Canada’s labour market: The silver lining in the economy?

The underlying strength in the labour market makes us question when (and if) will it start to translate into better household activity. We reckon household debt has some part to play in the slow transmission, and this doesn’t help the case for a Bank of Canada rate hike this year

One of the only areas that appears to have been pretty consistent in providing us with some good news recently is the robustness of the labour market and – although things held steady in March, this is the third consecutive month we’ve seen a relatively decent report. The first-quarter has painted a pretty positive picture for employment overall, with total gains at 116,000.

There is broad-based employment growth across provinces and sectors. However, as we'd anticipated, the unemployment rate remained at 5.8% because although jobs are available, the pool of available workers is also growing thanks in part to increases in immigration.

Wage growth: Starting from the bottom and now we’re here

Wage growth has continued to maintain good performance and carry on (or sustain) its upward momentum now for three consecutive months. In March, wage growth for full-time workers remained at a five-month high (2.3%). As we noted previously, the scope for more wage upside in the coming months persists, and this view was only reinforced by January's GDP report, which revealed some upbeat news for both the manufacturing and the construction sector.

Both of these sectors had been stuck in a bit of a rut - the construction sector actually boasted its first monthly growth in eight months in January. Labour-related production constraints have been frequently reported in business surveys – coupled now with the fact the sectors might be recovering from a 2018 dip. This points towards the potential for higher wages to attract workers.

But when will the strong labour market translate into better household activity?

As we’ve said before, we have really been seeing the strong labour market translate into better household activity; both the housing market and overall spending suffered in the final-quarter of 2018. Maybe we are hoping for things to happen too quickly, as – despite jobs creation and upward trending wages boding well for decent levels of domestic demand – it may take a little while before we see a pick-up in activity. After all, softer economic news, falling equity markets and higher interest rates through late last year don’t make it an easy environment to start opening your wallet.

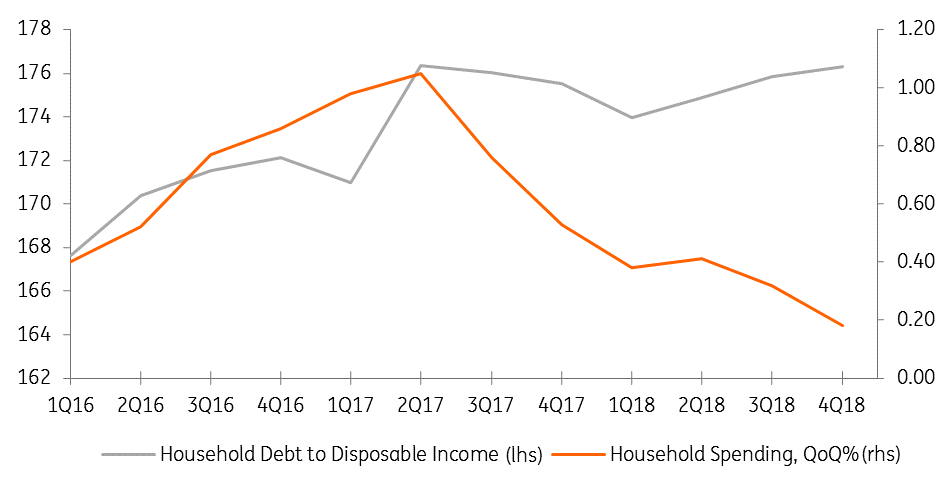

All this said, let’s talk about the so-called ‘elephant in the room’ which, in our view, is also keeping activity at bay. The percentage of Canada’s household debt to income started the year at 176.3%, which is the highest it has been since 1990. If households are running high levels of debt, it may be that they are starting to focus on reducing what they owe. This forms part of our argument as to why the transmission of solid labour market fundamentals is (possibly) slower-than-expected.

The level of household debt is a drag on spending

Bank of Canada rate hike this year? Still a bit tentative

Household spending is one of the key factors on the Bank of Canada’s (BoC) watch list with regard to timing its next rate hike - along with oil price developments and how the US-China trade war fairs out. Therefore, unless we see the labour market’s strength transfer into improved household activity, the BoC is likely to stay in wait-and-see mode.

If all three risks don’t materialise, we still think the central bank could make a move in the fourth quarter, though – given the Federal Reserve is firmly on hold, the chance of the BoC following in its footsteps become increasingly likely.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more