Canadian elections: Bracing for a minority government

Latest polls suggest that the Federal elections in Canada are likely to yield a minority government. The implications for the energy sector will drive market reaction but risks for the loonie appear tilted to the downside

Advance voting for Canada's Federal election on Monday has already begun, but the final results won’t be known until after the polls close on 21 October.

We believe there is a high potential for surprises, but the market impact will most probably depend on if one of the two larger parties - prime minister Justin Trudeau’s Liberals or Andrew Scheer’s Conservative party wins a majority. However, the implied probability from recent polls suggests that a minority government seems to be the most likely possibility.

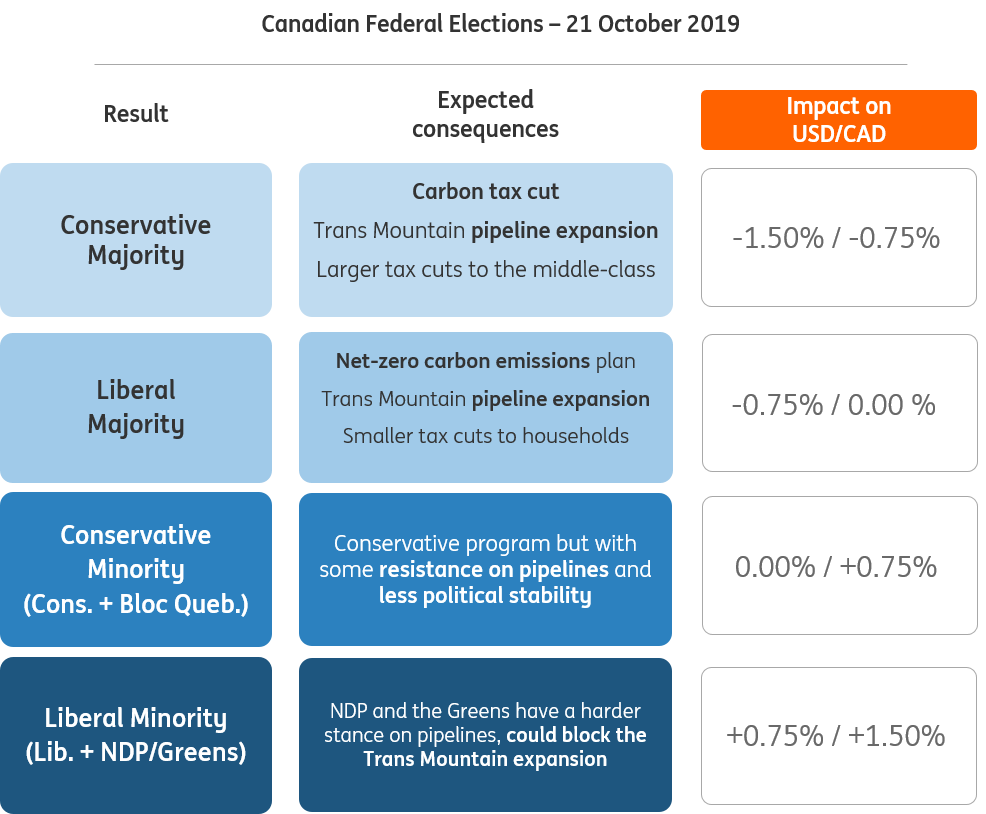

Between a Liberal-led minority and a Conservative-led minority, we expect the first one to be more CAD-negative.

The probability-weighted impact of the elections on USD/CAD appears to be moderately positive. In other words, the balance of risks for the loonie appear tilted to the downside.

Smaller parties to the fore

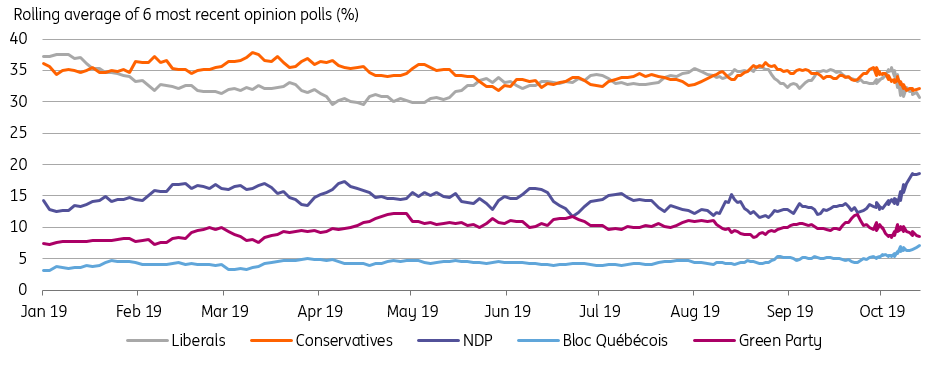

As parties seek to win control of the 338 member House of Commons, surveys suggest Trudeau's incumbent Liberal party is neck and neck with the opposition Conservative party with both polling around a third of the popular vote.

