France: An economy in shock

Based on innovative methods, INSEE has managed to estimate that the French economy was only operating at two-thirds of its capacity during the first week of lockdown

The slump set in very quickly

In France, INSEE published a first estimate of current activity across various sectors, together with its monthly business climate survey. The monthly survey ended on 23 March but the institute points out that the last week was poorly represented in the total sample, with only a few responses via the internet. Many respondents were already unavailable. The survey figures are therefore partial, and biased towards the first two weeks of March, so we will have to wait for the April results to have a more precise idea of the fall in economic sentiment during the crisis.

INSEE has therefore, for the first time, used new methods, many of them qualitative, to estimate the loss of activity by sector during the first week of lockdown, as well as the loss of demand by sector of activity. Both approaches (production and expenditure approaches) point to an economy operating at 65% of capacity.

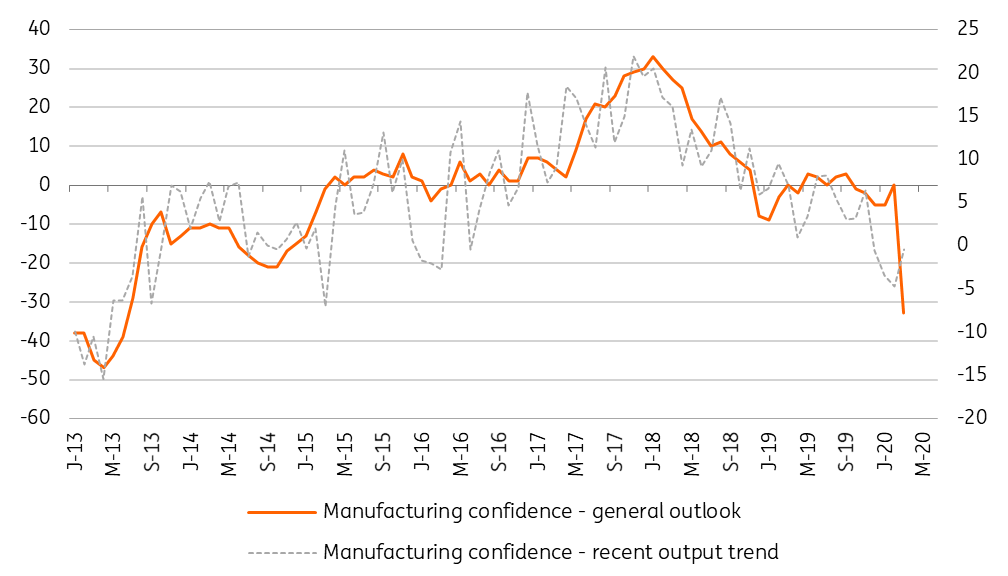

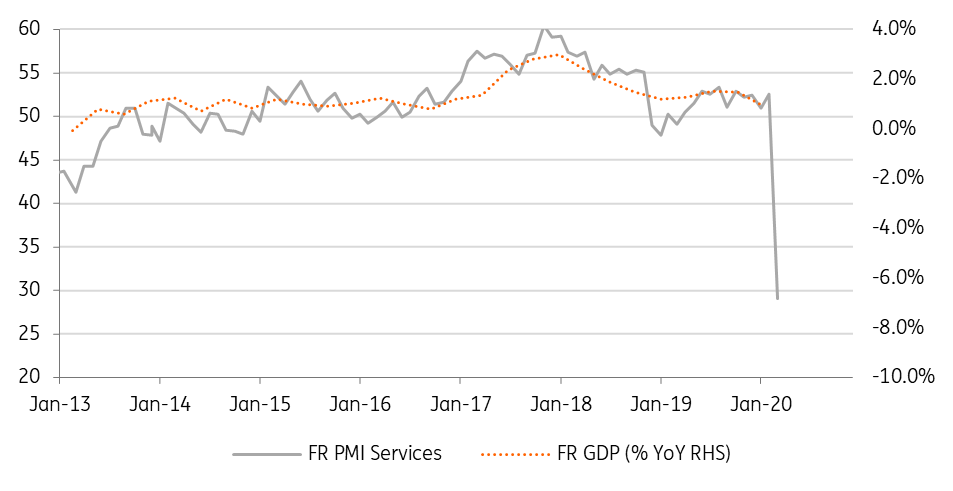

They may be partial, but these are awful figures nevertheless. Business climate collapsed by 10 points in March, the largest drop since the survey was first conducted in 1980, and one point more than at the start of the financial crisis in October 2008. The declines are stronger in services and retail sales than in industry (where the impact still seems limited - Chart 1). Similarly, in the building sector, which has since come to a virtual standstill, the indicator has remained above its long-term average, reflecting the situation at the beginning of March. In services, the drop in business confidence reflects the message given earlier this week by the PMI indicators, where the services index fell to an all-time low of 29 (Graph 2).

