Copper: What happened to the funds?

A slower recovery from the Chinese new year and escalating trade tensions has flushed out speculative length in the copper markets so that funds are now majorly short. After being the bears in the room for sometime, we now think this is a bullish indicator with markets looking oversold

Money Manager Positioning

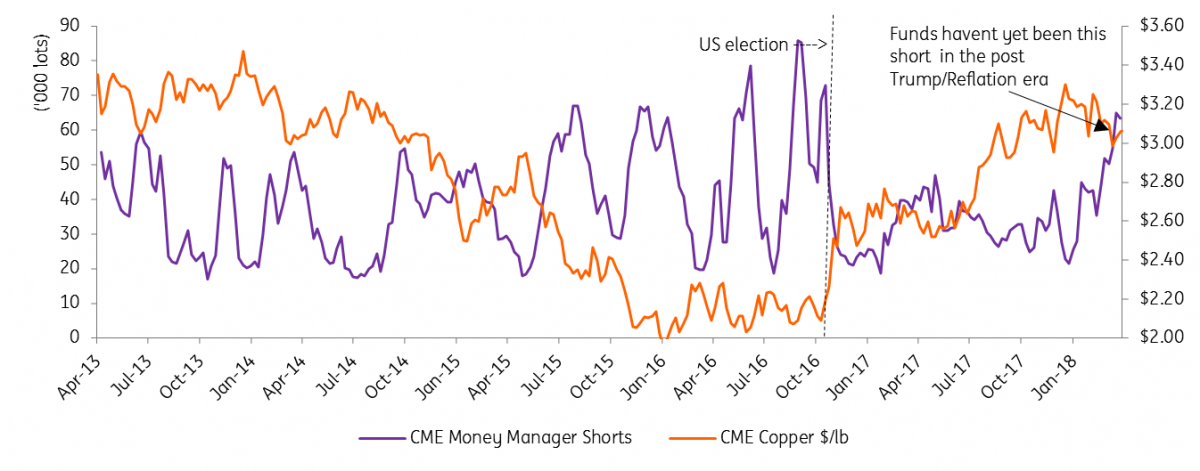

CFTC data shows that as of Tuesday, CME managed money short copper positions remained at highs not seen since before the US election in 2016. Combined with an exodus of long bets the money manager community is also almost net neutral copper for the first time since reflation became the market buzz word. Whilst on one hand the positioning reflects a lack of conviction in at least the near term prices it is a supportive sign that the market has been oversold, with more likelihood of short covering. Indeed Comex open interest has dropped 4% since then suggesting covering drove prices back to the US$6,800 levels.

On Shanghai the story is similar, open interest is up 15% year-to-date hitting highs not seen since 2014. With prices down 9% the building of short positions is again the likely driver. Some light covering has reduced the open interest by just 3% since prices bottomed, but as with Comex the positioning still looks stretched to the short side and prime for rallies to escalate higher should shorts be forced to cover.

In short, the combination of trade tensions and a slow rebound from Chinese new year (escalated by the national party congress) has flushed out much of the speculative length in markets. Whilst we previously called for downside on successful mine negotiations the positioning reports suggest the risk of large liquidations has largely passed. As fundamentals improve, and should trade tensions mitigate, copper is well positioned for a recovery.

Funds have biggest short on Comex since Trump election

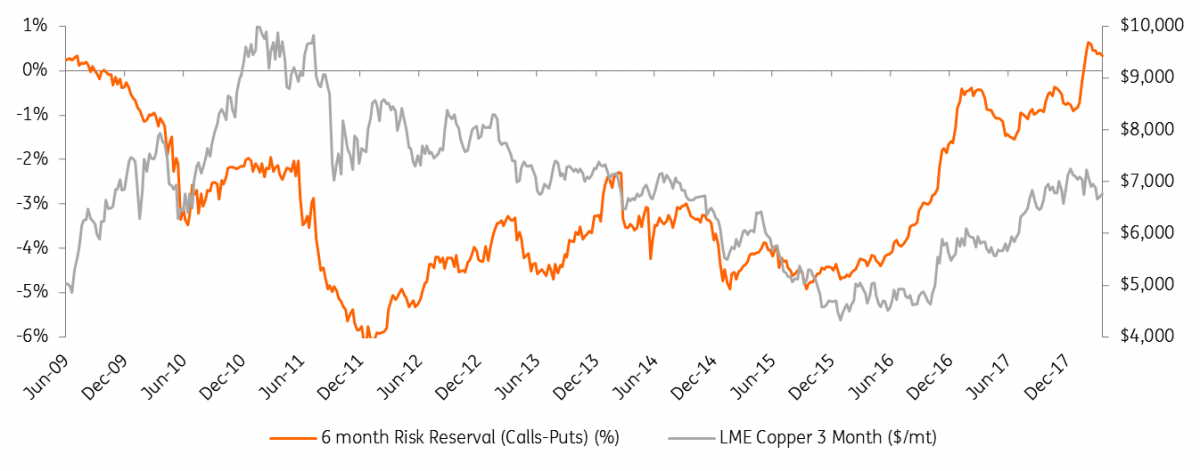

Options pricing record upside demand

Uncertain macro tensions have rattled the copper bull case, whilst a wide contango makes it costly for a fund to hold longs in the market. But with fairly binary opportunities for pricing break higher (eg, large supply disruptions like Escondida, China’s scrap restrictions), and supply tightness being lagged in the upstream rather than downstream markets, it is perhaps unsurprising that playing the bullish view on copper has shifted from futures into options.

Taking 6 months forward, (25 delta) calls have been priced at high premiums to puts since Febuary when prices first breached below US$7,000. At a 0.34% spread this reflects the highest demand bias to upside protection in at least 9 years. The skew to the upside goes out as far as January-19 compared to only March-18 at the beginning of the year.

Options risk reversal shows record premium for calls (6 months forward, %)

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Tags

CopperDownload

Download article