Car Market Outlook 2023: Seeing is believing

We expect that global car sales will rise by approximately 4% in 2023 despite a downbeat outlook for the global economy. This is due to more consistent production volumes, the delayed demand backlog and positive growth expectations for China

Growth expected to defy macro backdrop

We expect that global car sales will rise this year despite a downbeat outlook for the global economy. This may sound like a contradiction but a combination of the more consistent production volumes, delayed demand from the accumulated order books and some more positive economic momentum in certain regions, such as China, should result in an improvement in passenger car sales on the order of 4% in 2023. Looking beyond the current year, we also expect growth to be in the 4% to 5% range in 2024.

Low comparative base flatters the outlook

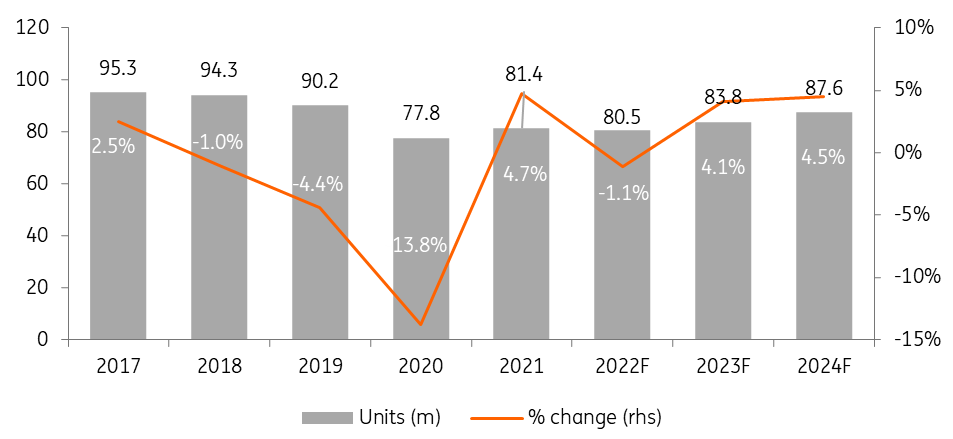

As we have documented in our previous market updates over the past two years, the initial recovery from a sharp drop caused by the emergence of Covid-19, was slowed down and then interrupted by various logistical headwinds, most prominently but not solely due to the shortage of specific semiconductors. While we are off the lows seen in 2020, last year’s global passenger car sales volumes measured in new registrations have likely ended up some 10-15% below the pre-pandemic peak of 2018-2019. Currently, as the numbers for the last year are being finalised and released, we expect that the FY22 passenger car sales ended up at approximately 80.5mn vehicles, down 1.1% year-on-year, broadly in line with our expectations updated mid-way through last year.

Uneven performance across the year and the top markets in 2022

In 2022, car sales trends were uneven across the top markets and across the year. In terms of the key geographies, China ended the year in positive territory, helped by government tax incentives, despite the continued strict Covid-19 policies. Conversely, the US market fared the worst year-on-year, with the sales number likely ending up in the sub-14mn territory, implying a decline of 7-8% over 2022. In Europe, Germany was an outperformer among the largest markets, achieving small growth of approximately 1% year-on-year in FY22, according to VDA, the German Association of Automotive Industry. German sales were buoyed towards the end of the year by the upcoming expiry or reduction of some of the electrified vehicle tax incentives. Other large European markets ended the year in negative territory to varying degrees. Elsewhere, India was a strong performer for the second year in a row with improved vehicle availability and robust demand while in Japan, new car sales dropped by 5.6% year-on-year in 2022, according to the Japan Automobile Dealers Association and the Japan Light Motor Vehicle and Motorcycle Association.

Positive dynamic across the top three regions expected in 2023

We currently expect modest single-digit growth of 3-5% across the three largest passenger car markets, including China, the US and Europe. We expect China’s demand to be supported by the removal of zero-Covid policies while sales in the US and Europe should reflect the accumulated delayed demand and order books, as production volumes improve with the semiconductor supply bottlenecks finally clearing up and delivery times gradually improving. Having said that, with 2023 already underway, we recognise that the shortages have not completely disappeared yet and are more impactful for some car manufacturers than others.

Global light vehicle unit sales

Demand weakness probably key risk for our current outlook

We have become used to various unexpected factors transpiring over the past three years from the emergence of Covid-19, to semiconductor supply shortages, to Russia’s invasion of Ukraine. We accept that further surprises are possible in 2023. One headwind which is currently well articulated is the weak economic outlook coupled with higher interest rates and elevated consumer inflation across leading Western economies. Therefore, we believe that a weakening in consumer demand due to the economic pressures on households is probably the highest risk factor for our passenger car sales expectations, in particular, in the latter part of the year when backlogs shrink. However, we also feel that at the moment, this risk is mitigated by the aforementioned delayed demand and existing order books as well as the relatively old age of the passenger car fleet in some geographies, such as in Europe.

