Canada: Rate hike next week all but confirmed

Everything is going swimmingly for the Bank of Canada. This week should see headline CPI begin a gradual slide towards the 2% target, and with core measures also around this mark, we see the central bank hiking rates three more times before the end of 2019

September’s headline inflation should come in at 2.6% year-on-year, unchanged (in monthly terms) from August. And given the newly minted United-States-Mexico-Canada-Agreement (USMCA), prior trade insecurities - which could have seen the Bank of Canada rethink its tightening plans - have ended, clearing the path for three more rate hikes before the end of 2019.

| 1.75% |

BoC Policy Rate25bp hike |

Late September oil rally should prop up headline CPI

Household activity may be subdued due to slowing wage growth, which may have dampening effects on inflation in the near-term.

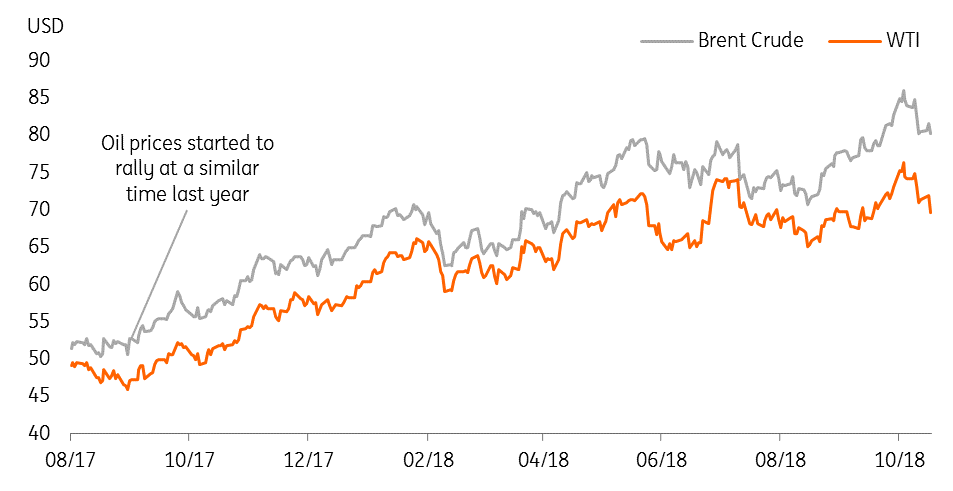

However, rising oil prices should help to keep September’s figure aloft. An oil price rally occurred at a similar time last year, creating a high base effect for inflation in September. Without the recent rally in oil prices, the year-on-year CPI figure would have been subject to downward pressure.

Global oil prices rallied at a similar time in 2017

Consumer prices aren’t at risk from tariffs

Although USMCA hasn’t led to the removal of the US’s existing steel and aluminium tariffs, this shouldn’t prove too much of a threat to consumer prices. In the BoC’s recent Autumn Business Outlook Survey firms reported that they are absorbing a large chunk of the extra cost from tariffs, rather than lifting output prices, amid competitive pressure.

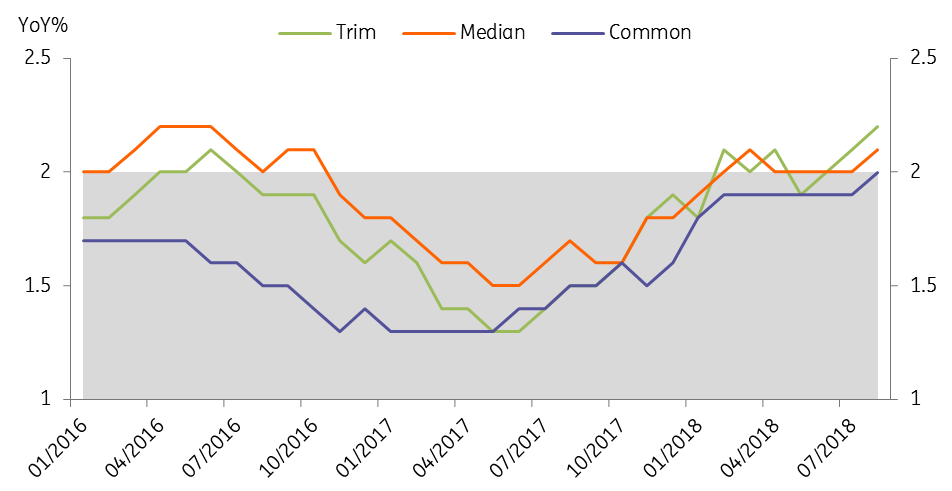

Core inflation is the key element influencing BoC policy decisions

More importantly for the BoC, all three of its main measures of core inflation ticked up in August and sit at, or slightly ahead of, the 2% target. Even further upward pressure on core numbers could come from positive news on wage growth; the BoC’s Autumn Business Outlook Survey indicated labour shortages are intensifying, so firms may move to push up wages in order to attract the desired skills.

Core measures are are all at least on the 2% target

Hike should come next week, regardless of CPI

The BoC will make its policy decision on the 24 October. And given this is the last chance (in 2018) for it to make a rate decision in tandem with the release of its quarterly monetary policy report, markets have priced in a 90% chance of a hike.

Core inflation is the key variable for the BoC’s policy decisions and the news here is good. This, coupled with the removal of the tariff threat on the back of USMCA, puts the BoC on track for two more rate hikes in 1Q19 and 3Q19.

"THINK Outside" is a collection of specially commissioned content from third-party sources, such as economic think-tanks and academic institutions, that ING deems reliable and from non-research departments within ING. ING Bank N.V. ("ING") uses these sources to expand the range of opinions you can find on the THINK website. Some of these sources are not the property of or managed by ING, and therefore ING cannot always guarantee the correctness, completeness, actuality and quality of such sources, nor the availability at any given time of the data and information provided, and ING cannot accept any liability in this respect, insofar as this is permissible pursuant to the applicable laws and regulations.

This publication does not necessarily reflect the ING house view. This publication has been prepared solely for information purposes without regard to any particular user's investment objectives, financial situation, or means. The information in the publication is not an investment recommendation and it is not investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Reasonable care has been taken to ensure that this publication is not untrue or misleading when published, but ING does not represent that it is accurate or complete. ING does not accept any liability for any direct, indirect or consequential loss arising from any use of this publication. Unless otherwise stated, any views, forecasts, or estimates are solely those of the author(s), as of the date of the publication and are subject to change without notice.

The distribution of this publication may be restricted by law or regulation in different jurisdictions and persons into whose possession this publication comes should inform themselves about, and observe, such restrictions.

Copyright and database rights protection exists in this report and it may not be reproduced, distributed or published by any person for any purpose without the prior express consent of ING. All rights are reserved.

ING Bank N.V. is authorised by the Dutch Central Bank and supervised by the European Central Bank (ECB), the Dutch Central Bank (DNB) and the Dutch Authority for the Financial Markets (AFM). ING Bank N.V. is incorporated in the Netherlands (Trade Register no. 33031431 Amsterdam).