Canada’s labour market: Resistant to the turbulence

Job creation and upward trending wages in February reinforce the fact that the economy has underlying strength. But the Bank of Canada is happy to prolong its pause to see how certain risks play out over the coming months

February’s employment report reinforces our view that – despite the global risk environment, the labour market remains robust. The year started with healthy job gains in both full and part-time positions (+67,000) and this momentum has carried on into February, where 56,000 positions were created. However, the unemployment rate has since drifted upwards from its four-decade low of 5.6% - now at 5.8%, but we aren’t majorly concerned. This should be taken positively as it is because more people are entering the labour market.

Wage growth worries have eased further

Another month, another sense that labour market strength is gaining momentum. Wage growth for full-time workers finally picked up to 1.8%YoY in January, and (as-we-anticipated) the upward trend continued in February as it accelerated to 2.3%.

We expected January’s upside relief to be more than a one-off. The Bank of Canada’s (BoC) most recent Business Outlook Survey suggested firms are implementing higher wages in order to attract workers due to frequent reports of labour-related production constraints. This points towards the possibility of further wage upside in the coming months.

The energy sector is now performing below-par, but is it hurting the labour market?

February’s employment report was reassuring. Job creation was broad based across both full and part-time positions, reinforcing our view that - underneath the increased uncertainty in both the domestic and global economic backdrop, there is a positive story. The employment report supports the idea that labour-related capacity constraints are pushing firms to expand their workforces and hire permanently. This is also an indication that high levels of demand (particularly from the US) is expected to persist in the near-term.

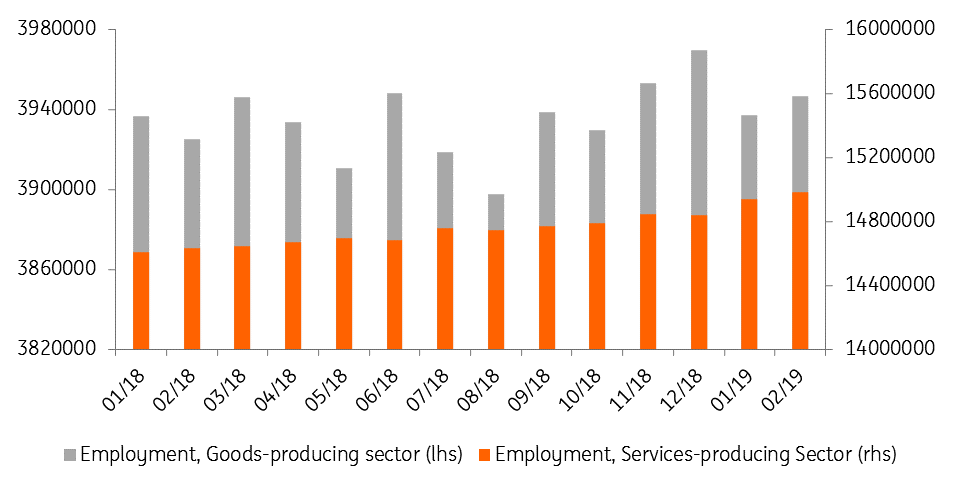

The rise in employment was largely due to gains in the services-producing industry, specifically in professional, scientific and technical services; the number of workers here grew for the third time in four months. Employment in the goods-producing industry has suffered more recently, though we saw a slight increase in February (+9,500).

The goods-producing sector has been suffering

Is this a sign that the deteriorating outlook for the energy sector is taking its toll on the labour market? Possibly. The local government in Alberta enforced mandatory oil production cuts – which started on 1 January, and having to reduce output has likely weighed on the hiring decisions of crude producers. So far, the labour market overall has shown resilience, but it could only be a matter of time until overall employment figures are suppressed.

The Bank of Canada are happy to sit back and see how things play out

Nonetheless, job creation and upward trending wages bode well for decent levels of domestic demand this year. However, a relatively strong labour market hasn’t always translated into better household activity - this is what we are seeing at the moment. Both the housing market and overall spending suffered in the fourth-quarter of 2018.

if risks don't materialise we think the central bank will want to make a move later this year

The timing of the BoC’s next rate hike depends on three key factors – namely household spending, oil markets and US and China trade developments. For now, the central bank are happy to sit back and see how these three risks play out over the coming months. If they don’t materialise we think the central bank will want to make a move later this year. We have roughly pencilled this to arrive in the third quarter, though this is also contingent on how the Federal Reserve acts over the next few months.

See here why the Bank of Canada are firmly in wait-and-see mode

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more