Carney cools GBP optimism

The August meeting was a dovish disappointment, which means sterling will remain under near-term pressure

BoE's message to markets: Brace yourselves, winter is coming

In keeping with our Game of Thrones preview, the takeaway for markets from the August Bank of England ‘Super Thursday’ meeting was “brace yourselves; winter is coming”.

The slightly more cautious growth projections, the dichotomy of Monetary Policy Committee views and a lack of coherent policy bias means the bar for a 2017 policy move remain pretty high. For us, a credible BoE rate hike debate remains more of a 2018 story.

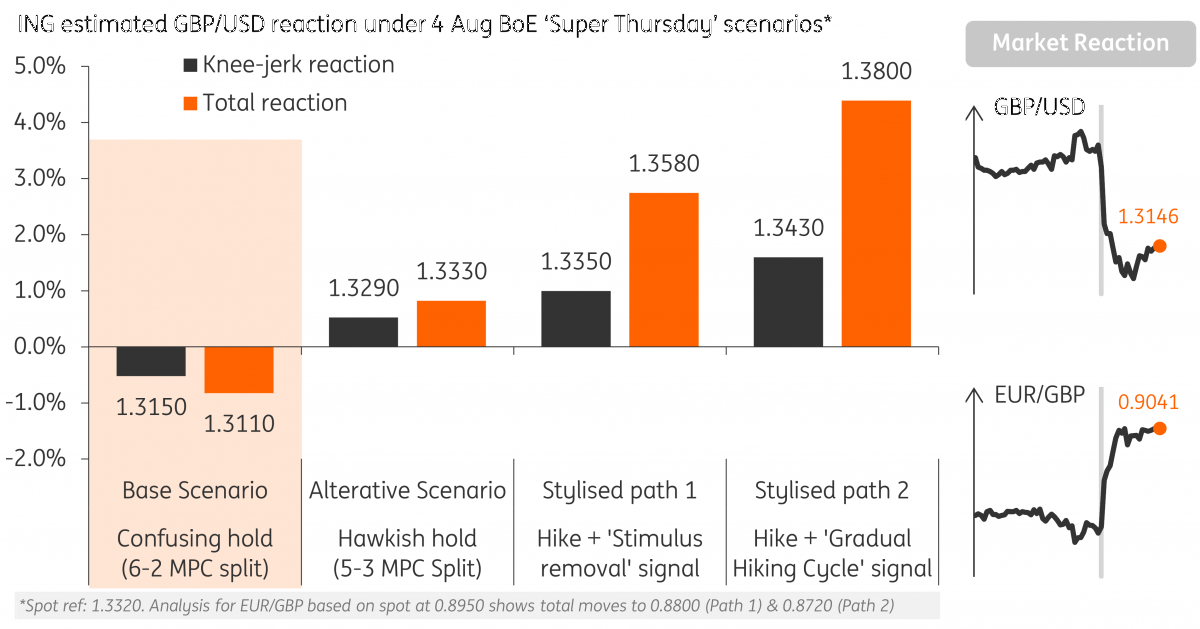

The 6-2 MPC split vote, with no new rate hike dissenters can be seen as a dovish disappointment, with some corners of the market hoping for greater hawkish gestures from the Bank of England. While the immediate fallout for the pound should be contained given the limited scope for the UK rate curve to flatten further, we see near-term downside risks. The BoE's patient policy approach means GBP can be placed amongst currencies vulnerable to being sold under the theme of monetary policy divergence.

- We expect EUR/GBP now to overshoot our 0.90 forecast for 3Q17 and stay above there. Unlike previous times when we have reached this level, particularly during crisis episodes -there are now fundamental reasons for it to remain at these elevated levels for a sustained period.

- Given that GBP/USD has been riding on the coattails of a rising EUR, we look for a recovery in the politically-charged USD and easing of the EUR euphoria to weigh on GBP/USD. In the near term, this points to downside risks to below 1.30, although we remain comfortable with our 1.35 year-end forecast.

Market expectations for BoE tightening changed little

Taking stock of the four key policy signals

-

MPC vote-split

The 6-2 MPC vote split was a dovish disappointment.So, a rate hike later this year looks a tall order and the 35% probability of a November rate hike priced into the UK curve looks fair at this stage, although we do see downside risks. Fading hawkish BoE expectations means the knee-jerk move lower in GBP that we’ve seen is fully justified in our view. -

Tolerance for above-target inflation

With Governor Carney noting that the sole cause for above-target inflation is GBP-related and therefore transitory, we think the leniency for high inflation is a dovish development. Also, the structurally weak GBP is unlikely to have any adverse consequences for inflation expectations - which we note has remained stable, if not declined, in recent months - also suggests a slightly greater tolerance for above-target inflation in the near-term. -

Inflation report projections and key judgements

The reduced confidence in underlying inflation pressures can be seen in the downward revision to the Bank's 2018/19 wage growth forecasts. Equally, the 2017 GDP growth estimate was nudged lower to 1.7% - though our economists still see this as being on the slightly optimistic side. While we acknowledge that GBP has adjusted to the recent slowdown in the UK economy, the Bank's more cautious forecast revisions today have provided a bit of a dovish reality check. -

Emerging consensus over near-term policy bias

We weren't holding our breath on a clear (hawkish) message from the MPC and the minutes continue to show a divergence of views and outlooks. This policy confusion is unlikely to inspire any meaningful GBP upside - even if the more hawkish MPC members continue to make a case for a near-term hike. At best, we think the discussion around a BoE rate hike will serve as putting a floor on short-term UK rates - but nothing more.

