Four reasons why the Bank of Canada will keep hiking in 2019

We expect Canada's central bank to take a pause in December, but decent growth, low unemployment and inflation at the bank's target level should keep policymakers on track for two - if not three - rate hikes next year

Growth to slow - but only modestly

For the time being, the Canadian economy continues to the reap the rewards of strong US activity and should see a respectable 2.5% growth rate overall for 2018. We may see a slightly slower pace of growth in 2019 (our forecasts look for 2.1%), reflecting a more moderate expansion in the US.

This is unlikely to faze many Bank of Canada (BoC) policymakers, although trade tensions remain a clear growth risk in 2019. Despite some positive headlines from the recent G20 meeting, we remain cautious about the outlook for US-China trade - particularly given that a lot needs to happen in the next 90-days. If tensions intensify, the resulting slowdown in the US, which is Canada's largest export partner would have negative consequences for the Canadian economic story.

'Nafta 2.0' approval should remove the grey clouds from the investment outlook

But a lot depends on what happens to the United-States-Mexico-Canada-Agreement (USMCA) as there are a few key hurdles to overcome - principally whether it will be ratified by (the now split) Congress. There have already been some murmurs by Californian representative Nancy Pelosi (who is expected to be the elected speaker of the US House of Representatives) that she would like to see better agreement on the labour and environment issues.

But assuming Congressional approval is eventually sought, the outlook for exports and investment should regain some energy next year, particularly if the fresh clarity prompts a rise in overall business confidence.

Wage growth woes should fade, boosting spending for now

Wage growth has been particularly disappointing over recent months, falling from 3.93% in May to 1.87% in October - for permanent workers. Importantly though, there are signs that this could begin to improve again in 2019. The central bank's recent Business Outlook Survey shows firms reporting production capacity constraints (particularly stemming from labour shortages) which prevents them from meeting higher demand, and we expect this to place renewed pressure on wages in 2019.

At the same time, consumer confidence is in good shape and should support spending in the near-term. More clarity about USMCA uncertainties should add a further boost if consumers grow more confident about the shape of the economy. That said, as higher borrowing costs continue to eat into disposable incomes, we may well see consumption contribute less to 2019 growth, and the housing market won't help that for two reasons.

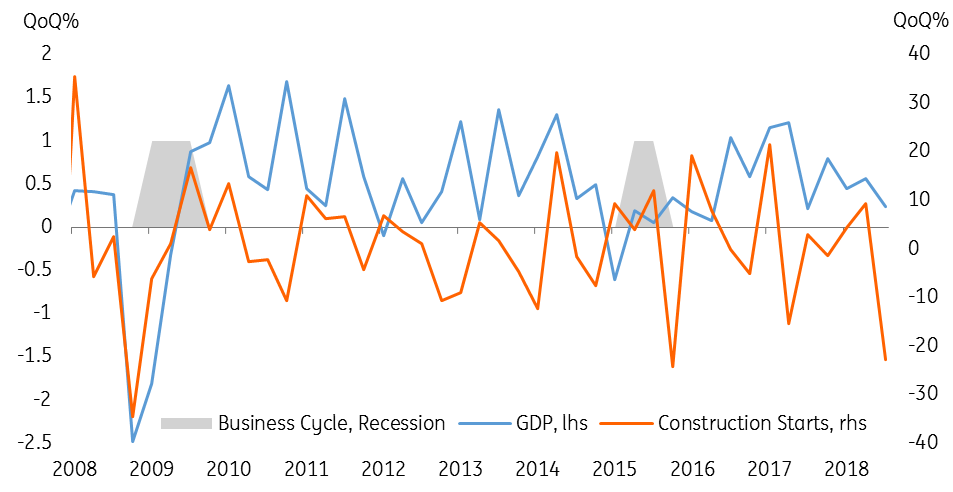

Firstly, higher rates and tighter mortgage rules are likely to see further declines in housing resales. This is also likely to feedback into more muted residential investment given excess supply issues, which will weigh on growth (much like in the US). We've already seen some signs of this in the construction data (see chart) below.

Dips in construction starts typically precede an economic slowdown

Secondly, house price gains are shrinking as house prices cool. The resulting wealth effect may weigh on spending and sentiment - particularly in areas like Vancouver, where prices have skyrocketed in recent years.

There are some silver linings though. The number of high-ratio mortgages being offered has fallen, which has helped make debt levels of new homeowners more sustainable.

Near-term target inflation should keep the central bank tightening

Inflation is expected to ease towards the Bank's 2% inflation target next year. We expect headline CPI to inch down to 2.1% in 2019, from 2.3% this year. This comes as the impact of higher gasoline prices and minimum wage increases continues to fade, alongside some downward pressure from the stronger Canadian dollar.

But what really matters for the central bank is core inflation, which is likely to remain supported by the solid growth and the wage outlook.

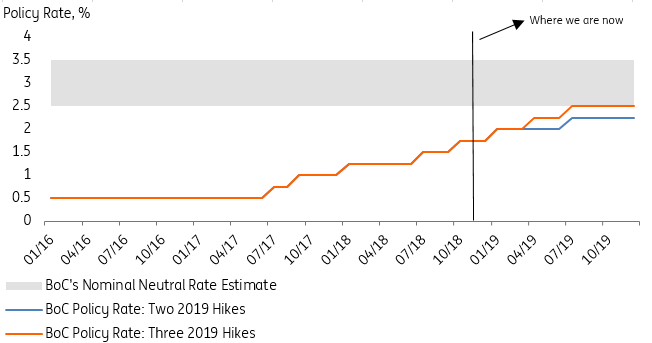

Bank of Canada policy rate outlook for 2019

What this means for interest rates

Putting all the pieces together, we expect two rate hikes in 1Q19 and 3Q19, taking the policy rate towards the lower end of the BoC's estimate of the nominal neutral rate (2.5%-3.5%, based on at-target inflation).

We're not ruling out a third hike next year either, depending on the strength of wage growth and if trade tensions remain in check.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more