French business confidence points to growth stability in the third quarter

Business confidence was stable in France in June, and more generally in the second quarter, indicating that growth is unlikely to accelerate much in the coming months. If the outlook for 2018 is less upbeat than three months ago, we believe it is still too soon to believe in the recently much more pessimistic official forecasts

The wind is turning for order books but investment and hiring intentions remain high

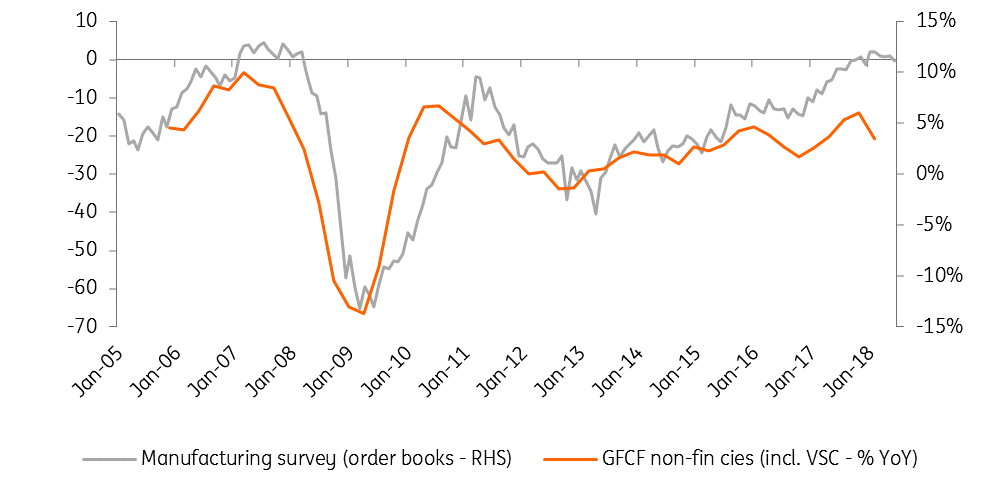

Figures published by INSEE show that confidence remained stable in both the manufacturing and service sector in June. In the industry, business confidence has been stable in the second quarter as a whole (109.5), slightly below 4Q17 and 1Q18. However, manufacturing companies are losing confidence in the general outlook (this component is down from its January peak and back at last year’s level). This could be due to the fact that order books, which had been filling up for the last six months, turned around in June while inventories, although still fairly low, increased somewhat in May and June. What allowed the stabilization in confidence is the optimistic expectations of manufacturing companies about their own production outlook in coming months. All in all, the picture, therefore, remains fairly positive for activity in the manufacturing sector, although less than in the beginning of the year.

The main downside risks are likely to impact growth negatively only at the end of the year, leaving space for a stronger domestic demand in coming months

In the building sector, confidence kept increasing in June: capacity utilization reached 90% for the first time this decade and hiring intentions remain elevated. The same survey in the service sector gave a less rosy picture in June. Confidence indeed did not recover from its drop of May and remained at last year’s level. Companies are more cautious about upcoming demand and hiring intentions slowed down markedly in June, coming back at their level of last October. Similarly, investment intentions, although they remain elevated, slowed down in June.

Can the current levels of confidence materialize in 2.0% growth in 2018?

All in all, the June confidence survey is showing that we can only count on a limited rebound of GDP in the third quarter. The extend of the slowdown (and of the strikes’ impact) in the second quarter of 2018 will therefore be key to determine this year’s growth. Recent projections by INSEE and Banque de France (respectively 1.7% and 1.8%) look pessimistic in that regard. On the investment front, with high capacity utilization and a high level of order books, we remain optimistic for 2018 while household spending should rebound in the second half of the year. Instability in the Eurozone around the future Italian budget and the prospects of a EU-US trade war could still have an effect, but we believe the bulk of it will be felt in 2019. Therefore, we still think that growth can approach 2.0% this year, before slowing down in 2019 while remaining above potential (1.8%).

Download

Download article"THINK Outside" is a collection of specially commissioned content from third-party sources, such as economic think-tanks and academic institutions, that ING deems reliable and from non-research departments within ING. ING Bank N.V. ("ING") uses these sources to expand the range of opinions you can find on the THINK website. Some of these sources are not the property of or managed by ING, and therefore ING cannot always guarantee the correctness, completeness, actuality and quality of such sources, nor the availability at any given time of the data and information provided, and ING cannot accept any liability in this respect, insofar as this is permissible pursuant to the applicable laws and regulations.

This publication does not necessarily reflect the ING house view. This publication has been prepared solely for information purposes without regard to any particular user's investment objectives, financial situation, or means. The information in the publication is not an investment recommendation and it is not investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Reasonable care has been taken to ensure that this publication is not untrue or misleading when published, but ING does not represent that it is accurate or complete. ING does not accept any liability for any direct, indirect or consequential loss arising from any use of this publication. Unless otherwise stated, any views, forecasts, or estimates are solely those of the author(s), as of the date of the publication and are subject to change without notice.

The distribution of this publication may be restricted by law or regulation in different jurisdictions and persons into whose possession this publication comes should inform themselves about, and observe, such restrictions.

Copyright and database rights protection exists in this report and it may not be reproduced, distributed or published by any person for any purpose without the prior express consent of ING. All rights are reserved.

ING Bank N.V. is authorised by the Dutch Central Bank and supervised by the European Central Bank (ECB), the Dutch Central Bank (DNB) and the Dutch Authority for the Financial Markets (AFM). ING Bank N.V. is incorporated in the Netherlands (Trade Register no. 33031431 Amsterdam).