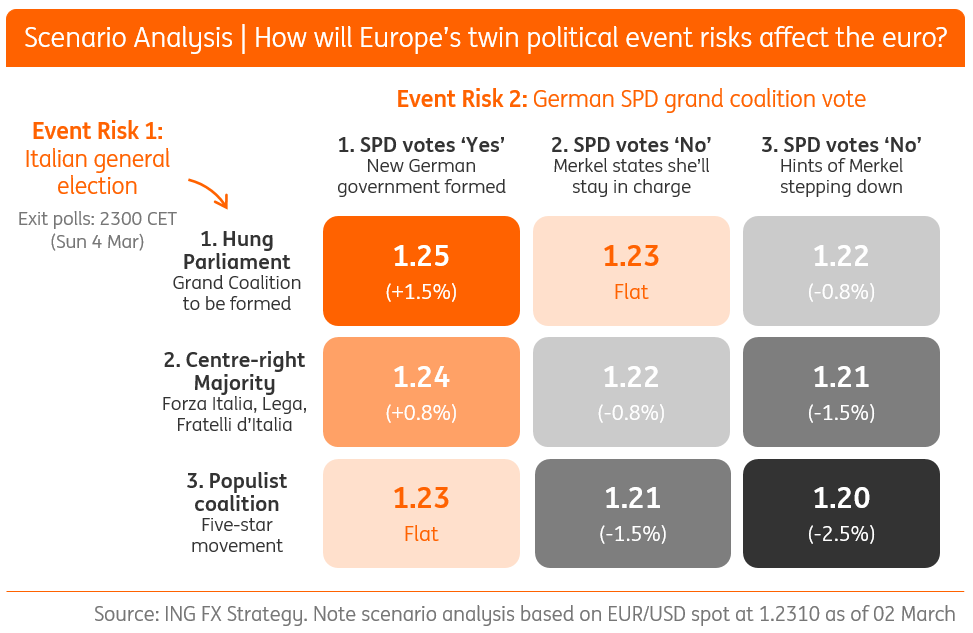

- EUR/USD goes into weekend political risk events slightly better bid - lifted by Trump protectionism. We tend to think neither the Italian elections nor the German SPD vote, will deliver a knock-out blow for the EUR. Instead, the US protectionism story will keep the dollar on the back foot. The EUR also sees an ECB meeting on Thursday, where we look for some dissension in the ranks from the noisy hawk. There is a slight risk of the language being modestly shifted to slightly less accommodative, although the threat to do more QE will remain.

- The US calendar sees February non-farm payrolls next Friday. Our team see wages staying at 2.9% YoY and a reasonably healthy +180k headline figure. The market is starting to consider pricing a fourth Fed hike this year - but we doubt the dollar enjoys much benefit from this. Instead, it seems that investors are looking to buy 10-year US Treasuries near 3.00% on the view that the Fed cycle is virtually priced (1m USD OIS 10 years forward are now 2.60%) and there is a fear that Trump could lead the US economy over a cliff into 2019 - which doesn't bode well for the dollar.

Tipping point

| Spot | Week ahead bias | Range next week | 1 month target | |

|---|---|---|---|---|

| USD/JPY | 105.40 | Mildly bearish | 102.50 - 106.20 | 103.00 |

- USD/JPY looks very vulnerable going into next week, with President Trump apparently due to deliver further details on steel tariffs. Given the negative impact of protectionism on risk assets, USD/JPY is the key vehicle to express this view - and the BoJ will find the current environment very difficult in which to intervene. We doubt any NFP-inspired bounce in Treasury yields can help the dollar much now.

- The local highlight of the week will be the BoJ meeting on Friday. It will have to acknowledge positive developments in the economy without fanning fears of an early BoJ exit. Any re-iteration that the BoJ could exit QQE in FY19 could only spell more trouble for USD/JPY/ We'll also see Japanese PMIs, the Jan BoP figure and confirmation of a softish 4Q17 GDP figure.

Short-term Brexit negatives priced in, now just waiting for a positive headline...

| Spot | Week ahead bias | Range next week | 1 month target | |

|---|---|---|---|---|

| GBP/USD | 1.3770 | Neutral | 1.3650 - 1.4000 | 1.4300 |

- GBP has come under pressure in a week full of negative Brexit sentiment - and while it may have been difficult to find the positives from PM Theresa May's keynote speech, the negatives had already been priced in by then. Given that GBP’s decline is more Brexit-sentiment driven – rather than a reassessment of UK economic fundamentals – history suggests that GBP has the propensity to correct sharply higher on any good news. We’ll need a catalyst, but risk-reward favours not chasing Brexit sentiment driven moves lower in the pound. The focus in the week ahead will be on UK-EU Brexit negotiations - and whether there are signs of any progress or conciliation on a transition deal (note in the absence of scheduled press briefings, GBP will be highly sensitive to flash headlines).

- It'll be interesting to hear what the BoE's Chief Economist Andy Haldane has to say on policy expectations in light of the recent Brexit noise (Tue); we note that expectations over a May BoE rate hike (and the UK rate curve in general) have remained fairly resilient - one reason why we see the moves in GBP as short-term sentiment driven. UK data wise - we'll get Feb Services PMI (Mon), industrial/manufacturing production and trade data (both Fri). In a weak USD environment, look for GBP/USD to consolidate - while EUR/GBP could tick higher but only if global risk aversion deteriorates (due to global trade war noise).

