French consumer confidence drops amidst fuel protests

French consumers’ optimism took a hit from the widespread grassroots protests across France in recent weeks and this is all in spite of the reduction in unemployment

| 91.6 |

Consumer confidence in NovemberLowest since January 2015 |

Grassroot protests hit consumer confidence

French consumer confidence dropped from 94.6 to 91.6 in November as a wind of revolt blows all over France.

More than 250k protesters have taken to the streets in the last few weeks complaining about the increasing prices at gas stations, partly due to the various environment taxes.

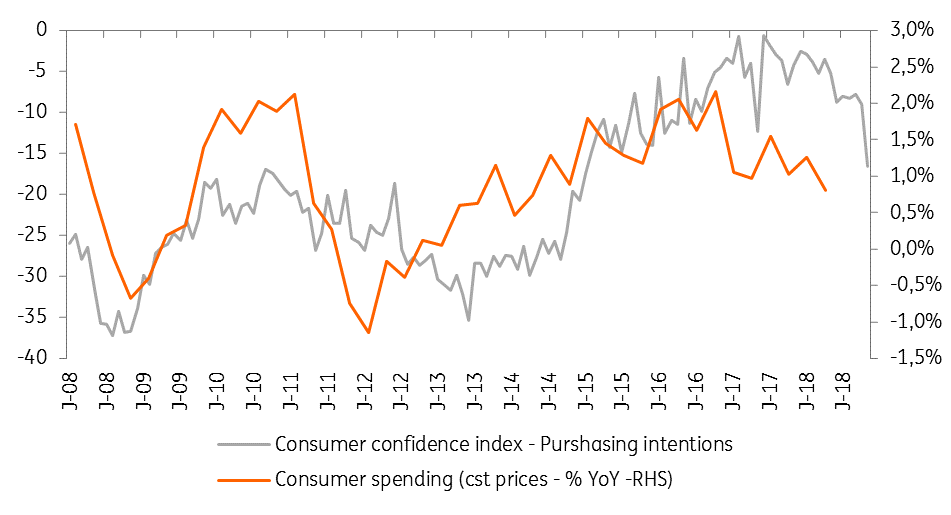

In November, fears of unemployment rebounded while the French also became more pessimistic about their ability to save. In particular, purchasing intentions took a plunge, which could be a cause for concern for retailers a few weeks before Christmas. One has to go back as far as January 2015 to see levels this low.

The President responds

When Emmanuel Macron presented his plans for energy transition earlier this week, he did his best to address both social and environmental concerns while remaining committed to the Paris Climate Agreement.

He promised to develop solutions for cleaner energy to become more affordable and two main budgetary measures were confirmed: a nine billion euros investment plan to help households improve energy efficiency and switch to cleaner cars via a premium scheme alongside a 7 to 8 billion euros investment plan for renewable energy annually.

The 0.5 billion euros announced last week to counter the protests weren't denied and included two measures.

The first is a conversion premium of 2000 euros for those who want to switch to low-emission vehicles, and modest households could get 4000 euros thanks to the new measure. The second is to temporarily increase support for the five million people driving quite far to work to receive a tax subsidy. In parallel, several measures were announced to help support those using gasoline to heat themselves.

With lower oil prices in the international market and the Christmas season fast approaching, we expect the protests to abate. And we don't think their impact on 4Q18 GDP will be significant

The law will also modify the French energy mix: all coal energy plants will be closed by 2022, and the first two nuclear reactors will be closed in Eastern France by 2020, followed by another 12 more between 2025 and 2035, depending on the European policy mix and technological progress in renewable energies. This aims at cutting nuclear energy to 50% of the energy mix in 2035.

It is unclear if these answers will calm down the protests, but at least it avoids frustrating Macron’s core electorate.

With lower oil prices in the international market and the Christmas season fast approaching, we expect the protests to abate. However, their impact on consumer confidence could be long-lasting and dent retail sales in 4Q18. However, at this stage, we don't think that the impact on 4Q18 GDP will be significant.

Unemployment figures remain well oriented

Contrary to the dominant consumer sentiment in November, the job market still looks in good shape even though it isn't very dynamic. The unemployment rate in 3Q18 was stable at 9.1%, and the latest data shows that unemployment declined by 9.7k after 37.2k in October.

