Czech Republic: Consumer confidence hits record high

Consumer confidence reached a new high in January due to favourable labour market conditions

Consumer sentiment remains strong

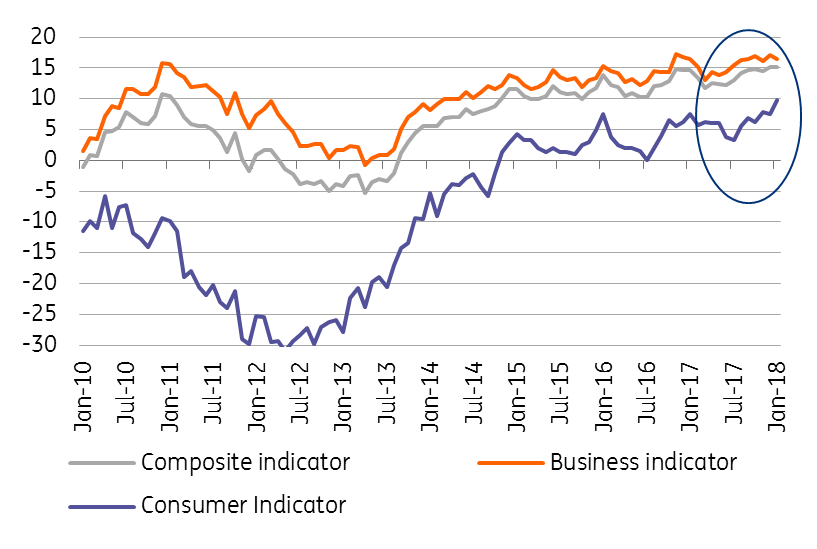

The Czech economy is entering 2018 in an optimistic mood. Consumer confidence increased further in January, reaching its highest level in history. Czech households are more confident about the economy and their own personal finances in the year ahead, they are not concerned with an increase in unemployment, and plan to save more. All these measures of consumer sentiment reached the highest, or one-of-the highest levels in history, bringing total consumer confidence to a new high at the beginning of the year.

Driven by very tight labour market

This optimism has been driven by very favourable conditions in the labour market, i.e. the historically-low unemployment rate accompanied by the highest number of job vacancies, which has led to a pick up in wages. According to Wednesday's survey, almost a third of industrial companies cite the lack of staff as the most important barrier to the growth. In fact, the labour market has become the most important barrier to the growth overall.

Confidence Indicators (seasonaly adjusted, points)

Business confidence is also favourable, but has not yet reached pre-crisis levels

Business confidence has also been gradually improving in recent years, though the average level of optimism has not yet reached the pre-crisis level of 2006-2008. Despite slightly weaker confidence in industry in January-- driven by weaker production expectations for the next 3 months-- confidence in all business segments was above its one-year average this month. As such, confidence in the business sector is the highest in ten years. Capacity utilisation in the manufacturing sector reached 86%, the strongest figure since the end of 2008 and above the long-term average of 83%.

The Czech National Bank will tighten monetary policy next week

Confidence indicators suggest the Czech economy is entering 2018 in a buoyant mood. Although economic growth will slightly decelerate this year, there is still room for further monetary tightening. Today's figures are the last before the CNB's monetary policy meeting and they clearly indicate that the bank should take action. As such, another hike next week is a done deal, in our view.

"THINK Outside" is a collection of specially commissioned content from third-party sources, such as economic think-tanks and academic institutions, that ING deems reliable and from non-research departments within ING. ING Bank N.V. ("ING") uses these sources to expand the range of opinions you can find on the THINK website. Some of these sources are not the property of or managed by ING, and therefore ING cannot always guarantee the correctness, completeness, actuality and quality of such sources, nor the availability at any given time of the data and information provided, and ING cannot accept any liability in this respect, insofar as this is permissible pursuant to the applicable laws and regulations.

This publication does not necessarily reflect the ING house view. This publication has been prepared solely for information purposes without regard to any particular user's investment objectives, financial situation, or means. The information in the publication is not an investment recommendation and it is not investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Reasonable care has been taken to ensure that this publication is not untrue or misleading when published, but ING does not represent that it is accurate or complete. ING does not accept any liability for any direct, indirect or consequential loss arising from any use of this publication. Unless otherwise stated, any views, forecasts, or estimates are solely those of the author(s), as of the date of the publication and are subject to change without notice.

The distribution of this publication may be restricted by law or regulation in different jurisdictions and persons into whose possession this publication comes should inform themselves about, and observe, such restrictions.

Copyright and database rights protection exists in this report and it may not be reproduced, distributed or published by any person for any purpose without the prior express consent of ING. All rights are reserved.

ING Bank N.V. is authorised by the Dutch Central Bank and supervised by the European Central Bank (ECB), the Dutch Central Bank (DNB) and the Dutch Authority for the Financial Markets (AFM). ING Bank N.V. is incorporated in the Netherlands (Trade Register no. 33031431 Amsterdam).