Canada inflation preview: A greasy picture

Oil will be the main feature in October’s price story and we expect to see an overall positive contribution to inflation. This shouldn't ring any alarm bells for the Bank of Canada or prompt a re-think on its hiking plans. But what about wage growth?

Canada’s September inflation shocked the consensus by coming in at -0.4% month-on-month (analysts expected +0.1%)- a trend which could cause a few headaches at the Bank of Canada (BoC) if it persists. However, we don’t expect a similar surprise in October. We're looking for a 0.2% MoM rise, with energy prices the main contributor.

October oil price rally should hoist yearly figure

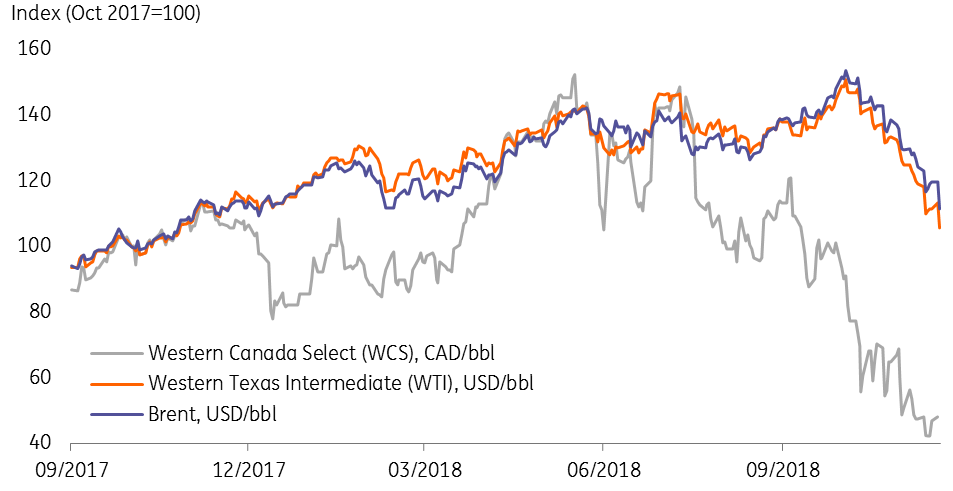

September’s inflation estimate was wrong partly because analysts misjudged the impact of oil prices. The rally in crude oil didn’t start until the back-end of the month and gasoline prices actually eased over the month. October’s energy price story should be positive given this month took the brunt of the gasoline rally. This should keep the headline figure propped up above the Bank of Canada’s 2% inflation target; we forecast 2.3% YoY.

Heavy WCS discount shouldn’t offset net positive impact

The outlook for November is clearly less inflationary, with the emerging decline in oil prices posing downside inflation risks in the near-term.

Wage growth is still poor…where’s our pick-up?

It was another sad story for wage growth in October; average hourly wages (for permanent workers) stood at 1.9% year-on-year, down from a high of 3.9% YoY in May. A slowing pace of income gains coupled with higher borrowing costs should ultimately weaken household activity - though there have been no signs of this yet.

In the BoC’s October Business Outlook Survey, firms reported that labour shortages were a major production constraint and hiring intentions remained positive. To us, this is a hopeful sign that the labour market will tighten and give an upside boost to wages in the month ahead.

Higher policy rates will contribute to fading price pressures

Higher borrowing costs will feed through the economy next year, acting as a brake on growth, which we think will result in a mild inflation slowdown – perhaps exacerbated by moves in oil prices.

| 2.1% |

Average inflation forecast for next yearCompared to the 2.3% forecast for 2018 |

Average inflation in 2019 is forecast at 2.1%, down from 2.3% this year. The BoC will continue to hike as long as its key rational (core inflation) is around the 2% target, and we expect two hikes in 1Q19 and 3Q19. We're not ruling out a third increase but this is subject to downside risks subsiding.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more