US: Fed set to hike in May, but it is likely to mark the peak

Fed hawkishness indicates officials feel the need to do more to ensure inflation returns to target in a timely fashion, especially with consumer spending and jobs growth performing well in the first quarter. Recession risks are mounting and inflation pressures are moderating, which we think will result in the Fed reversing course in the fourth quarter

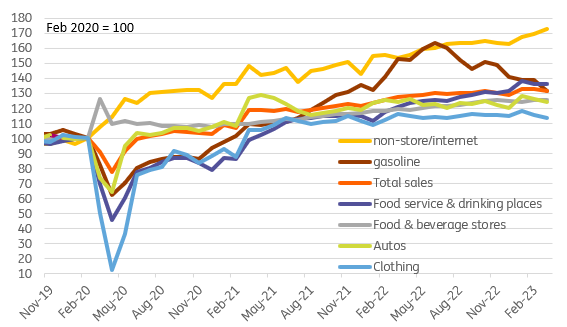

Retail sales confirm strong first quarter consumer spending story

US retail sales fell 1% month-on-month in March, a worse outcome than the 0.5% drop expected. The trend is not great with four declines in the past five months (with a 3.1% jump in January the solitary gain). However, there was an upward revision to February (to -0.2% from -0.4%) while the 'control group', which strips out some of the more volatile components and historically better tracks broader consumer spending patterns, was not as bad as feared, falling 0.3% rather than by -0.5% as the consensus had expected.

US retail sales components Feb 2020 = 100

Consequently, the three-month annualised growth rate for the retail sales control group (which strips out food, gasoline, building materials and auto dealers) is now running at 9.5% on a three-month annualised basis and 5.7% year-on-year. Combined with the hot core CPI MoM print (+0.4%) and the firm jobs story through the first quarter, it should keep the Fed in the mindset of hiking 25bp in early May.

That certainly seems to be the message from the Fed speakers this morning. Fed Governor Chris Waller commented that core inflation has not shown much improvement and is still too high, meaning that the Fed’s job is not yet done. Indeed the recent data flow 'validate' the Fed’s decision to have hiked in March although he did at least acknowledge that the tightening of credit conditions in the wake of recent stresses reduces the workload of the Fed. Voting member Austan Goolsbee then warned that the Fed has "got to stop inflation". The combination of firm first quarter consumer spending and key voting Federal Open Market Committee members seemingly backing the case for more action means we are now pretty much 21bp priced for May versus 18bp earlier in the day. We do expect the Fed to raise rates by 25bp on 3 May.

But headwinds are intensifying and inflation pressures are easing

We think that will be the last hike though given the headwinds facing the consumer sector are intensifying and inflation pressures are easing. Indeed, rising job lay-off announcements, higher borrowing costs and tighter lending conditions (which will hit credit card spending and car loans in particular) plus falling house prices are never a good combination for consumer spending. This still accounts for around 70% of all economic activity in the US.

Additionally, while industrial production was firmer than expected in March, rising 0.4% MoM versus the 0.2% consensus and February's growth was revised up 0.2 percentage points to +0.2% MoM growth, the details paint a weaker picture. Both manufacturing and mining output fell 0.5% MoM with all the strength in utilities, which jumped 8.4%. This will inevitable correct lower over the next couple of months as weather patterns stabilise. Manufacturing output is now 1.1% lower than in March 2022 and with the ISM remaining in contraction territory the outlook for the sector doesn't look good.

Import prices are falling rapidly, implying downside risk for PPI and CPI

Meanwhile import prices fell 0.6% MoM, lower than the -0.1% predicted with YoY import price inflation now -4.6%. The chart above suggests PPI could soon slow to below 2% YoY with a sub 3% CPI print before year-end a possibility. As such the combination of weaker activity and the prospect of rapid falls in inflation mean we continue to look for aggressive rate cuts, potentially amounting to 100bp, before the end of the year.

Download

Download articleThis publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more