Default rates: Higher for longer

We're getting mixed signals in terms of default rates expectations, as rating agencies are taking a more optimistic approach, while we expect default rates to stay elevated for longer. We dive into fundamentals and feel the support from governments and central banks are potentially keeping sinking ships afloat despite the inevitable

We're getting mixed signals in terms of default rates expectations, as rating agencies are taking a more optimistic approach, while we expect default rates to stay elevated for longer. In any case, default rates are an essential factor for credit; however, at the moment, there is a difference in opinion amongst the rating agencies as the reliance on Covid-19 expectations is heaviest on forecasts.

When we dive into fundamental drivers, we forecast default rates to remain higher for longer. Loss given default rates are higher, rates and spreads are expected to rise, and leverage metrics are deteriorating. Therefore, we are likely to see higher default levels for a more extended period due to how the pandemic has impacted different sectors.

We're getting mixed signals in terms of default rates expectations, as rating agencies are taking a more optimistic approach, while we expect default rates to stay elevated for longer

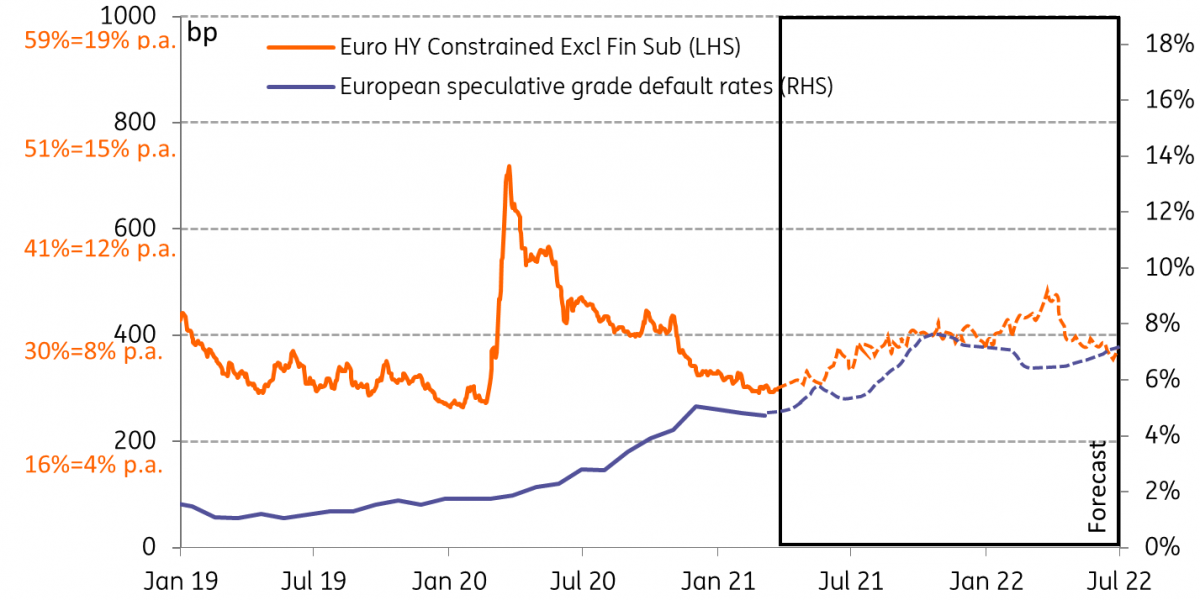

As it stands, the European speculative-grade default rates are being pencilled in at 4.7% according to Moody’s and 5.3% according to S&P. However, Moody’s baseline forecast estimates a sharp decrease in default rates by the end of this year. We think this is too optimistic.

S&P, on the other hand, expect default rates to increase slightly more towards the end of the year and begin falling from then onwards. Indeed we are more in line with S&P’s expectation of rising default rates; however, we also expect default rates to stay high for longer.

