FX: Peak Trump?

The strong dollar and aggressive protectionism continues to ask major questions of vulnerable Emerging Markets. This narrative looks set to extend into the November US mid-terms. Add in the Italian budgetary position and EUR/USD should stay under pressure over coming months. The wild card here, however, is President Trump’s desire for a weaker dollar

President Trump has played his hand well

President Trump has played his hand well. After a relatively quiet first year in office, the protectionism characterising his second year has been launched from a position of strength. Here the $1.5 trillion fiscal stimulus agreed at that start of the year has provided a strong tail-wind to the economy. The tax break on repatriated profits has also provided direct support to the US stock market – and the dollar.

Whether US mid-term elections clip Trump’s wings remains to be seen, but we suspect we will see Peak Trump over coming months. That aggressive protectionism should be reflected in the dollar pressing new highs against vulnerable EM currencies and perhaps some marginal new lows in EUR/USD - aided by uncertainty around the Italian budget.

Were Trump’s trade position to turn more conciliatory after the mid-terms and, as we forecast, the ECB to progress with monetary normalisation through 2019, then we should see EUR/USD recovering towards the 1.25 area. At some point as well, US twin deficits will catch up with the dollar – although this may not be a story until late 2019.

$175 billion of US overseas earnings were repatriated in 1Q18

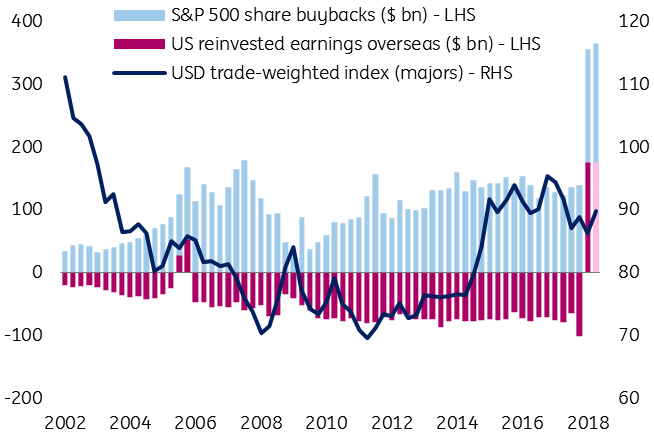

Returning to the subject of the US tax cut, US Balance of Payment data shows an enormous $175 billion of US overseas earnings being repatriated back to the US in 1Q18. That helped finance the $180 billion of share buybacks of S&P 500 stocks that quarter. 2Q18 data shows another $190 billion of share buybacks occurred suggesting that corporate repatriation was still a major factor. These amounts dwarf the peak $50 billion per quarter repatriated under the Homeland Invest Act in 2005.

Massive repatriation of US corporate profits

Rising US rates, a stronger dollar and firming energy prices create perfect storm for EM

The tax cut has undoubtedly strengthened the dollar and asked severe questions of countries struggling with sovereign debt (Argentina) or subject to political sanctions (China, Russia and Turkey). And the unlucky combination of rising US rates, a stronger dollar and firming energy prices have proved a perfect storm for the likes of India.

Beyond the future of protectionism, an important question is whether US corporates are drip-feeding overseas earnings back into the US economy or whether the bulk of the activity has been seen already? We’re looking into this closely, but suspect that since the repatriation is open-ended, the flows may well be front-loaded – effectively translating into front-loaded dollar strength. Early signs that President Trump is becoming more serious about the need for a weaker dollar should limit its strength as well in 4Q18.

US equities insulated during US protectionism

Download

Download article

7 September 2018

Global Economic Update: Peak Trump? This bundle contains {bundle_entries}{/bundle_entries} articlesThis publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more