France: Second-quarter growth disappoints

GDP figures for the second quarter just wiped out any hope of seeing French GDP growth reach 2% again this year. It seems that everything that could go wrong actually did. The causes are known, but the effects were larger than expected. Current indicators are pointing to a stronger second half but full-year growth of 1.8% is about all we can hope for now

| 0.2% |

Disappointing quarterly growth in 2Q18 |

| Worse than expected | |

What went wrong?

It generally happens that a plane crash is the consequence of several independent elements which, taken in isolation, would have done little harm, but taken together, they actually bring the aircraft down. The same was true for second quarter GDP growth figures. All that could possibly go wrong, did.

First, despite the fear of trade wars and the slowdown of eurozone demand, exports rebounded in the second quarter by 0.6%. A better performance in the first quarter, but not enough to compensate for the strong rebound in imports. This wiped off 0.4pp from growth in the second quarter.

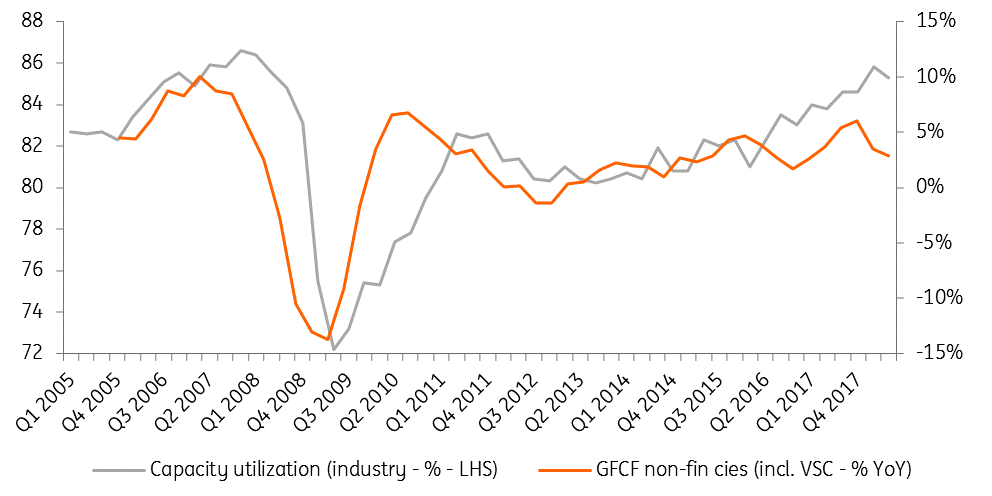

Domestic demand was affected by higher oil prices (+35% year on year) and weeks of strikes in the transportation sector. Private consumption declined (by 0.1% quarter on quarter) for the first time since 3Q16. It seems that despite very low interest rates, consumers also refrained from buying more houses as investment declined (by 0.1% QoQ) for the first time since mid-2015. This affected total investment growth, which wasn't strongly supported by businesses either. Indeed, corporate investment rebounded less than expected, by 1.1% QoQ after the dismal 0.1% registered in the first quarter, widening the gap with very high capacity utilisation rates (see graph).

Can it get better?

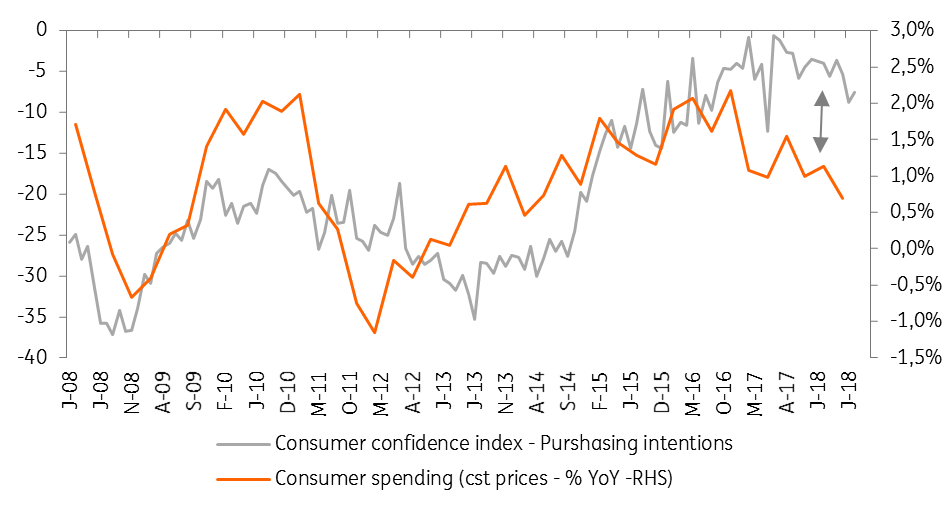

The good news is that when negative shocks all materialise at the same time, the likelihood that things get worse declines. The threat from strikes is low for the third quarter and trade war fears could abate as well following on Jean-Claude Juncker's meeting with Donald Trump in Washington. Unemployment is declining, but it seems that consumers are opting for more savings rather than for more consumption despite the low interest rate context. If we expect a rebound of private consumption in the third quarter (and no, it will not be a World Cup victory effect), it is likely to be temporary as higher oil prices will take time to be digested. In 2018, we do not expect private consumption growth to exceed the very slow 1.1% reached in 2017.

Purchasing intentions are not materialising

Nevertheless, activity indicators remain elevated, order books are at high levels and capacity utilisation would justify another corporate investment rebound. In the real estate market, we also expect higher investment in the coming months as interest rates are low and as surveys in the building sector are more positive than at any time in the last ten years.

It is therefore too soon to label this the end of the cycle, but the slower growth of the first half makes it unlikely that growth could reach 1.8%, let alone the 2.0% forecast so far for 2018. We are therefore still far from the end of the cycle, and the outlook remains supportive for reform. But the countdown has begun…

Download

Download article"THINK Outside" is a collection of specially commissioned content from third-party sources, such as economic think-tanks and academic institutions, that ING deems reliable and from non-research departments within ING. ING Bank N.V. ("ING") uses these sources to expand the range of opinions you can find on the THINK website. Some of these sources are not the property of or managed by ING, and therefore ING cannot always guarantee the correctness, completeness, actuality and quality of such sources, nor the availability at any given time of the data and information provided, and ING cannot accept any liability in this respect, insofar as this is permissible pursuant to the applicable laws and regulations.

This publication does not necessarily reflect the ING house view. This publication has been prepared solely for information purposes without regard to any particular user's investment objectives, financial situation, or means. The information in the publication is not an investment recommendation and it is not investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Reasonable care has been taken to ensure that this publication is not untrue or misleading when published, but ING does not represent that it is accurate or complete. ING does not accept any liability for any direct, indirect or consequential loss arising from any use of this publication. Unless otherwise stated, any views, forecasts, or estimates are solely those of the author(s), as of the date of the publication and are subject to change without notice.

The distribution of this publication may be restricted by law or regulation in different jurisdictions and persons into whose possession this publication comes should inform themselves about, and observe, such restrictions.

Copyright and database rights protection exists in this report and it may not be reproduced, distributed or published by any person for any purpose without the prior express consent of ING. All rights are reserved.

ING Bank N.V. is authorised by the Dutch Central Bank and supervised by the European Central Bank (ECB), the Dutch Central Bank (DNB) and the Dutch Authority for the Financial Markets (AFM). ING Bank N.V. is incorporated in the Netherlands (Trade Register no. 33031431 Amsterdam).