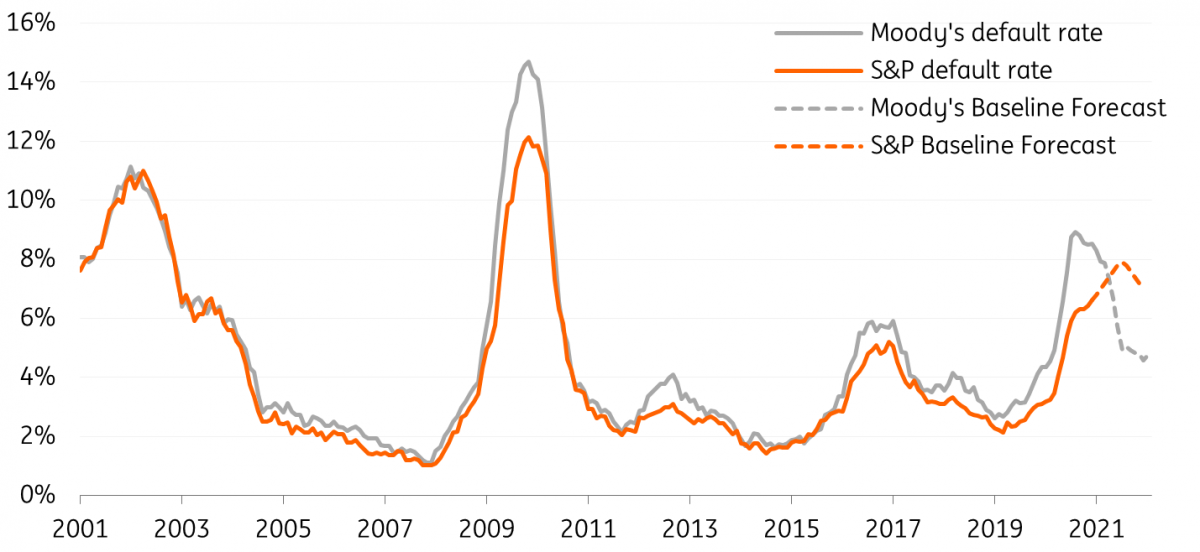

Our forecast is for an increase in default rates and default rates to stay high for longer. This contrasts with what we saw during the dot com bubble in the early 2000s and the credit crisis of 2008 when default rates shot up significantly very quickly and then came sharply back down shortly after. This time we expect not to reach default rates as high as these previous crises but instead to stay relatively high for significantly longer. The situation this time round has been effectively longer, and considerable support from governments and central banks potentially keeping sinking ships afloat despite the inevitable sink.

Our expectations are based on five points:

- The global economy is set to rebound, but sectoral vulnerability remains

- Expected widening of spreads from these overpriced levels

- Rates are set to rise and continue to rise

- A growing pool of leverage and deteriorating leverage metrics

- Continued downgrades, more fallen angels

Global economy set to rebound, but sectoral vulnerability remains

The pandemic has battered the global economy over the course of 2020. With vaccination efforts picking up, a widespread economic recovery is in the making for 2021. The recovery has so far been uneven, though with parts of Asia already seeing GDP well above pre-crisis levels, the US set to reach that level this quarter. The eurozone and UK are not expected to do so before 2022. Especially in Europe, expectations of growth remain relatively modest as fiscal support will not be as strong as it has been in the US. In fact, many countries are set to reduce fiscal deficits over the course of the recovery.

Even in Europe, some parts of the economy are already recovering; think of durable goods production, for example. But others are lagging as some sectors remain closed or are operating at very low levels of activity for months already. This increases the risk of an unbalanced recovery, with some sectors coming out strong while others remain vulnerable for quite some time. While the economy is embarking on a rebound of output, government support withdrawal happening too quickly remains a downside risk for the outlook.

The longer-term impact of the pandemic remains uncertain. The IMF remains rather optimistic for advanced markets with limited permanent damage factored into their outlooks, but sectoral impacts can widely differ. The largest sectoral impact can be expected around trends that were already happening before the crisis, think of growing numbers in online shopping or remote working. The pandemic will have speed up those trends, although it is still hard to determine the precise impact once economies reopen again.

We are careful in expecting a radical change in consumer behaviour that is sometimes predicated on the back of the pandemic.

Expected widening of spreads from these overpriced levels

We expect a widening of spreads at some point in the coming months, and already we've seen limited mutual fund inflows.

Tapering discussions will begin, and we may see a slow down in quantitative easing coming into 2022. Yields are still at historically low levels and are expected to rise, meaning we can also expect higher underlying rates. This will spur changes in the investment environment, changes in the funding environment and most importantly, spur changes in the debt servicing costs as funding yields rise.

On the back of the substantial QE, spreads are currently looking cosmetically tight. With the ongoing uncertainties surrounding vaccines, the largely negative rating migrations and deteriorating fundamentals, we feel spreads are too overpriced.

The chart below shows the theoretical compensation for these spreads based on loss given default calculations assuming a 40% recovery rate (i.e. how high should credit spreads be to compensate for certain cumulative or annual default rate).

EUR spreads & implied default rates

Using the Euro high yield index with a current spread of 280 basis points, the 1-year implied default rate amounts to just 5.4%, with a 5-year default rate of 22%.

Similarly, with the USD high yield index with a spread of 307bp, the 1-year implied default rate reaches over 5.9%, while the 5-year suggested default rate is 24%. This is indeed close to what S&P is pencilling in for their 12-month trailing default rate but below what Moody’s have pencilled in.