Production and sales volumes to grow more in synch this year

After several years of production lagging behind sales volumes, last year was potentially the first one where the picture was more balanced. We expect this trend to continue in 2023, with similar volumes and rates of growth across both sales and production, hopefully with some positive balance in favour of the latter in order to rebuild some inventories.

Profitability likely to be more pressured than during the past two years

We have noted previously that leading car manufacturers have indeed expanded their profitability and margins during the past two years, despite pressures on their production volumes. At this point, we believe that the risks will be more to the downside this year with various pressures emanating from the more balanced supply and demand picture, continued cost inflation and potentially, more price-sensitive consumer demand. We note that the car manufacturers will not stand still and will aim to counter these pressures with cost savings and continued prioritisation of production of the more profitable models. However, on balance, we would expect that the room for manoeuvre will be smaller this year.

Auto parts manufacturers still on the receiving end but may have some partial respite

As before, we believe that auto parts manufacturers continue to be exposed to the same problems experienced by car manufacturers in 2023. However, insofar as production volumes grow, this should provide some protection against potential risks with certain material prices expected to be lower year-on-year and others mitigated via the contractual or, at times, voluntary pass-through mechanisms.

Global electric car fleet continues to expand

There’s little doubt now that the future of cars is electric. In early 2022, the global EV fleet (battery electric: BEV + plug-in hybrid electric: PHEV) had an estimated size of 16 million cars (just over 1% of the total vehicle fleet). In FY 2022 only, over 10 million new EVs were registered. This strong inflow of new EVs will continue in 2023. Countries and almost all major car brands have made pledges to phase out ICE vehicles in new sales, generally targeting 2030 to 2035 in Europe. For car makers, the transition - and its pace - is a tremendous strategic challenge including the restructuring of organisations as well as the overhaul of product portfolios and production locations. Toyota is the only large brand left focusing on multiple solutions, but it is also seeking to catch up.

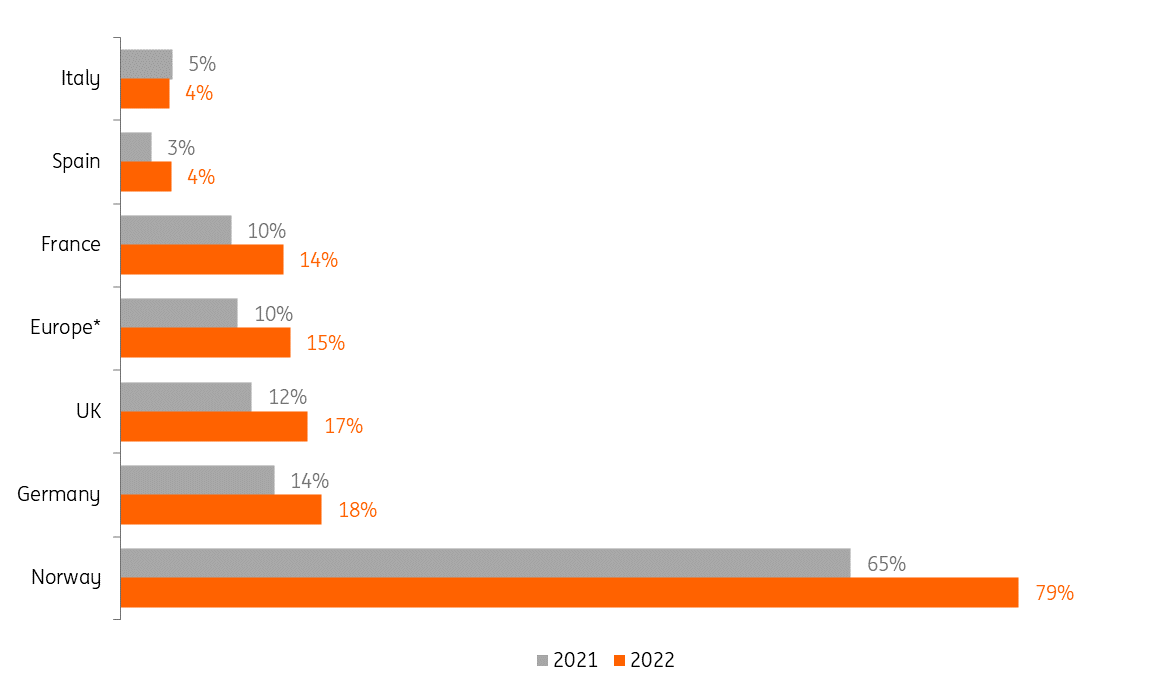

Europe’s largest car market approaches full electric penetration of 20%

Europe adopted the most ambitious regulatory push for BEVs. The largest European car market, Germany, reached a full electric share of 18% in 2022 followed by the UK (17%) and France (14%) ( second and third largest markets). When including PHEVs, Germany exceeded the milestone of a 30% electric share in new car registrations in 2022. Among the large European car markets, Italy surprisingly lags in electrification with a market penetration of only 4%. In contrast to other countries, the BEV share even slipped in 2022.

