Canadian jobs preview: Wage growth woes

A healthy jobs market is typical at this time of year in many sectors, and business confidence has held up relatively well. But worries about a slowing wage growth may put a dampener on the positive prospects for Canada's labour market

A reduction of 51,600 jobs in August meant the Canadian jobs report was somewhat disappointing, although it's worth noting this was predominantly driven by losses in part-time positions. We are hoping to see a minor pick-up in the September job’s report on Friday, but there are a few reasons to suspect that the unemployment rate will stay unchanged at 6%.

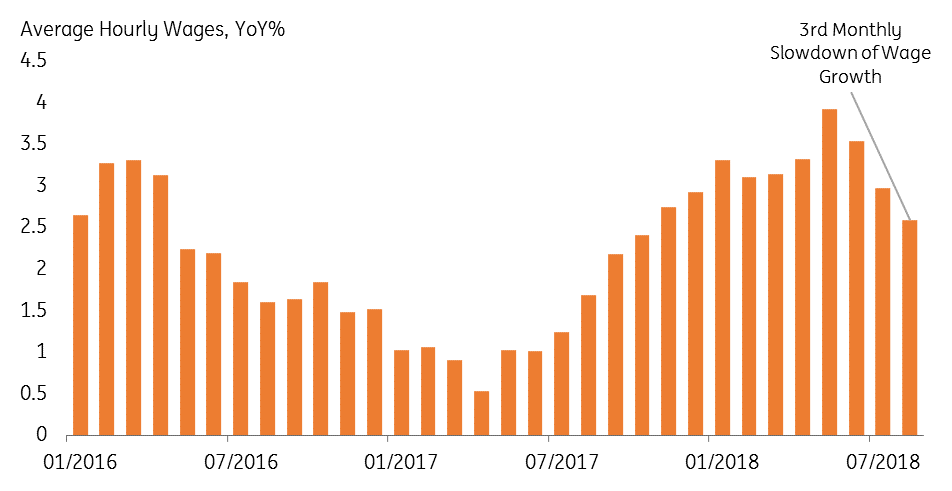

Generally speaking, the jobs market is usually healthy at this time of the year in many sectors - although some more volatile than others. However, average hourly wages (for permanent workers) slowed in August for the third month running, indicating that the jobs market may be encountering more slack. Given September is usually a month where post-university graduates put their long summers behind them and enter the job market, a lower availability of jobs could offset any positivity coming from the increase in the participation rate. We saw a similar pattern back in July.

Average hourly wage growth for permanent workers

Full-time job numbers should give an insight into business confidence

On a lighter note, business confidence appears to have held up relatively well despite growing Nafta uncertainty over the summer months. The recent positive news on Canada-US trade means business confidence should remain supported, meaning that a positive September jobs reading could be followed by further strength over the next few months.

Nothing should stop the Bank of Canada’s October hike…but where next?

Falling wage growth is a slight worry, and although we think almost nothing will get in the way of a Bank of Canada (BoC) hike later this month, a more pronounced slowdown could feasibly see policymakers take a more cautious approach to further tightening.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more