Furthermore, most recent CDS auctions have been using recovery rates of 30%, this further drives down the implied default rates. Therefore, it is clear spreads are currently over-priced.

Rates are set to rise and continue to rise

Markets at the moment are underestimating rates; our rates strategists forecast for a rise in rates over the coming two years.

They expect the Bund to hit 0% by the end of this year and further rise up to 0.15% by the end of 2022, and reach 0.5% in 2023. The US 10-year Treasury is expected to rise above 2% and end the year closer to 2.25%. Further increasing from there up to 2.75% by the end of 2022, and hitting 3% in 2023.

Naturally, this adds a higher interest cost, particularly for the speculative-grade universe. This will, in turn, limit opportunities for high yield names to finance themselves. Combined with the growing underlying pressure of leverage metrics, it will add stress onto already struggling corporates. Moreover, as rates rise over a longer time, spreads should stay more elevated for the coming years.

The average cost for a Euro speculative-grade corporate to finance themselves at the moment is just over 3%, using a single B rated index as a proxy. In contrast, U.S. speculative-grade corporates finance themselves at just over 4%. These current levels are historically very low, and as rates rise, the cost of financing could rise back up closer to the 20 year average of above 8% for both Euro and USD.

EUR & USD Single B rated debt Yields

Growing pool of leverage and deteriorating leverage metrics

Deteriorating leverage metrics have been a growing theme over the past number of years.

According to Moody's, 2020 pencilled in an increase of net debt to EBITDA up to nearly six times. In fact, these numbers were already reflecting high leverage pre-pandemic as there has been increasing net debt to EBITDA numbers for the past four years. Similarly, the FCF/Debt ratio has increased from roughly 2% in 2019 up to roughly 4.5% in 2020. This was also seen in 2008 when the FCF/Debt ratio reached up to 6%, which then remained above 2% until 2011.

Similarly in the U.S, Net debt to EBITDA numbers have risen significantly even pre-covid crisis. According to S&P, Net Debt to EBITDA has risen from just 3.9 times in 2010 up to 5.2 times in 2018 and 2019. Initially, in 2020 on the back of the pandemic, net debt to EBITDA fell for new issues as investor risk aversion escalated. However, this rebounded towards the end of 2020, increasing back up to 5.2 times.

U.S. Net Debt to EBITDA for new issued debt

Moody’s Loan covenant quality indicator assesses the quality of covenants within loans. The quality of loan covenants are falling considerably, and this is a worrying trend in the loan market as it offers little protection to investors and issuers. As illustrated below, the loan covenant quality indicator in the US has been falling over the past eight years.

For some time now, the indicator has been below the weak level protection threshold, which in itself is concerning. However, in 4Q19, we were already approaching the lowest level protection threshold, making us more cautious on the loan markets.

Deteriorating Covenant Quality

More fallen angels than rising stars

For 2020, we have seen consistent downgrades and fallen angels (downgraded from investment grade to high yield). But so far, in 2021, we have seen further downgrades, but there have also been a few upgrades alongside that.

Naturally, after such a negative span of downgrades, a certain level of upgrades can be expected as ratings are corrected. However, unlike the consensus, we do not expect any considerable rising stars this year (upgrades from high yield to investment grade). In fact, we expect to see more fallen angels over the coming months. Particularly as the amount of companies with a negative outlook is still substantially larger than before the crisis, according to Moody’s data.

Furthermore, the vast majority of these downgrades have already been happening in the high yield space.

European Default rates

Moody’s Forecast

According to Moody’s, their 12-month trailing default rate is currently standing at 4.7%, down slightly from 5.1% at the end of November. Their base case scenario forecast a year-end default rate of 2.5%, although this is set to increase back to 2.8% by the end of February 2022. This scenario is based on their expectation for vaccines to be widely distributed to the public by mid-year and for fiscal and monetary policy to remain steady for 2021. Moody’s pessimistic scenario includes more lockdowns as the pandemic is prolonged. Additionally, fiscal and monetary policy support lessens as well as trade tensions and geopolitical instability. Under this scenario, they forecast default rates to hit 7% by the end of the year and 8.3% by the end of February 2022. Moody’s optimistic scenario indicates a default rate at 1.9%, rising slightly up to 2.1% by the end of February 2022 based on a quicker than expected recovery.

