FX: Trade and tightening; two key factors forcing the dollar lower

Two key themes have played out in FX markets so far this year; the commodity price boom and central banks looking at conventional normalisation policies. The dollar benefits from neither of these and can fall another 5% this year

Terms of trade delivers the positive income shock

The ability to contain the Covid-19 outbreak has clearly played a major role in the strong performance of asset markets this year. Yet the success of the US vaccination programme has so far delivered little benefit to the dollar.

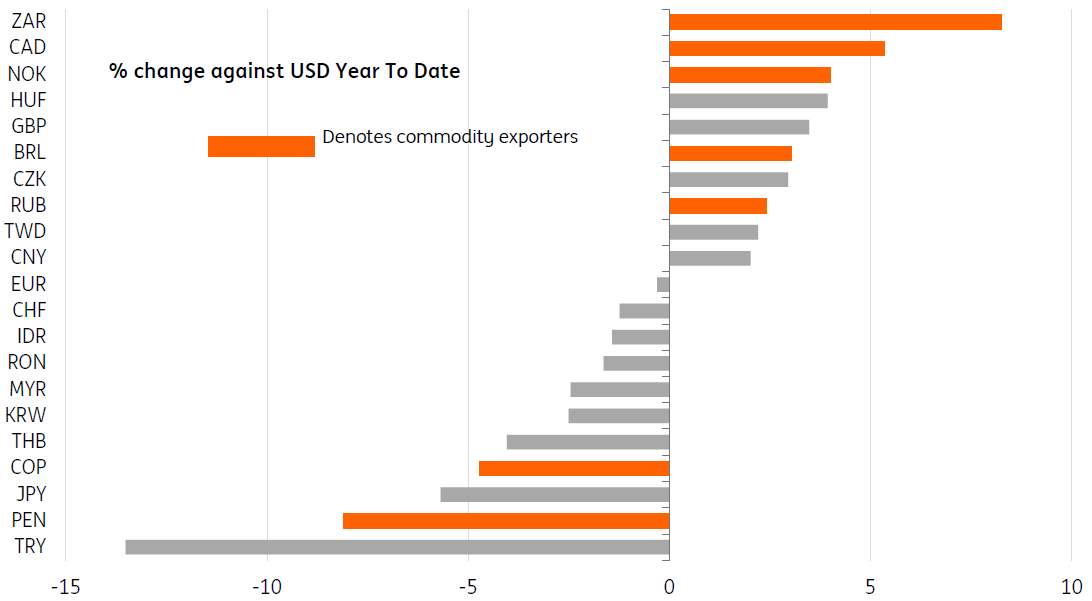

Instead, it's the commodity exporters who are at the top of the leader board as far as FX performance this year is concerned. In a world suffering higher import prices, the commodity exporters have been fortunate enough to enjoy terms-of-trade gains where export price increases have exceeded those of import prices. This has delivered a positive income shock. South Africa, Norway, and Canada stand out here.

Big natural importers of commodities, such as Turkey and Japan, have been on the other side of that trade and this is reflected in their currency performance. While it seems unlikely that commodities will sustain the same pace of increase later this year – and that some doubts are emerging about the strength of Chinese demand in the second half – our team broadly expects the commodity complex to stay supported through the rest of 2021 so maintaining this theme as a driving force in FX.

FX performance against the dollar this year

Tightening camp swells

As we discussed last month, Norway and Canada also deserve their place on the FX leader-board given that local central banks look set to respond to better economic prospects with rate hikes. The market prices in 125bp and 75bp of Norges Bank and Bank of Canada hikes respectively over the next two years.

Joining Norway and Canada are many currencies in Eastern Europe. These have recently seen good demand on the switch to more hawkish policies in the region, where 125-150bp of tightening is now priced in the likes of the Czech Republic, Poland, Hungary and Russia over the next two years. Petr Krpata discusses this is in more detail in the CEE section of our monthly report. This theme will continue through the second half of the year and markets will increasingly focus on the next central bank to shift to a hawkish tilt.

Patience at the Fed and the ECB keeps EUR/USD subdued

Positioning themselves at the back of the tightening queue are the US Federal Reserve and the European Central Bank. Indeed, it seems the ECB would like to position itself as more patient than the Fed in order to keep a lid on EUR/USD. With both banking systems awash with liquidity, volatility is unsurprisingly dropping. This tends to point to subdued EUR/USD trading this summer in a 1.20-1.24 range and traded levels of volatility continuing to sink.

Yet if the Fed can stay patient through key events risks such as the June 16th FOMC meeting, we suspect that negative real US yields can keep the dollar gently offered into the late August Jackson Hole symposium. And assuming equity investors rotate into the European growth story – as they have started to do over recent weeks – we suspect EUR/USD can head up to 1.25 late summer and 1.28 by year-end.

Negative real rates are keeping the dollar on its lows

Download

Download article

10 June 2021

ING Monthly Update: Looking for freedom This bundle contains {bundle_entries}{/bundle_entries} articlesThis publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more