Fuel oil: The looming IMO deadline

January 2020 is fast approaching, and so too is the implementation of new regulations from the International Maritime Organization (IMO), where the sulphur limit for the shipping industry will fall to 0.5%. Here we look at what's changed since our last update, how the market may deal with surplus high sulphur fuel oil (HSFO), and why we believe there is further weakness ahead for the market

The forward curve tells the story

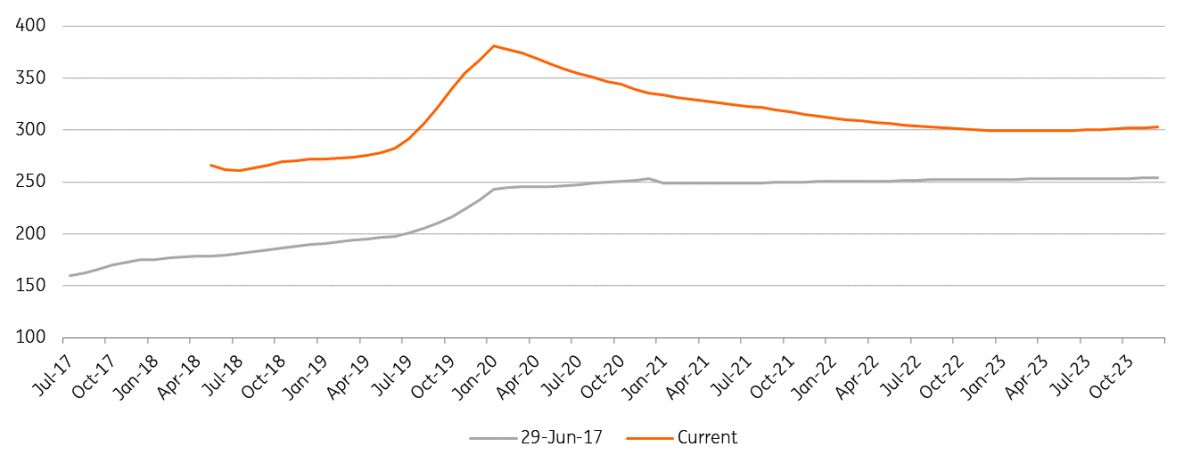

Given the implementation of the regulation, the shape of the HSFO forward curve is unsurprising, being in steep backwardation in the approach to 2020, due to the expectation of much weaker demand.

In our last IMO note (June 2017), the spread between the ICE gasoil and the HSFO forward curve was around US$250/t in early 2020. However as time has gone by, and it has become clearer that a large portion of the industry will move towards a marine diesel, at least initially, the spread in early 2020 has widened out to around US$380/t. This should start to entice more ship owners to look at installing scrubbers, which would allow them to continue burning the cheaper HSFO.

ICE Gasoil/NWE 3.5% fuel oil forward curve spread (US$/t)

Any changes in upcoming regulation?

One of the big concerns around this new regulation is how the IMO through flag states could effectively implement this regulation, particularly in international waters. Given the widening in the Gasoil/HSFO spread, the attractiveness to burn a non-compliant fuel may be just too tempting for some ship owners. This is one reason why the IMO recently updated the regulation, banning ships from carrying a non-compliant fuel, unless that ship has a scrubber installed.

Any more clarity on what route ship owners will take?

Given this wide gasoil/HSFO spread it does start to make the option of installing scrubbers more attractive for the shipping industry. However, an industry survey carried out by Drewry, found that at least for the existing fleet, the industry will largely look to turn to a compliant fuel, with 66% saying they would use a low sulphur fuel, whilst 13% said they would look to install scrubbers, and 8% potentially looking at LNG.

For the existing fleet, it is understandable that owners do not want to invest heavily in installing scrubbers or retrofitting with LNG engines, particularly with those ships that are approaching scrapping age. Additionally, some ship owners may find it a risky investment to install scrubbers, with the risk of further regulatory changes. There is growing pressure on the industry to reduce C02 emissions moving forward, and in fact, the IMO recently committed to reducing C02 emissions by 50% by 2050. Obviously though, the shorter the payback period for a scrubber, the smaller this risk.

For new builds, the result from the Drewry survey was slightly different, although most owners still favoured the use of a compliant fuel, 37% said they would look to use a low sulphur fuel, 21% would look at ships installed with scrubbers, and 24% would consider LNG ready ships.

What is interesting looking at the new build survey results, was that there seems to be more interest in LNG vessels, rather than just installing scrubbers. Whilst we believe that there certainly will be growth in LNG vessels, we think initially the uptake will be slow, given that globally there is still insufficient LNG bunkering infrastructure.

Either way, it appears as though HSFO demand from the shipping industry will decline post-2020, with the bulk of the industry looking to switch to a compliant fuel. This does mean that the market can expect to see a surplus of HSFO. But how will the market tackle this surplus?