S&P Forecast

S&P pencilled in a 12-month trailing default rate of 5.3% as of the end of 2020. In their base case scenario, the eurozone economy rebounds in 2021 to 4.8% growth, and default rates increase to 6.5% by the end of 2021. This scenario takes into account ongoing lockdowns and substantial support from central banks and governments. In their pessimistic scenario, they forecast default rates to reach 9% by year-end if lockdowns are extended and a slower rollout of vaccines. The optimistic scenario for S&P includes substantial PEPP support and falling yields to encourage investors down the rating spectrum in search for yield, ultimately supporting weaker issuers and opening up possibilities to finance. In such a scenario, default rates would decrease to 3% by the year-end.

Our Forecast

Our European default rate forecast is more in line with S&P, where we expect default rates to continue to rise. We expect defaults rates to stay high for significantly longer. We forecast defaults rates to remain around the range of 6%-8% over the coming two years.

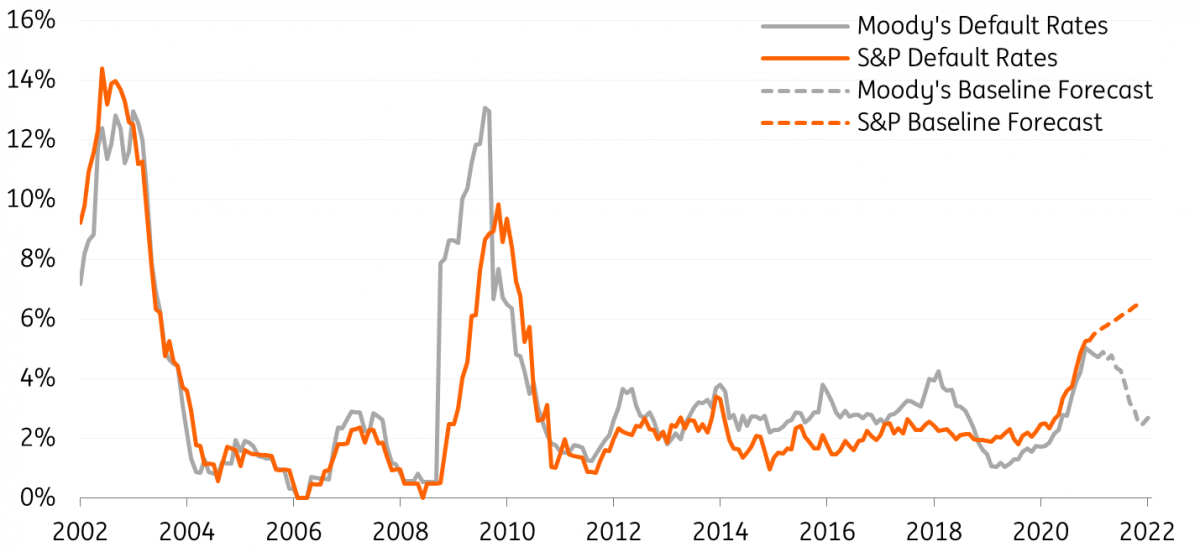

U.S default rates

Moody’s Forecast

The U.S. 12-month default rate is currently sitting at 7.9%, according to Moody's. Under their base case scenario, they forecast default rates to drop to just 4.6% by December 2021 and then jump back to 4.9% by February 2022. The pessimistic scenario for Moody’s involves a sharp increase to 12.6% by the year-end and continuing up to 14.6% by the end of February next year. Moody’s optimistic scenario entails a strong recovery leading to a default rate forecast of just 2% for the year-end and maintaining around the 2% area for the initial months of 2022.

S&P Forecast

According to S&P, at the end of 2020, their 12-month trailing default rates amounted to 6.6% for U.S. speculative-grade. Under their base case scenario, they forecast default rates to increase slightly up to 7% by the end of 2021. This is based on expected economic growth and slowing downgrades. However, S&P also outline the weakness in the speculative-grade universe. In their pessimistic scenario, if infection rates rise or a gradual unwinding of fiscal and monetary policy, they forecast default rates to reach up to 9.5% by the end of 2021. The S&P optimistic scenario has a default rate forecast of 3% by the end of this year. This largely reflects what market signals are implying about future default activity, as vaccines are rolled out and new rounds of fiscal stimulus.

Our Forecast

Our U.S. default rate forecast is in line with S&P, where we expect defaults to rise to at least 8% by the end of the year. However, in Europe, we also expect defaults to stay high for longer, likely within the range of 7%-9% for the coming two years.

We expect default rates to rise slightly from here, but we also expect default rates to stay elevated for a prolonged period.

Under the basis of our economic outlook, spreads are looking too rich as we expect widening, a continuation of downgrades and fallen angels and the growing pool of leverage with worsening leverage metrics.

For Europe, our expectation is more in line with S&P. While in the U.S. S&P also initially expects a rise, they also forecast a quick turnaround lower before the year-end.

Download

Download articleThis publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more