Overall, we view GBP's fallout from the August 'Super Thursday' meeting as entirely justified and continue to see near-term downside risks. While markets may have recently got caught up in the wave of hawkish BoE euphoria, we doubt the short-term outlook here is likely to change for the good - especially until we see more progressive steps towards a transitional deal.

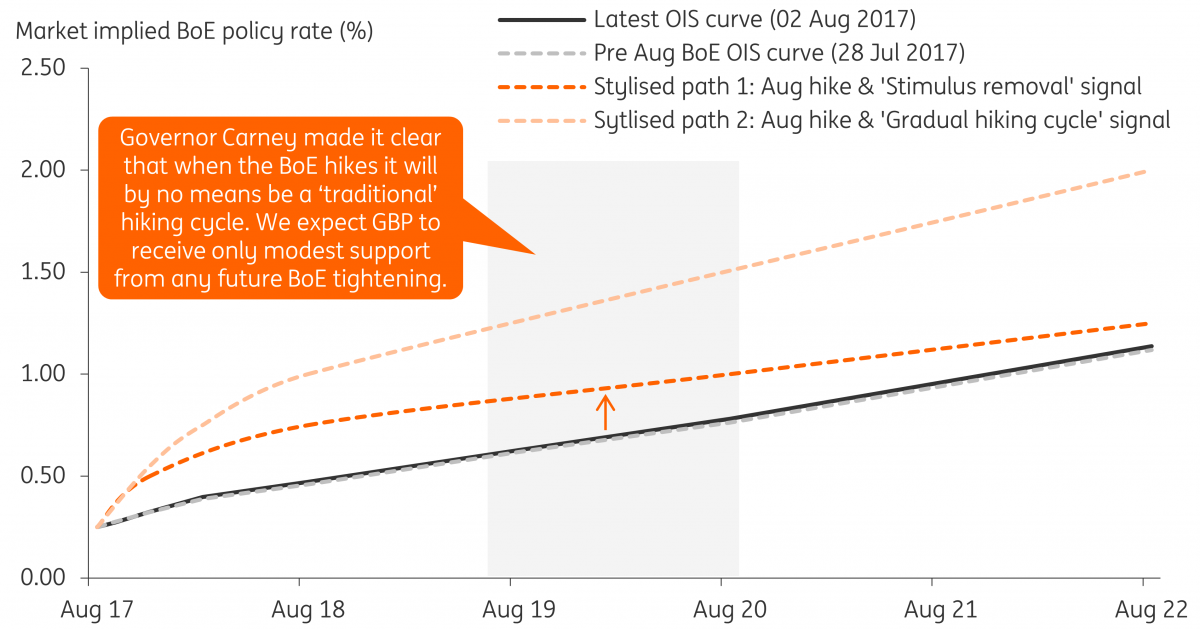

The discussion around lower trend growth in the UK in the post-meeting news conference underpins why we think GBP will remain lower for longer. Governor Carney has told us whenever the Bank does raise interest rates, it will by no means be a 'traditional' hiking cycle and we continue to expect GBP to receive only modest support from any future BoE tightening.

GBP fallout after a confusing BoE hold justified

Download

Download article"THINK Outside" is a collection of specially commissioned content from third-party sources, such as economic think-tanks and academic institutions, that ING deems reliable and from non-research departments within ING. ING Bank N.V. ("ING") uses these sources to expand the range of opinions you can find on the THINK website. Some of these sources are not the property of or managed by ING, and therefore ING cannot always guarantee the correctness, completeness, actuality and quality of such sources, nor the availability at any given time of the data and information provided, and ING cannot accept any liability in this respect, insofar as this is permissible pursuant to the applicable laws and regulations.

This publication does not necessarily reflect the ING house view. This publication has been prepared solely for information purposes without regard to any particular user's investment objectives, financial situation, or means. The information in the publication is not an investment recommendation and it is not investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Reasonable care has been taken to ensure that this publication is not untrue or misleading when published, but ING does not represent that it is accurate or complete. ING does not accept any liability for any direct, indirect or consequential loss arising from any use of this publication. Unless otherwise stated, any views, forecasts, or estimates are solely those of the author(s), as of the date of the publication and are subject to change without notice.

The distribution of this publication may be restricted by law or regulation in different jurisdictions and persons into whose possession this publication comes should inform themselves about, and observe, such restrictions.

Copyright and database rights protection exists in this report and it may not be reproduced, distributed or published by any person for any purpose without the prior express consent of ING. All rights are reserved.

ING Bank N.V. is authorised by the Dutch Central Bank and supervised by the European Central Bank (ECB), the Dutch Central Bank (DNB) and the Dutch Authority for the Financial Markets (AFM). ING Bank N.V. is incorporated in the Netherlands (Trade Register no. 33031431 Amsterdam).