As such, it looks as though the left of centre New Democrats (NDP) and Bloc Quebecois will control the balance of power. While neither are suggesting they would be open to an alliance, the NDP (with the Green party) would most likely side with the Liberals if it came to that. However, we think Bloc Quebecois are most likely to side with the Conservatives.

Neck and neck: Conservatives and Liberals

Liberals key policy proposals

The main policy differences between the two leading political parties are around the climate and the energy sector.

The incumbent Liberal party wants to reach net-zero carbon emissions by 2050, front-loading them by improving the targets set for 2030. Nonetheless, they would still look to complete the $7.4bn Trans Mountain pipeline expansion, which would expand the system’s capacity for carrying crude and refined oil from Alberta to British Columbia’s coast from 300,000 barrels per day to 890,000 barrels.

In terms of taxes, they are planning to cut small business tax from 11% to 9%, slash middle-class taxes and improve maternity and parental benefits. They would then introduce a 1% surcharge for non-residential property buyers and give first-time buyers 10% off the price of their first home.

If they need support from the NDP, then there could be discussions over higher corporation tax rates and a possible wealth tax. More realistically, we could see more investment in climate change measures and support for grants to make buildings more energy-efficient, offset by cuts to government subsidies to the energy sector.

Conservatives key policy proposals

The main opposition Conservative party are taking a different line by promising to eliminate the carbon tax, which currently stands at $20 per tonne of C02, scheduled to rise to $50/tonne by 2022. The Conservatives will also complete the Trans Mountain pipeline expansion and look at other investment in energy transportation. Tax cuts for middle-income households would be more substantial than Liberals (incomes below C$47,000 would see their tax rate drop from 15% to 13.75%).

Given Canada's focus on energy and the scale of tax cuts, the Conservative manifesto may well be marginally favoured by financial markets – especially if the Liberals have to form a coalition with NDP. The Conservative manifesto may be perceived as potentially more likely to offset the increasing concerns about the global economic outlook.

Economic backdrop remains supportive

Canadian households are already in a good place given the strength of the job markets. The latest labour report showed employment growth is strong and wages are rising. With significant tax cuts, this could be enough to keep consumers resilient even though export-orientated parts of the economy may well come under pressure.

Nonetheless, we still have the view that the Bank of Canada will eventually respond to the threats to growth with looser monetary policy. Indeed, we continue to highlight the close relationship the Canadian economy has with the US – the latest ISM numbers look particularly grim. Moreover, given Canada’s significant trade and energy sector exposure, we doubt that it can continue to confound expectations in the face of a weaker global backdrop.

Polls suggest downside risk for the CAD

The high uncertainty around the outcome of the elections leaves a question mark for the 1-week outlook for the Canadian dollar. However, markets are probably not expecting a big impact on the currency from the elections.

The USD/CAD implied volatility curve shows no spike in vols in the 1-week tenor (that covers the elections), attaching a much higher market-moving impact of the Federal Reserve and Bank of Canada meeting in a fortnight. The break-even for USD/CAD straddles on the night of the elections is around 35 pips, indicating limited expected spot move triggered by the results.

No "spike" in the USD/CAD volatility curve

Despite this shows that markets are quite relaxed about these elections we suspect that the implications of the new government for the energy sector may be significant, which may warrant higher CAD volatility next week compared to the expectations.

In general, we expect the looser stance of the Conservative party on “Green” restrictions to the energy sector (they pledged to remove the carbon tax and are in favour of pipeline extensions) to warrant their win would likely be the most welcome by Canadian dollar bulls. However, the true discriminator in terms of market impact will likely be whether the result of the election will allow the formation of a majority government.

For two reasons, a minority government (either Liberal or Conservative) will likely be CAD-negative:

- It would inevitably carry a higher amount of political uncertainty (latest two minority governments did not make it to the end of the mandate)

- It would allow the minor parties (NDP, Greens or Bloc Quebecois) to enter government, and this doesn't bode well for the energy sector as they all have (NDP and Greens in particular) opposed oil pipelines projects.

Four scenarios for Canadian elections and the CAD

Therefore, in our view, markets are likely to favour a majority government and Scheer’s Conservatives hold the key to it.

The latest surveys show there is a high degree of uncertainty about the results. But at this stage, the most likely result seems that the Conservative win more votes but not enough for a majority and still end up having to strike a coalition with another party, almost surely the Bloc Quebecois and thereby form a majority government.

Bloc Quebecois advocates for Quebec sovereignty and supported the 1995 Quebec independence referendum that failed by a small margin. Even if they form a coalition pact with the Conservatives, the chances of another referendum seem fairly limited, although the question may generate somewhat higher perceived instability in the Canadian political backdrop.

In our scenario analysis, this eventuality should be neutral-to-mildly-negative for the Canadian dollar.

Polls-implied probabilities of elections outcomes

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more