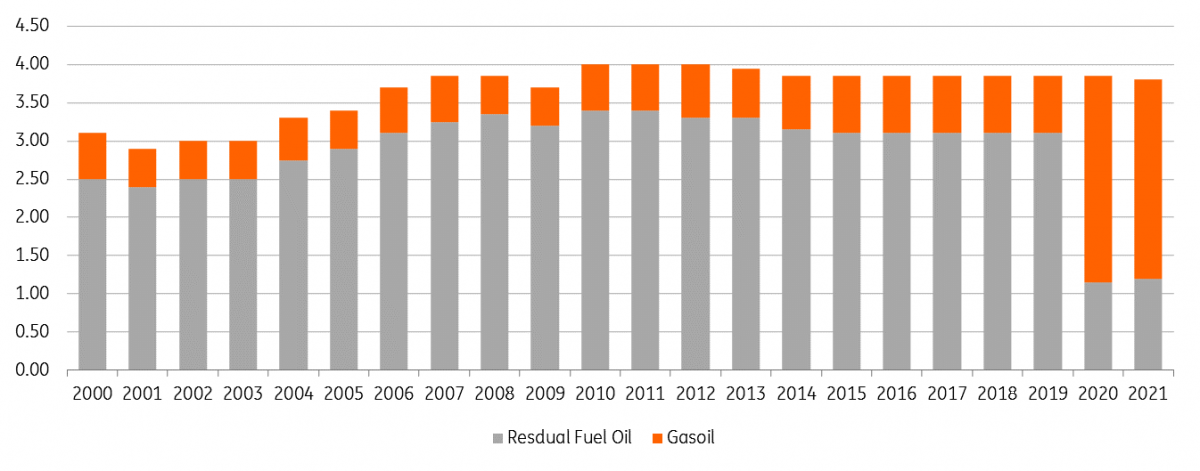

Marine fuel consumption (MMbbls/d)

Investment from refiners

One solution to reduce the residual fuel oil surplus post-2020, is by refiners investing in secondary upgrades, which would help to increase the yield of middle distillates, and reducing the yield of residual fuel oil. The US refinery industry clearly benefits from the IMO regulation. Refineries in the country are already more complex than the average global, with residual fuel oil yields significantly lower than other regions. According to the EIA, residual fuel oil yields in the US over 2017 averaged just 2.5%, this compares to more than 5% over large parts of the 1990s.

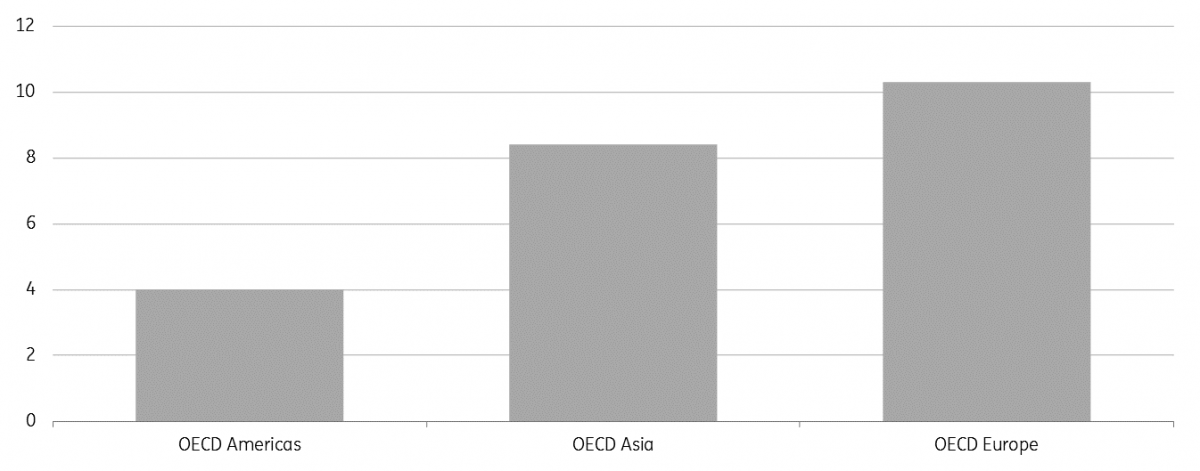

Meanwhile, looking at IEA data, residual fuel oil yields in OECD Europe averaged 10.3% over the last five years, this compares to 8.4% in OECD Asia and 4% in OECD Americas. This clearly suggests that the European refinery industry will likely suffer post-2020 without the necessary upgrades.

In some regions, there are already refinery modernisation plans underway. Russia over the last several years has been upgrading refineries in order to increase yields of lighter end products. These upgrades are clearly reflected in Russian fuel oil exports, which have fallen from a monthly average of 4.62mt in 2011 to 3.29mt in 2017.

Rosneft has seen its refinery depth (percentage of obtained petroleum products, not including fuel oil relative to the quantity of crude oil) increase from 68.9% in 1Q16 to as high as 77.1% in 3Q17, and given Russia’s energy strategy this is a trend that is expected to continue moving forward. Under the country’s energy strategy, the aim is to see a refinery depth of 90% by 2030. However, within the local industry, there have been suggestions that refinery margins will need to improve in order to drive further investment.

US residual fuel oil yields (%)

OECD five-year average residual fuel oil yields (%)

Will power generators step in to fill demand?

A solution on the demand side, would be for other end users to step in. One sector could be power generators. The IEA estimates that the Middle East alone has the potential to burn an additional 460Mbbls/d based on current capacity. Other countries which could potentially turn increasingly to fuel oil for power generation include Russia, South Korea, Taiwan and the Philippines.

However, we would need to see fuel oil prices trade down to levels where it makes sense for coal power generators to switch feedstock. A number of coal power plants have the capability to switch fuel, but obviously, it will need to make economic sense.

At the moment it clearly does not make sense, with the cost of burning fuel oil much higher than burning coal. However if we look at the forward curve, the spread between the two does narrow, although further weakness would still need to be seen before fuel oil is competitive. Assuming unchanged coal prices, HSFO prices would need to trade down to around US$150/t, which is US$100/t lower than where the forward curve is currently trading in early 2020.

This suggests that support may come from another end user before power generators step in, and this would likely be the shipping industry. We believe that the current spread should be attractive enough for the shipping industry to go the scrubber route, and further weakness relative to gasoil only makes this case stronger.

Power generation cost by feedstock (USD/MWh)

Download

Download articleThis publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more