FXSwitzerlandUnited Kingdom...

G10 FX Week Ahead: A Stealth US Border Tax?

Dollar investors will be looking to make sense of the Republicans' US tax plans, although chances of big reform remain remote, to say the least.

While the economic implications of the House GOP tax plan will be thrashed out this week, the main question investors should be asking themselves is whether the Tax Cuts and Jobs Act (TCJA) stands a chance of making it through Congress. With not enough revenue-raising measures to offset large tax cuts geared towards helping Corporate America, there's enough for both the GOP fiscal hawks and conservatives to push back on. Chances of US tax reforms happening still remain low at best.

Majors: A game-changing US tax plan?

EUR: Making cents of the US tax plan

- Despite a lot of fresh (US) inputs, the dollar hasn't gone very far. In fact, one-month EUR/USD traded volatility is crashing below 6% and favouring more range trading in the near-term. Going forward expect the US tax plan to remain in focus, including potential scoring by the CBO and GOP mark-ups this week.

- Were the tax plan to make progress, e.g. passed in the House by Nov 16th, we don't think the repatriation story would be key to the dollar. Instead, some elements of the border tax proposal - disguised as 'excise duties' in Brady tax bill - could bring back into focus the economic arguments for a one-off appreciation adjustment in the US dollar.

ING

JPY: Still the best vehicle to play US tax reform

- Away from the US tax reform and generally positive US data, the focus this week will be Trump's trip to Asia. North Korea has been quiet recently, but could re-emerge were missile tests to be used to grab attention. Assuming that doesn't happen, the USD/JPY story looks constructive.

- In terms of data, the US calendar is very quiet (talk of Taylor getting appointed as Fed Vice Chair?) and there are just a few Fed speakers. Japan sees current account data and minutes from the Oct 31st BoJ meeting - unlikely to challenge the view that JGB yields remain anchored while US yields rise.

ING

GBP: Fading the Carney confusion

- We attribute the pound’s circa 1% knee-jerk move lower to markets pushing back their expectations for additional BoE rate hikes, although the overall level of tightening priced in has returned back to where it had been on average over October. The market-implied BoE policy rate in 3 years’ time is now at 1.00% - which we deem appropriate for now relative to BoE’s message this week.

- The bigger driver for GBP tends to be the overall level of tightening priced – and this remains data, and more importantly, Brexit-dependent. On the Brexit front, negotiations are expected to resume - while the government may release its analysis on the Brexit 'No Deal' implications. Data wise, only industrial production and trade data to note (both Fri).

ING

Dollar: Politics may dominate RBA and RBNZ meetings

AUD: Looking for a 2Q18 RBA rate hike

- Another disappointing jobs report puts the pressure on the RBA when they meet this week (Tue). Certainly, the economic data of late has been fairly lacklustre, which lends itself to a slightly more cautious RBA tone. The fallout in the AUD from a dovish RBA is likely to be limited given that the curve has already pushed back expectations for a rate hike to Nov-18. Our economists see this as slightly pessimistic - especially under an environment of synchronised global growth; we have a 2Q18 rate hike tentatively pencilled in. On the surface, a hawkish RBA re-pricing would be AUD positive - timing when this happens is important.

- Australian political risks are a factor, but we note that the currency is more taking its cue from the relative underperformance of base metals (iron ore) in the commodity complex. It's difficult to make the leap from Australian politics to any fundamental impact on the domestic economy. Nor does it pose any immediate implications for RBA policy.

ING

NZD: How will the RBNZ respond to the new government?

- The RBNZ meeting (Wed) will dominate the domestic agenda in a fairly otherwise quiet week. It will be particularly interesting to hear what central bank officials have to say given the new Labour government's intention to reform the RBNZ's mandate to include a 'full employment' objective. Under a Fed-like dual-mandate approach, we note that there may be some scope for policy rates to stay lower for longer as some labour market slack still needs to be absorbed. Equally, however, we point to pre-election comments by the RBNZ's McDermott noting that the output gap is close to zero.

- We think NZ political risks are fairly priced into the currency - and the story may, in fact, be slightly overdone. Indeed, AUD/NZD looks to have topped out and with our fair value estimates pointing to a range of 1.0920-1.1020, there is still some risk premium to be priced out of crosses.

ING

CAD: Consolidation likely but still some downside left

- While the Aug GDP data disappointed, the beat in the Oct jobs figures helped buffer some of the CAD downside. We still think there is further room for CAD to move lower as markets fully price out scope for a Dec BoC rate hike (currently a 25% probability is priced in). Cautious policy talk from Governor Poloz this week (speech on Wed) might be the final blow here.

- We have been calling for a retrace up to the OECD PPP fair value estimate of 1.27. Now we're here, we expect $/CAD now trades within the broad 1.25-1.30 range - with the risks skewed to the top-end of this range.

Source: ING

EUR crosses: Inflation data in Switzerland and Norway

CHF: Swiss inflation the highlight of a quiet week

- EZ peripheral debt continues to perform well despite uncertainty in Catalonia, meaning that there hasn't been any discernible safe-haven buying of the CHF. Instead, EUR/CHF remains well bid as the SNB continues to merits the need for a weaker currency.

- Relating to that Monday sees the Swiss Oct CPI release, expected at 0.7% YoY, the highest since 2011, but still way below the SNB's inflation target of close to 2%. CHF sight deposits are also out on Monday and any further fall (off CHF20bn this year) could add to view that safe-haven money is leaving.

ING

SEK: Still looking for the correction lower

- We continue to see the recent EUR/SEK upside as an overreaction, with the cross trading 1.5% rich versus its short-term fair value. Given the current attractive levels and what is likely a relatively cleaner positioning (following the SEK sell-off), we expect EUR/SEK to stabilize below the 9.80 level.

- As per the data points, we look for a strong print in the notoriously volatile Sep IP (Mon). Most importantly, the focus will be on Riksbank Minutes (Thu). Given the October Riksbank meeting took place before the ECB meeting, we don’t look for signs of pre-commitment on the pace of QE (extension vs an end).

Source: ING

NOK: Above consensus CPI to support krone

- NOK decoupled from SEK during the past days as the meaningful rise in the oil price provided support to krone.

- Data-wise, the focus turns to the Oct CPI (Fri) which should still remain well below target (1.6% in Sep vs 2.5% target). Yet, we believe the consensus estimate of 1.4% looks too low. An upside surprise to CPI should be NOK positive, with EUR/NOK converging towards 9.4500.

ING

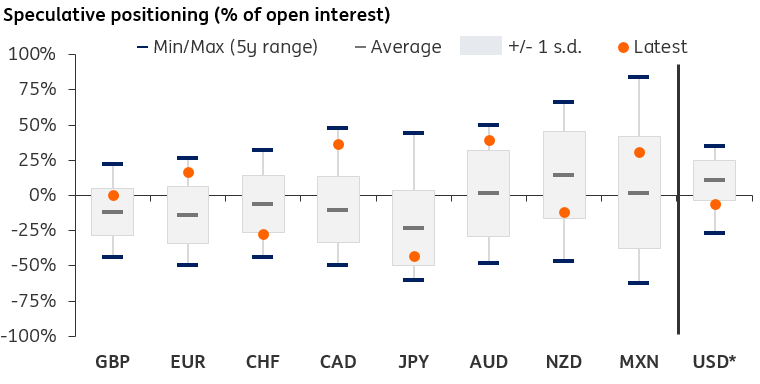

G10 FX Positioning: Neutralisation in motion

Source: CFTC, Bloomberg, ING as of 31 Oct 2017 (data reported with a lag). *Aggregate USD positioning against G10

Content Disclaimer

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more