FX markets: Betting on Biden

With less than a month to go until the US presidential election, it is fair to say that FX markets are starting to behold a vision of a Joe Biden presidency. That has seen FX volatility levels fall and the dollar soften against those currencies driven by global activity

The falling cost of insuring presidential election risk

The USD/JPY derivative market – typically one of the most significant vehicles to express uncertainty – seemed to breathe a sigh of relief after the first presidential TV debate. The view here seems to be that Joe Biden pulling away in the opinion polls reduces the risk of a contested election.

We show that reduced pricing of risk in what is called the term structure of the USD/JPY FX options market. Our chart below shows the pricing of the USD/JPY volatility curve on two specific dates. The first being 25 September, a few days before the first debate, when Joe Biden was running about nine points ahead of President Donald Trump in opinion polls. The second on 6 October, when Biden’s lead in the polls had extended to 20+ points.

We think recent price action represents important clues to post-election market developments. Despite fears of a tax and spend Biden administration being negative for risk assets, it actually seems investors can live with an alternative (probably centrist) administration – especially should it secure Congress.

While these two volatility curves show a clear kink around the timing of the election – i.e. now captured by the one-month tenor on the chart – it is noticeable that the volatility curve priced on 6 October is substantially lower. In other words, investors now attach lower pricing to risk – or the cost of insurance – around the US election.

This reduction in perceived risk has seen US equities reclaiming half of their September sell-off and the dollar unwinding around 70% of September’s corrective rally. We think this price action represents important clues to post-election market developments. Despite fears of a tax and spend Biden administration being negative for risk assets, it actually seems investors can live with an alternative (probably centrist) administration – especially should it secure Congress.

USD/JPY volatility curve sinks post presidential debate

Releasing the reflation trade in FX

Barring events that could derail recovery hopes, (such as more aggressive lockdowns or Washington gridlock on a contested US election), we are expecting reflation trades to continue to play out in FX markets. Most recently the global reflation trade has extended beyond the asset classes of equities, commodities, and FX into the bond market, where the US 10-30 year Treasury curve is now at its steepest levels of the year.

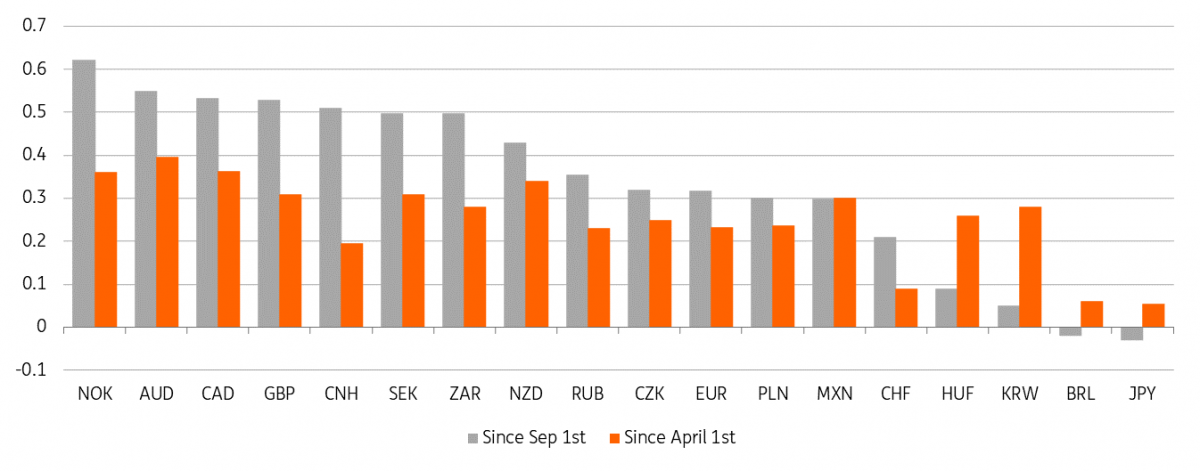

Our chart below shows how key currency performance against the dollar has been correlated with the shape of the US 10-30 year curve this year. No surprise to see the commodity currencies with the strongest correlation here, but a surprise to see the CNH coming up on the rails as the People's Bank of China allows a little more flexibility in the renmimbi.

Daily currency correlations (via USD) with changes in US 10-30 year Treasury Curve

We largely expect these trends to continue and favour the dollar decline extending throughout 2021. The euro, and European currencies in general, also have to battle with local challenges of: a) Brexit and b) the progress and implementation of the EU recovery fund.

Clarity on both should emerge by year-end and allow EUR/USD to start building a path to 1.25.

Download

Download article9 October 2020

October Economic Monthly: Winter is coming This bundle contains {bundle_entries}{/bundle_entries} articlesThis publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more