The fall in industrial activity is still partial

A shock differentiated by sector

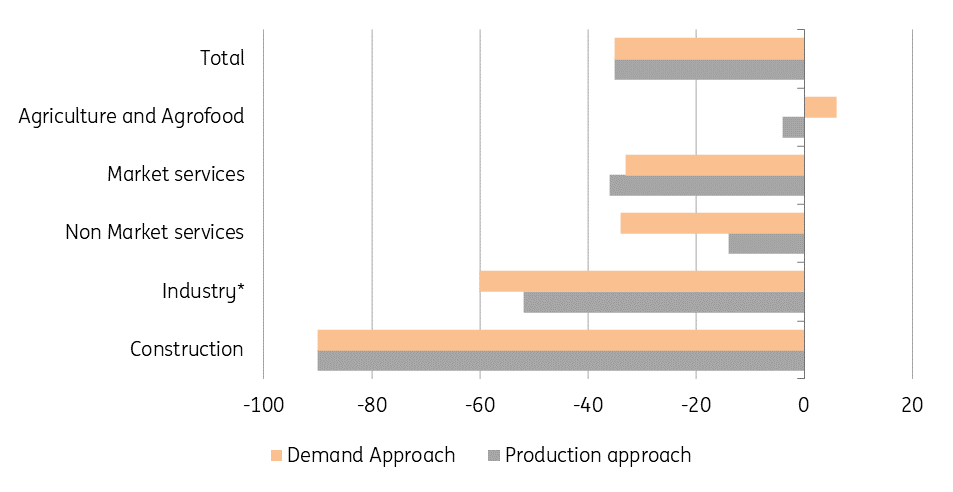

According to INSEE, which used various new and often qualitative methods for its estimation, not all sectors were affected in the same way. It is obvious that this estimate is bound to evolve over time, but it nevertheless already offers more precise information on what is happening (an extraordinary light in the thick economic fog in which we must have the honesty to admit we are all immersed). INSEE uses two of the approaches used to compute GDP to present its main result: that only 65% of the French economy was operating during the first week of confinement.

According to the "production" approach (which considers the value-added of each sector to calculate GDP), the loss of value-added compared to a normal week ranges from 36% in market services to 52% in industry and nearly 90% in construction (Chart 3). The weighted average (by weight of these sectors in value-added) shows a drop of about 35%. Similarly, according to the "expenditure" approach (where GDP is considered as the sum of the different demands), the loss in consumption is estimated at 60% for industry (excluding food processing), 56% for market services (excluding real estate) and 90% for construction. The increase in activity in the agro-food industry, and the smallest loss in non-market and real estate services allows INSEE to obtain a weighted average of (again close to) 35%.

PMI services pointed to a strong contraction

The economy is in shock

Both business cycle indicators and these initial signs of a decline in activity point to a sharp contraction in GDP. INSEE refused to quantify this in its publication but indicated that a fall of three percentage points (in GDP growth over the year 2020) per month of lockdown is a reasonable estimate of the shock. The way in which this shock will mark total growth in 2020 will depend essentially on the shape of the recovery and the length of the lockdown, two components for which only assumptions are possible at this stage. However, it is already clear that the first estimates of the recession (-1% in 2020) have quickly become outdated and will have to be revised downwards again very soon.

First estimates of activity losses per sector during the French lockdown

* Industry excluding construction and agrofood

"THINK Outside" is a collection of specially commissioned content from third-party sources, such as economic think-tanks and academic institutions, that ING deems reliable and from non-research departments within ING. ING Bank N.V. ("ING") uses these sources to expand the range of opinions you can find on the THINK website. Some of these sources are not the property of or managed by ING, and therefore ING cannot always guarantee the correctness, completeness, actuality and quality of such sources, nor the availability at any given time of the data and information provided, and ING cannot accept any liability in this respect, insofar as this is permissible pursuant to the applicable laws and regulations.

This publication does not necessarily reflect the ING house view. This publication has been prepared solely for information purposes without regard to any particular user's investment objectives, financial situation, or means. The information in the publication is not an investment recommendation and it is not investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Reasonable care has been taken to ensure that this publication is not untrue or misleading when published, but ING does not represent that it is accurate or complete. ING does not accept any liability for any direct, indirect or consequential loss arising from any use of this publication. Unless otherwise stated, any views, forecasts, or estimates are solely those of the author(s), as of the date of the publication and are subject to change without notice.

The distribution of this publication may be restricted by law or regulation in different jurisdictions and persons into whose possession this publication comes should inform themselves about, and observe, such restrictions.

Copyright and database rights protection exists in this report and it may not be reproduced, distributed or published by any person for any purpose without the prior express consent of ING. All rights are reserved.

ING Bank N.V. is authorised by the Dutch Central Bank and supervised by the European Central Bank (ECB), the Dutch Central Bank (DNB) and the Dutch Authority for the Financial Markets (AFM). ING Bank N.V. is incorporated in the Netherlands (Trade Register no. 33031431 Amsterdam).