Federal Reserve: Dovish dose of reality

No change today from the Federal Reserve. Covid-19 is far from beaten and there are mounting challenges to the US growth outlook. The central bank is sounding even more dovish, likely culminating in a strategy shift in September

Fed funds target rate stays at 0-0.25%, QE stance unchanged

With markets functioning well, bond yields at such low levels, the Fed yesterday extending emergency lending programmes and the focus currently on another round of fiscal stimulus, we weren’t going to see a major policy move today. Officials unanimously decided to leave the Fed funds target rate unchanged at 0-0.25% with no change to their quantitative easing stance, which has seen Treasury and mortgage-backed security purchases slow sharply since the peak of the crisis in March. The only other announcement was an extension of dollar repo and swap lines through to 31 March in another sign it is looking to ensure market functioning continues without stress.

The accompanying statement repeats the line that the Fed remains committed to keeping the Fed funds rate at the 0-0.25% level “until it is confident that the economy has weathered recent events and is on track to achieve our maximum-employment and price-stability goals”. Given the Fed’s dot diagram from June, which showed just two FOMC members expecting the Fed to announce any increase in the policy rate before the end of 2022, there is little need to be any more explicit with their policy guidance at this stage.

The Fed’s dose of realism

The only major statement change is that at the beginning of the second paragraph it adds an explicit warning that “the path of the economy will depend significantly on the course of the virus”. It seems to be yet another effort to try to provide a dose of realism in contrast to what appears to be equity market optimism that recovery is plain sailing from here. In the press conference, Fed Chair Jay Powell expressed the same view as at last month’s testimony to Congress that “until the public is confident that the disease is contained, a full recovery is unlikely”.

We agree completely. Covid-19 is far from beaten and while there is optimism about a vaccine that can allow a return to “normality”, the timing and its efficacy are still unknown. Meanwhile, a renewed spike in cases is forcing state Governors to backtrack on reopening plans, which is shuttering businesses with workers losing their jobs. At the same time the US$600 a week benefit boost to 31.8 million claimants has effectively ended and will be replaced with something much smaller in size. With virus fears on the rise, jobs being lost and incomes being squeezed, we feel the recovery could be much bumpier than what is currently priced.

In this regard Fed Chair Powell emphasised how "critical" fiscal support has been to the recovery so far in a plea for an agreement between the Republicans and Democrats on another fiscal package. Pretty obviously, interest rates are not going anywhere for a very long time and the bond markets and dollar are reflecting this.

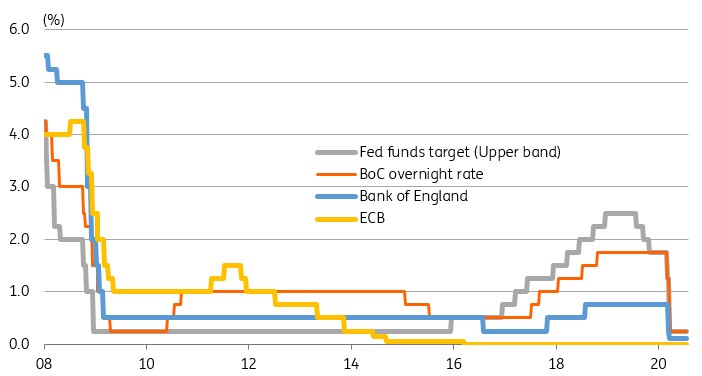

Central bank policy rates

A change of strategy is coming…

They also indicated that markets should prepare for a potential change in strategy "in the near future" regarding the way they ensure their dual goal of price stability and maximum employment. It seems probable that the Fed’s long running review of its policy setting framework will be announced in September and it will involve a shift away from a policy of pre-emptively raising interest rates before inflation reaches the 2% target.

Instead, they are seemingly moving towards a policy of targeting 2% inflation over a period of time – thereby tolerating bouts of above 2% inflation to make up for long periods of sub-target inflation. This would clearly imply looser monetary policy for longer and help reinforce the message from the dot diagram that a rate hike remains at least another two and a half years away.

Additional policy options downplayed... for now...

Financial markets continue to price in the possibility of negative interest rates, but officials have been dismissive of this and within the press conference Jay Powell again hinted they are not an attractive option. For example, there is little evidence to suggest it has boosted inflation in the eurozone or Japan while the Fed is of the view that such a move “could have more significant adverse effects on market functioning and financial stability here than abroad”. It also acts as a disincentive for businesses to maintain cash buffers to deal with future financial stress. Instead, the negative interest rate pricing behaviour is more likely to be some traders hedging positions rather than a conviction the Fed will take this step.

Another option that continues to be discussed as a potential future policy tool is yield curve control – using QE to target specific yields to prevent borrowing costs rising too far too quickly. However, with the US 10Y Treasury yielding less than 60 basis points and the 30Y a mere 1.25% there is no pressing need to do anything. If yields start to rise on economic optimism and the perception that inflation is rising, the Fed is unlikely to stand meaningfully in the way. However, if it is more a fear of a demand/supply mismatch, as Treasury issuance rises to fund a fiscal deficit we think could hit 20% of GDP this year, then they will be far more willing to prevent rising borrowing costs from threatening the recovery.

Download

Download article31 July 2020

Covid-19: The shocking numbers are in This bundle contains {bundle_entries}{/bundle_entries} articlesThis publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more