China: Strongly against a trade war

The US's changing stance towards China is a reflection of its concern about the rise of China. If the US continues its hostility towards “Made in China 2025”, future trade negotiations could look rather futile

Trade talks could be futile if the US continues to impose tariffs and sanctions on China

China has become increasingly irritated by a US administration that keeps changing its mind on tariffs. Results from previous negotiations have been taken off the table until the US cancels it’s planned tariffs on China. Media reports suggest that the US could announce its tariff plan by mid-June.

If the US follows through with its plan to announce sanctions on high-tech Chinese goods and related businesses before the end of June, it's also likely that China will take a similar approach to US businesses operating in China.

Clearly then, June looks set to be a tense, rollercoaster month for China-US trade and investment.

China to continue to open up its market even if China-US trade talks yield no result

Meanwhile, China has made repeated statements that it plans to further open up its markets to the rest of the world – especially for consumer goods, clean energy and high-tech products. But if the US imposes tariffs on Chinese goods, China will do the same for US goods. That implies that the opening up of the Chinese market would benefit every other economy, except the US.

A divide and conquer strategy

Take China's tariff cut on automobiles as an example. The policy benefits all automobile manufacturers from European brands to Japanese and Korean producers. However, US manufacturers won't gain unless the US lifts tariffs on Chinese imports of steel and aluminium.

Of course, tariffs on automobiles may not hurt the US to a great extent given that it doesn't export cars in large numbers. But if the opening up of markets includes agricultural products and energy- and if the US insists on imposing tariffs on Chinese goods- US companies would be worse off from the tariff cuts by China on these goods.

The opportunities brought about by China’s liberalisation would most likely be felt by so-called ‘Belt and Road’ countries in relation to energy, and by Europe/Asia for agricultural products. These countries can enter into the Chinese market without facing competition from US companies. Empty trade talks would effectively mean the US is shutting itself out of the business, while at the same time, the rest of the world would have stronger trade ties with China.

US worries about the rise of China

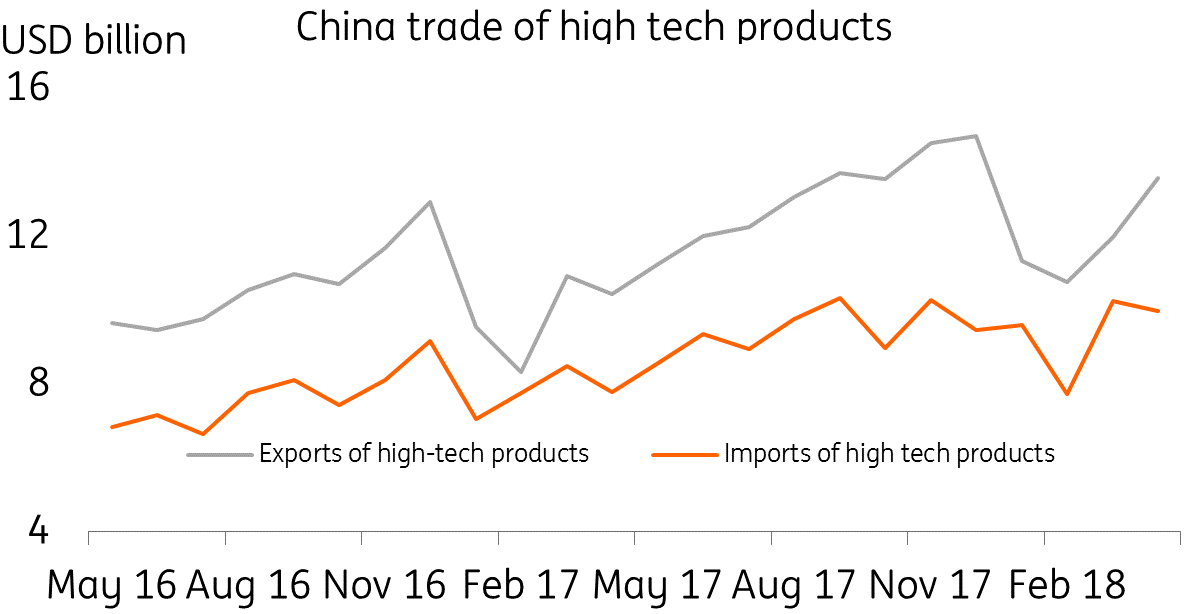

As we pointed out in previous notes, the US isn't just targeting a narrowing in the bilateral trade deficit. It also feels that its status as the world's biggest and most high-tech economy in the world is under threat from China's "Made in China 2025" plan.

We believe that the US is working hard to delay China's economic advancement, especially in sectors related to the high-tech industry. Therefore the chances of the US allowing more exports of technological-related goods and services to China is fairly low, even if this would help lower the trade deficit.

In this case, we think China would put more effort into achieving its self-sustained high-tech target by investing more in targeted industries. The biggest tech companies in China echo Xi Jinping's aim to be self-sustained in high-tech sectors. We expect that investment in these sectors will be one of the key drivers of future Chinese growth. Our forecast of 6.8% GDP growth still holds, on the basis that this investment will offset the loss of activity from deleveraging reform and any loss of trade.

China-US bilateral trade deficit could be closed by US exporting high tech goods to China, but that will not happen

Our forecast

For 2Q18, we also keep our forecast for 6.8% YoY GDP growth, helped by decent consumption and investment, as indicated by good PMI numbers and industrial profits.

We have also revised our yuan forecast due to the stronger dollar created by recent trade tensions and uncertainty in Europe.

Download

Download article

11 June 2018

Good MornING Asia - 11 June, 2018 This bundle contains {bundle_entries}{/bundle_entries} articles"THINK Outside" is a collection of specially commissioned content from third-party sources, such as economic think-tanks and academic institutions, that ING deems reliable and from non-research departments within ING. ING Bank N.V. ("ING") uses these sources to expand the range of opinions you can find on the THINK website. Some of these sources are not the property of or managed by ING, and therefore ING cannot always guarantee the correctness, completeness, actuality and quality of such sources, nor the availability at any given time of the data and information provided, and ING cannot accept any liability in this respect, insofar as this is permissible pursuant to the applicable laws and regulations.

This publication does not necessarily reflect the ING house view. This publication has been prepared solely for information purposes without regard to any particular user's investment objectives, financial situation, or means. The information in the publication is not an investment recommendation and it is not investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Reasonable care has been taken to ensure that this publication is not untrue or misleading when published, but ING does not represent that it is accurate or complete. ING does not accept any liability for any direct, indirect or consequential loss arising from any use of this publication. Unless otherwise stated, any views, forecasts, or estimates are solely those of the author(s), as of the date of the publication and are subject to change without notice.

The distribution of this publication may be restricted by law or regulation in different jurisdictions and persons into whose possession this publication comes should inform themselves about, and observe, such restrictions.

Copyright and database rights protection exists in this report and it may not be reproduced, distributed or published by any person for any purpose without the prior express consent of ING. All rights are reserved.

ING Bank N.V. is authorised by the Dutch Central Bank and supervised by the European Central Bank (ECB), the Dutch Central Bank (DNB) and the Dutch Authority for the Financial Markets (AFM). ING Bank N.V. is incorporated in the Netherlands (Trade Register no. 33031431 Amsterdam).