Europe's largest car market Germany reached a full electric share of 18% in 2022 - EVs failed to make progress in Italy

Full electric vehicles (BEV) as a percentage of total new car registrations in Europe’s largest car markets + Norway.

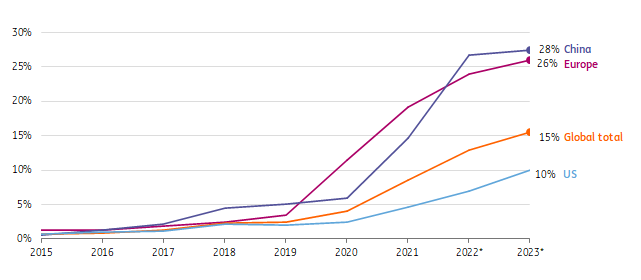

EV progression slows in China and Europe – US is catching up

Global joint new registrations of e-cars (BEV+PHEV) reached an estimated level of 13% of total new sales in 2022. We expect this share to increase to 15% in 2023. Pushed by the phase-out of subsidies and ‘front loading’, EV sales soared in China in 2022. China is already the world’s largest EV market with 6.5 million new BEVs and PHEVs in 2022, taking the global lead from Europe in electrification. However, the termination of direct cash subsidies (only 5% tax exemption remains) is expected to significantly slow the growth of the EV share in new sales. In 2023, we expect 28 out of every 100 new cars to be electric in China. Several European countries including Norway, Sweden, Germany, The Netherlands, and the UK are also adjusting their fiscal support for electric vehicles, which pushes Europe onto a weaker growth path as well. The US - on the other hand – is now catching up more quickly on the back of a maximum $7,500 credit. One out of every 10 new cars and light trucks in the world's second-largest car market is expected to be (plug-in hybrid) electric in 2023.

Expansion of EV shares in China and Europe slows as phase out of support begins

% of electric vehicles (BEV + PHEV) in total new car registrations per region

EV stimulus still relevant as price parity is delayed

Due to supply constraints caused by underinvestment and the war in Ukraine, estimated battery prices have increased for the first time to just over $150 per kWh (BNEF). This is comparable to 2020 levels. Given persistently higher battery metal prices as well as looming shortages, the downward trend is unlikely to pick up this year. This means price parity with conventional cars will be delayed and fiscal support is still needed for mainstream drivers, even though more affordable models are being introduced. This collides with the reduction of government support in the earlier-mentioned countries. In Europe especially, higher charging costs also add to costs as a growing number of potential EV drivers do not have the opportunity to charge at home.

From a corporate angle in Europe, though, we can expect an even stronger push for EVs in 2023 as businesses need to report emissions and seek to speed up the decarbonisation of their car fleets. Some countries are even considering mandatory electric cars for corporate car leasing after 2025. Production will continue to have an influence on EV sales as well. Semiconductor supply has improved, but EVs require more chips. And battery supply is tightening, which also explains why car makers including GM, Ford and Tesla are engaging with mining companies.

Plug-in hybrid sales start to shift to fully electric in leading countries

PHEV shares have already passed the peak in countries like Norway, Sweden, and Denmark, where electrification is making significant progress. In these front-running countries, the EV market has reached the point where buyers are opting for fully electric cars. The government push (Norway even aims to phase out new ICE sales in 2025), the ongoing introduction of new models, consumer affordability, as well as the future residual value are all likely to be factors here.

Chinese EV brands are going global

Chinese EV brands like Aiways, MG (SAIC), NIO, Xpeng and especially BYD are ready to advance in other parts of the world. Chinese brands have the advantage of a developed local supply chain network infrastructure for EVs, and BYD is an original battery manufacturer. Their activities outside of China are still small, but EVs have opened the global market and Chinese brands are expected to acquire more market share in Europe, as Korean Kia and Hyundai have done in the past. In the US, it will be harder to compete as only domestically-manufactured and sourced EVs are eligible for tax credits, although smaller Chinese EVs are significantly cheaper. Traditional car makers – particularly Volkswagen and GM and Ford - are making progress in global EV sales as well. All in all, the EV market is becoming more mature and naturally, the market composition is becoming more diverse. This also seems to be one of the reasons for the lower prices of Tesla in Europe and the US to keep ramping up production and meet its production objectives.

Download

Download articleThis publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more