We expect the unemployment rate to continue declining in the coming quarters, but no reason to celebrate as we don't think it'll be enough to avoid GDP slow down

At this pace, 2018 should be the first year when all unemployment categories will have seen a decline as a whole. In 2017, job creation was not sufficient to fully absorb the end of past subsidised job schemes, resulting in increases in temporary unemployment. However, we need to see more job creation to have unemployment fall below 8.5% in 2019.

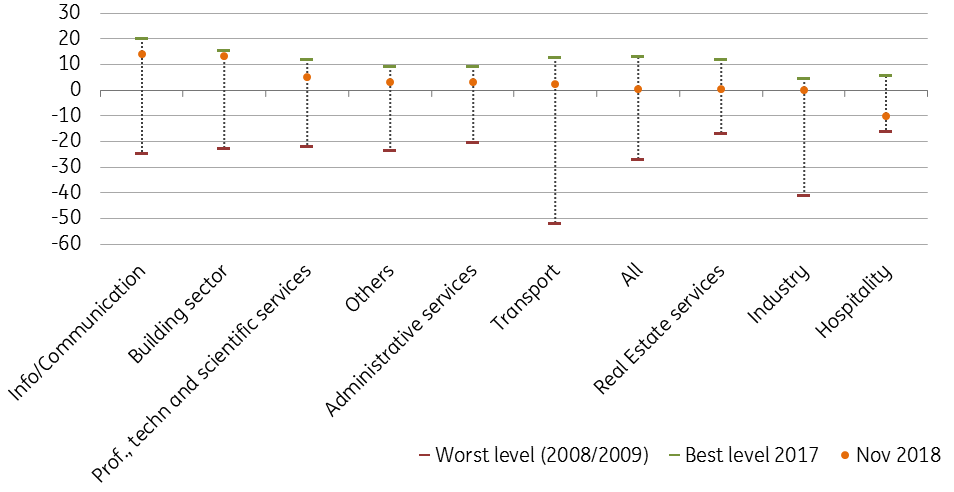

The outlook still looks encouraging as business confidence surveys showed in November. Hiring intentions remain high and if not always close to their 2017 peak – are still very far from their historical lows as seen above.

Therefore, we expect the unemployment rate to continue declining in the coming quarters. This, together with lower oil prices, should allow for some private consumption growth acceleration in 2019. There is no euphoria though as private consumption growth will be limited at 1% this year and should only rebound by 1.5% in 2019 - not enough to avoid GDP growth slow down.

"THINK Outside" is a collection of specially commissioned content from third-party sources, such as economic think-tanks and academic institutions, that ING deems reliable and from non-research departments within ING. ING Bank N.V. ("ING") uses these sources to expand the range of opinions you can find on the THINK website. Some of these sources are not the property of or managed by ING, and therefore ING cannot always guarantee the correctness, completeness, actuality and quality of such sources, nor the availability at any given time of the data and information provided, and ING cannot accept any liability in this respect, insofar as this is permissible pursuant to the applicable laws and regulations.

This publication does not necessarily reflect the ING house view. This publication has been prepared solely for information purposes without regard to any particular user's investment objectives, financial situation, or means. The information in the publication is not an investment recommendation and it is not investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Reasonable care has been taken to ensure that this publication is not untrue or misleading when published, but ING does not represent that it is accurate or complete. ING does not accept any liability for any direct, indirect or consequential loss arising from any use of this publication. Unless otherwise stated, any views, forecasts, or estimates are solely those of the author(s), as of the date of the publication and are subject to change without notice.

The distribution of this publication may be restricted by law or regulation in different jurisdictions and persons into whose possession this publication comes should inform themselves about, and observe, such restrictions.

Copyright and database rights protection exists in this report and it may not be reproduced, distributed or published by any person for any purpose without the prior express consent of ING. All rights are reserved.

ING Bank N.V. is authorised by the Dutch Central Bank and supervised by the European Central Bank (ECB), the Dutch Central Bank (DNB) and the Dutch Authority for the Financial Markets (AFM). ING Bank N.V. is incorporated in the Netherlands (Trade Register no. 33031431 Amsterdam).