Canada: The return of Nafta

Nafta is back - and it even has a new name. On the back of this we saw positive CAD news - lifted 0.5%, after one of the many, and most important, deadlines was finally reached to finalise ‘USMCA’; a big sigh of relief for the Canadian economy. But has the negotiating process done any damage?

A new Nafta deal, or should we say United-States-Mexico-Canada-Agreement (USMCA), was agreed by the US and Canada in the late hours of Sunday, 30 September. The deadline was met with a few hours to spare, enabling Mexican President, Enrique Pena Nieto, and his Congress enough time to sign off on the new trade deal before the new Mexican President takes over at the beginning of December.

The US Congress will have until 30 December to review and sign the deal, but, still pivotal for the new trilateral agreement to be effective is the Congressional vote of approval on legislation underpinning the deal, which won’t take place until next year, post-mid-term elections. The latter seems likely that the Democrats will take control of Congress, and although chances of approval have been heightened, given Canada has been included in USMCA, there’s no guarantee; an assessment of the new terms of trade still needs to be completed, which may prove an obstacle for Trump administration.

A deal is reached, but did the process harm the Canadian economy?

Surprisingly, for now, the current steel and aluminium tariffs the US imposed on Canada – a hefty 25% and 10% respectively, remain in place despite the newly agreed trade deal, and so will Canada’s tit-for-tat countermeasures; 25% tariffs on various US metal products and 10% tariffs on an assortment on consumer goods. But is it an issue that tariffs aren’t dropped?

Based on the latest Canadian inflation data, although we experienced bumper inflation (3% YoY) in July, when looking into the details we reported no observable impacts from tariffs – and this was the first month where full effects of the trade spat between the US and Canada, namely Canada’s retaliatory tariffs, could have been reflected in prices. August proved a moderate slowdown (2.8% YoY), aligned with our expectations that July brought this year’s peak price growth. We predict headline inflation to drift back towards the 2% target come 2019.

Canadian growth tells a similar story

And the run of healthy domestic data continued, with business confidence appearing to have held up well; underlying a disappointing headline in the August job’s report was a 40,000 increase in full-time employment, suggesting firms weren’t wary about extending hiring plans, predominantly down to strong foreign demand (particularly in the US).

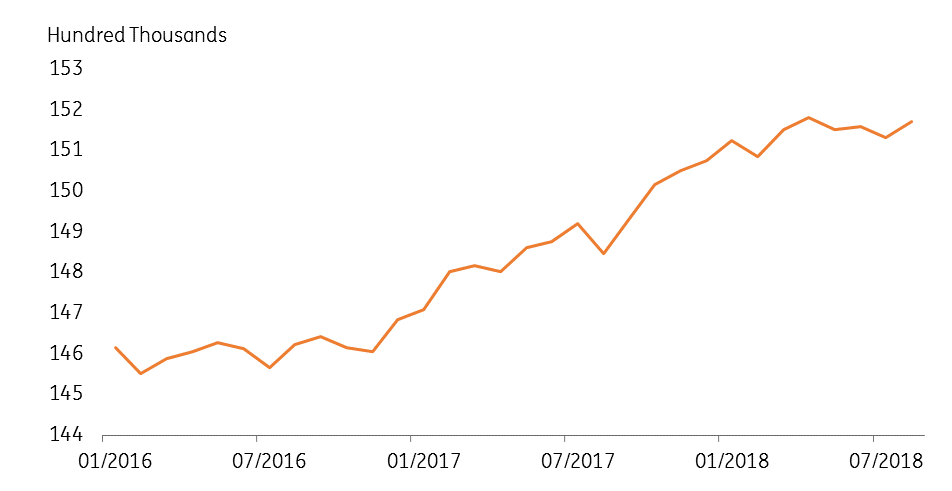

Canadian full-time employment

Seemingly, Canadian exporters have sucked up US demand regardless of the trade tensions that existed between the two countries, contributing to July’s trade deficit, which narrowed to the smallest level observed since December 2016. We predict the Canadian growth story to be aligned with our forecast of a modest US slowdown, gradually easing off into 2019.

Five things you need to know about USMCA

Our trade team touched upon some of the key points from the final stage of the negotiations - here are our top five takeaways from USMCA…

1) Less threats on Canada’s autos

Well, unless production surpasses 2.6 million units annually, which is unlikely given they currently stand at (roughly) 1.8 million units. The dynamics of the auto industry concerning the three participating countries of USMCA will also change; to qualify for tariff-free entrance into the US, 75% of automobile content is now required to be produced in the NAFTA-region, up from 62.5%, and 40% of the input into making automobiles must come from factories paying workers at least US$16 per hour.

2) Tariffs aren’t gone completely

Quite surprisingly, Canada agreed to finalise the deal with the steel and aluminium tariffs still in place. This was an important factor Canada said they needed to see gone before they could reach an agreement with the US, but it seems negotiators changed their minds.

3) Chapter 19 isn’t going to budge

The dispute settlement system, particularly Nafta’s Chapter 19 which was concerned with anti-dumping and countervailing duties, was one of the major sticking points in the negotiations. Canada battled hard to keep this, often stating it was a red line they wouldn’t cross.

4) Canada’s dairy industry was likely used as a negotiating tactic

Canada has agreed to allow US expansion into their protected dairy market, likely a concession offered to the US with hope to fudge their way to the final deal.

5) Good day, sunshine

USMCA will have a 16-year term, with a review every 6 years. Canada will see this as an improvement to the ‘sunset clause’; a Nafta expiration date of every 5 years, initially proposed by the US.

An October hike is almost a done deal

An October hike from the Bank of Canada (BoC) is all but certified, and the positive USMCA news, coupled with solid domestic data, should help to keep the BoC on their gradual tightening path. We’re keeping a close watch on the September jobs report this Friday, as the BoC’s intentions now will hinge on pure economic activity, although trade insecurities didn’t necessarily knock them off course. Our FX team see USD/CAD moving down towards the 1.27/1.28 region on the back of a confirmed trade deal, likely moving further if it weren’t for caution in global risk aversion.

Download

Download article5 October 2018

In case you missed it: Finding the silver lining This bundle contains {bundle_entries}{/bundle_entries} articlesThis publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more