Navigating the 'global trade war' noise

| Spot | Week ahead bias | Range next week | 1 month target | |

|---|---|---|---|---|

| AUD/USD | 0.7750 | Mildly bearish | 0.7630 - 0.7820 | 0.7700 |

- Details over the US administration's steel and aluminium tariffs will dominate the AUD narrative in the week ahead, with the currency likely to track sentiment for commodity markets - and global risk more broadly. Should Australia be exempt from any tariffs, then we would expect this to curb any AUD downside bias. The knock-on effects from US steel tariffs remains a watch this space for AUD markets.

- While we expect a choppy external trading environment, the domestic focus will be on the RBA meeting (Tue) and 4Q Australian GDP data (Wed). We expect the former to be a non-event given the lack of meaningful developments since the prior meeting (if anything, risks are titled to the more dovish side). On the GDP front, markets are looking for a 2.5% YoY print - although we note there are downside risks given the soft capex data this week.

NZD caught in the cross-fire

| Spot | Week ahead bias | Range next week | 1 month target | |

|---|---|---|---|---|

| NZD/USD | 0.7238 | Mildly bearish | 0.7170 - 0.7300 | 0.7200 |

- NZD/USD is caught in the cross-fire of Trump protectionism and a weaker dollar story. Presumably were we to see an escalation in a trade war, with perhaps China addressing agricultural trade, the uncertainty might start to weigh on NZD.

- The NZ data calendar is very light this week. The market currently prices is on its way to pricing the first hike in one year's time. GDP data on the 14th should shed some light here.

Will Trump exempt Canada from tariffs?

| Spot | Week ahead bias | Range next week | 1 month target | |

|---|---|---|---|---|

| USD/CAD | 1.2870 | Neutral | 1.2750 - 1.2980 | 1.2600 |

- CAD has been hit by the Trump tariff news, being a big exporter of steel and to the US. (That said, these exports are less than 2% of Canada's total exports). We think there is a chance that Trump seeks to exempt ally Canada from these tariffs, or at least merely holds Canada to 2016/17 levels as a quota, rather than imposes 10-25% tariffs. Clarity on this could see CAD recover a little.

- But a global trade war won't help the CAD - if Trump ushers in a new era in aluminium protectionism. This week also sees a BoC rate meeting. It looks too early for the BoC to be pushing for another hike and instead it will wait for clarity on NAFTA and other trade issues before re-assessing policy.

SNB will limit fallout of European politics

| Spot | Week ahead bias | Range next week | 1 month target | |

|---|---|---|---|---|

| EUR/CHF | 1.1510 | Mildly Bullish | 1.1450 - 1.1600 | 1.1700 |

- Sunday's event risk will be key for EUR/CHF in the early part of the week. We see quite an asymmetrical outcome. Were the SPD to reject the coalition deal we see EUR/CHF supported near 1.1450. EUR/CHF liquidity has dropped sharply since the SNB has got heavily involved in the market and we think they can contain any EUR losses on politics. A benign outcome at the week-end could lead to a sizable EUR/CHF advance however as the last of the major European elections pass. (Our team thinks that a hung parliament is not actually that bad for Italian assets).

- The highlight of the local data set will be the Feb CPI data, expected to decelerate to 0.5% to 0.7% YoY. Currently, money markets price more SNB than ECB tightening by end 2019. We would expect the SNB will want to correct this pricing - perhaps at their quarterly rate meeting on March 15th. Trump's protectionism is providing headwinds to our core view that EUR/CHF will trade a lot higher this year.

SEK pounded by protectionism

| Spot | Week ahead bias | Range next week | 1 month target | |

|---|---|---|---|---|

| EUR/SEK | 10.1600 | Mildly Bullish | 10.1000 - 10.2900 | 10.0000 |

- EUR/SEK has pushed back to the highest levels since early 2010, driven by both a dovish Riksbank and now growing fears over US protectionism. Typically fears over global trade tend to hit the SEK - given Sweden being a small, open economy.

- Given a tough week for protectionism, we think EUR/SEK can push ahead. Local data probably won't have too much bearing here. Of the releases, detached home prices for February may be most interesting. Our team looks for some stability in prices here - but we doubt this is enough to turn around the EUR/SEK bull trend just yet.

Impact of inflation target shift exaggerated

| Spot | Week ahead bias | Range next week | 1 month target | |

|---|---|---|---|---|

| EUR/NOK | 9.6300 | Mildly bearish | 9.5600 - 9.6800 | 9.6000 |

- NOK got a lift on Friday from the Fin Min's announcement that Norges Bank CPI target would be 2.0% vs 2.5%. Norges Bank put out a statement to stay that this would not affect operational policy. The rates market, eg FRAs into 2019 continue to firm up and provide support to NOK - though we think this whole story is more neutral.

- Instead, the story over the coming week will be Friday's CPI data. The market expects a bounce back from the very low January readings (eg 1.1% YoY for core) but we are not so sure. Trump's protectionism may also be weighing on oil markets indirectly, which won't help NOK.

Download

Download article

Content Disclaimer

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more